- United Kingdom

- /

- Energy Services

- /

- LSE:WG.

Here's Why John Wood Group (LON:WG.) Is Weighed Down By Its Debt Load

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that John Wood Group PLC (LON:WG.) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for John Wood Group

How Much Debt Does John Wood Group Carry?

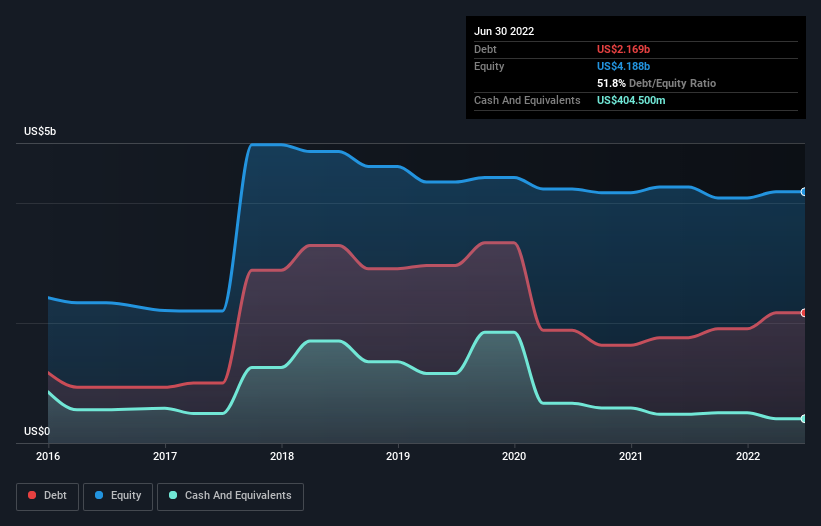

As you can see below, at the end of June 2022, John Wood Group had US$2.17b of debt, up from US$1.76b a year ago. Click the image for more detail. However, it also had US$404.5m in cash, and so its net debt is US$1.76b.

How Healthy Is John Wood Group's Balance Sheet?

We can see from the most recent balance sheet that John Wood Group had liabilities of US$2.61b falling due within a year, and liabilities of US$2.85b due beyond that. Offsetting this, it had US$404.5m in cash and US$1.56b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.49b.

This deficit casts a shadow over the US$1.18b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, John Wood Group would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 1.3 times and a disturbingly high net debt to EBITDA ratio of 6.6 hit our confidence in John Wood Group like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Another concern for investors might be that John Wood Group's EBIT fell 16% in the last year. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if John Wood Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, John Wood Group recorded free cash flow worth 52% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

To be frank both John Wood Group's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Taking into account all the aforementioned factors, it looks like John Wood Group has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Given our concerns about John Wood Group's debt levels, it seems only prudent to check if insiders have been ditching the stock.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:WG.

John Wood Group

Engages in the provision of consulting, project management, and engineering solutions to energy and built environment worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives