- United Kingdom

- /

- Oil and Gas

- /

- LSE:SHEL

Does Shell’s Recent Pullback Signal a Fresh Opportunity in 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Shell is still worth buying after its long run, or if the best gains are already behind it, this article will walk you through what the current share price really implies about its value.

- Despite a solid longer term track record, with the share price up 13.3% over the last year and 144.1% over five years, Shell has recently cooled off, slipping 3.9% over the past week and 8.1% over the last month, leaving it up a modest 3.9% year to date.

- Recent headlines have focused on Shell reshaping its portfolio, from ongoing divestments of mature oil and gas assets to increased capital commitments in LNG and targeted low carbon projects, all while maintaining a disciplined dividend and buyback policy. These moves are being read by the market as a balancing act between cash generation today and positioning for the energy transition. This helps explain the mix of optimism and caution in the recent share price.

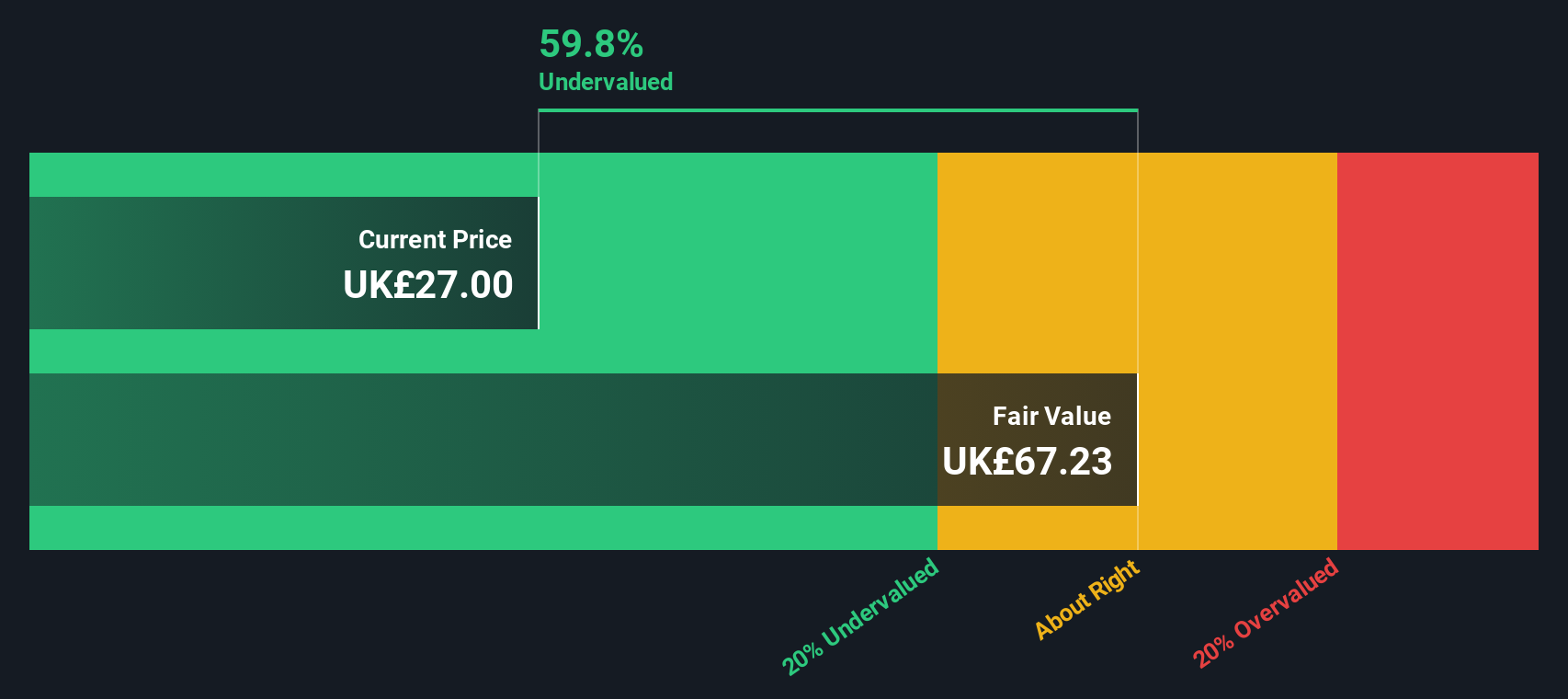

- Right now, Shell scores a 4/6 on our valuation checks, signaling it looks undervalued on several metrics but not across the board. You can see the breakdown in this valuation score. Next we will unpack what different valuation approaches say about Shell, and why there may be an even better way to judge whether the stock is truly cheap or expensive by the end of this analysis.

Find out why Shell's 13.3% return over the last year is lagging behind its peers.

Approach 1: Shell Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Shell, the 2 Stage Free Cash Flow to Equity model starts with last twelve month free cash flow of about $27.9 billion, then uses analyst forecasts for the next few years before extrapolating trends further out.

Under this framework, Shell's free cash flow is expected to remain robust, with projections around $26.1 billion by 2029, and gradually tapering into the early 2030s as growth normalizes. Because these figures are in dollars while the share price is quoted in pounds, the model keeps all cash flow assumptions in dollar terms before converting to an intrinsic value per share.

