- United Kingdom

- /

- Communications

- /

- AIM:FTC

March 2025 UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such uncertain times, investors often look for opportunities that combine affordability with growth potential. Penny stocks, though sometimes seen as a relic of past market eras, continue to offer intriguing possibilities for those willing to explore smaller or newer companies with strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £419.72M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.985 | £296.88M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £147.26M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.28 | £412.58M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.80 | £67.91M | ★★★★★★ |

| Croma Security Solutions Group (AIM:CSSG) | £0.865 | £11.88M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.39 | £214.38M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.17 | £154.81M | ★★★★★☆ |

Click here to see the full list of 442 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Anpario (AIM:ANP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anpario plc, with a market cap of £94.06 million, produces and distributes natural feed additives aimed at enhancing animal health, hygiene, and nutrition.

Operations: The company's revenue is derived from its Vitamins & Nutrition Products segment, which generated £32.72 million.

Market Cap: £94.06M

Anpario plc, with a market cap of £94.06 million, operates without debt, ensuring financial stability and eliminating concerns about interest payments. The company has experienced a 25.3% earnings growth over the past year, surpassing its five-year average decline of 7.4% annually. While Anpario's revenue is forecast to grow by 15.03% annually, its return on equity remains low at 8.5%. The management team and board are seasoned with average tenures exceeding industry norms, contributing to the company's high-quality earnings despite an unstable dividend track record and recent profit margin improvements from 7.6% to 9.2%.

- Click to explore a detailed breakdown of our findings in Anpario's financial health report.

- Examine Anpario's earnings growth report to understand how analysts expect it to perform.

Filtronic (AIM:FTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology across the United Kingdom, Europe, the Americas, and internationally with a market cap of £251.83 million.

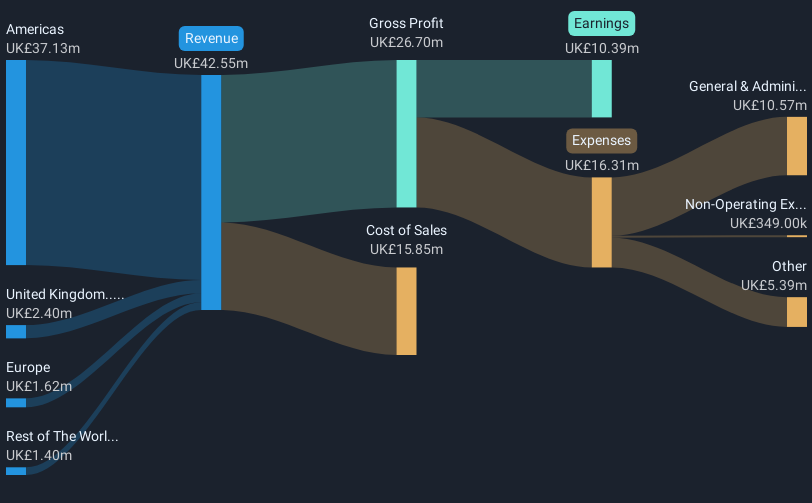

Operations: The company's revenue is derived from its Wireless Communications Equipment segment, which generated £42.55 million.