Putting it all together, the DCF model implies a fair value of roughly £57.63 per share. At this level, the stock appears to trade at about a 54.4% discount to its estimated intrinsic value on a cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Shell is undervalued by 54.4%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

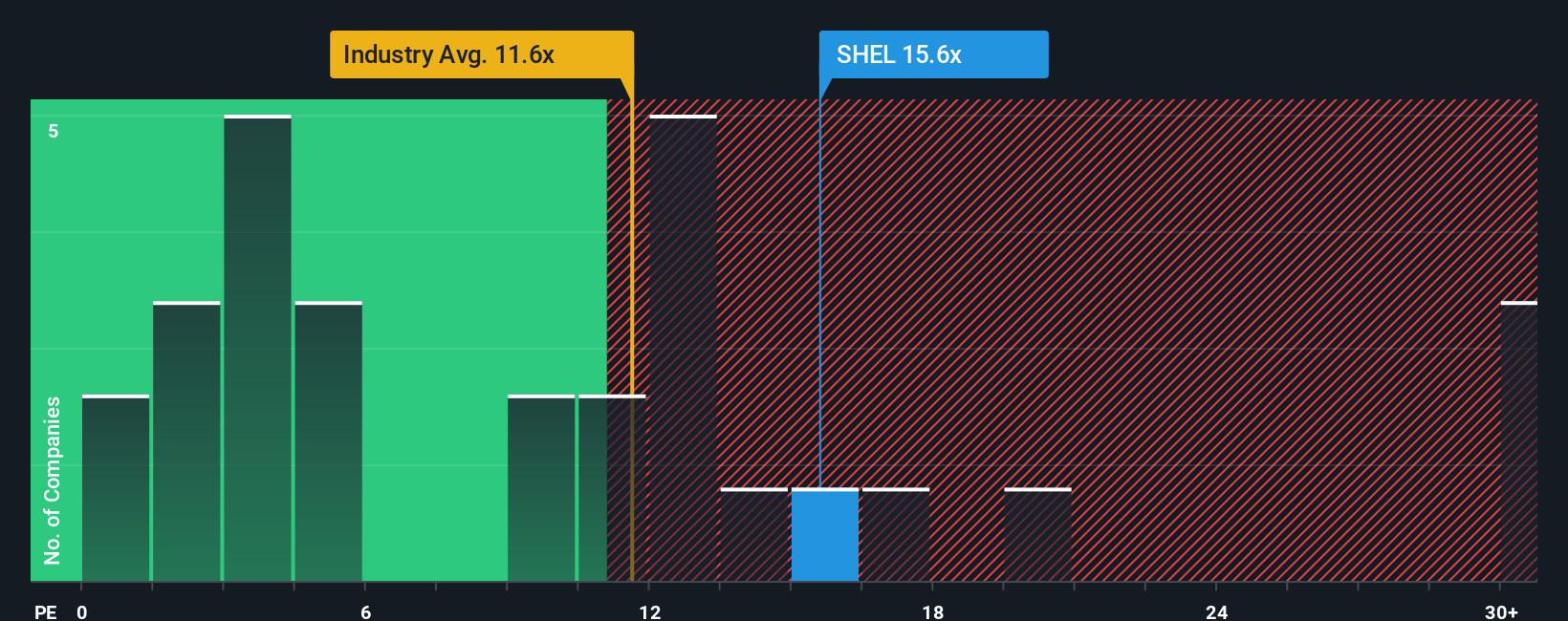

Approach 2: Shell Price vs Earnings

For a mature, consistently profitable business like Shell, the price to earnings, or PE, ratio is a useful way to gauge how much investors are paying for each pound of current earnings. In simple terms, faster growing and lower risk companies tend to justify a higher PE, while slower growth or higher uncertainty usually deserves a lower, more cautious multiple.

Shell currently trades on a PE of about 13.8x, slightly above the Oil and Gas industry average of around 13.2x, but below the broader peer group average of roughly 15.3x. To move beyond these broad comparisons, Simply Wall St calculates a proprietary Fair Ratio of 18.4x for Shell, which reflects its specific mix of earnings growth prospects, profitability, scale and risk profile.

This Fair Ratio is more informative than a simple industry or peer comparison because it explicitly factors in Shell’s fundamentals rather than assuming all energy companies deserve similar multiples. When we compare Shell’s actual 13.8x PE to the 18.4x Fair Ratio, the market appears to be pricing the stock at a discount to what its fundamentals would suggest.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Shell Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you attach a clear story to the numbers by setting your own assumptions for Shell’s future revenue, earnings, margins and, ultimately, fair value. You can then compare that fair value to today’s share price to decide whether to buy, hold or sell. The platform keeps your Narrative dynamically updated as new news or earnings arrive. For example, a bullish investor who believes Shell’s LNG expansion will drive resilient free cash flow might set a higher long term margin and arrive at a fair value closer to £39.36. In contrast, a more cautious investor who is worried about chemicals weakness, capital allocation and the pace of the energy transition might assume lower earnings growth and a compressed multiple, landing on something nearer £27.06 instead.

Do you think there's more to the story for Shell? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SHEL

Shell

Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)