Market Cap: £251.83M

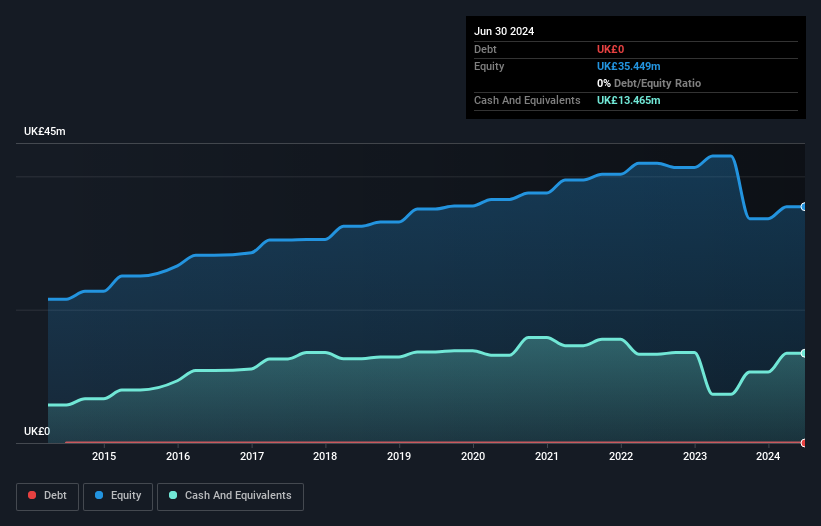

Filtronic plc, with a market cap of £251.83 million, recently secured a significant contract with SpaceX worth £16.8 million, enhancing its revenue prospects for fiscal 2025 and 2026. The company has transitioned to profitability, reporting sales of £25.6 million and net income of £6.73 million for the half year ended November 30, 2024. Filtronic's strong financial position is underscored by its debt-free status and outstanding return on equity of 42.5%. Despite high volatility in share price and an inexperienced management team averaging only 0.8 years in tenure, the board remains experienced with an average tenure of 4.2 years.

- Dive into the specifics of Filtronic here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Filtronic's future.

On the Beach Group (LSE:OTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: On the Beach Group plc is an online retailer specializing in short-haul beach holidays under the On the Beach brand in the United Kingdom, with a market cap of approximately £360.72 million.

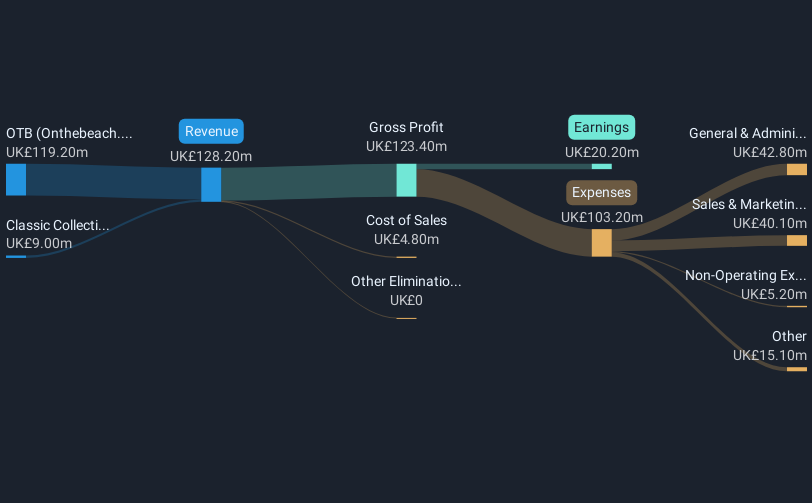

Operations: The company's revenue is generated from its Classic Collection segment, which contributed £9 million, and its OTB segment (Onthebeach.Co.Uk and Sunshine.Co.Uk), which accounted for £119.2 million.

Market Cap: £360.72M

On the Beach Group plc, with a market cap of £360.72 million, demonstrates financial stability through its debt-free status and substantial short-term assets (£423.7M) exceeding liabilities (£310.9M). The company has shown significant earnings growth of 69.7% over the past year, outperforming industry averages and maintaining high-quality earnings with improved net profit margins (15.8%). However, its management team is relatively inexperienced with an average tenure of 1.9 years, though recent board changes have introduced seasoned expertise in digital consumer businesses. The stock trades at a discount to estimated fair value and analysts expect further price appreciation.

- Jump into the full analysis health report here for a deeper understanding of On the Beach Group.

- Explore On the Beach Group's analyst forecasts in our growth report.

Key Takeaways

- Explore the 442 names from our UK Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FTC

Filtronic

Designs, develops, manufactures, and sells radio frequency (RF) technology in the United Kingdom, Europe, the Americas, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives