- United Kingdom

- /

- Consumer Finance

- /

- LSE:0R4W

Top UK Dividend Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces pressures from weak global cues and faltering trade data from China, investors are increasingly looking for stability amidst market volatility. In such conditions, dividend stocks can offer a reliable income stream, making them an attractive option for those seeking to balance risk with steady returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.88% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.89% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.83% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.87% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.63% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.18% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.13% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.69% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 6.51% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.71% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Multitude (LSE:0R4W)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multitude AG, with a market cap of €131.48 million, operates in Finland offering digital lending and online banking services through its subsidiaries.

Operations: Multitude AG generates revenue through its segments in SME Banking (€16.09 million), Consumer Banking (€113.40 million), and Wholesale Banking (€10.15 million).

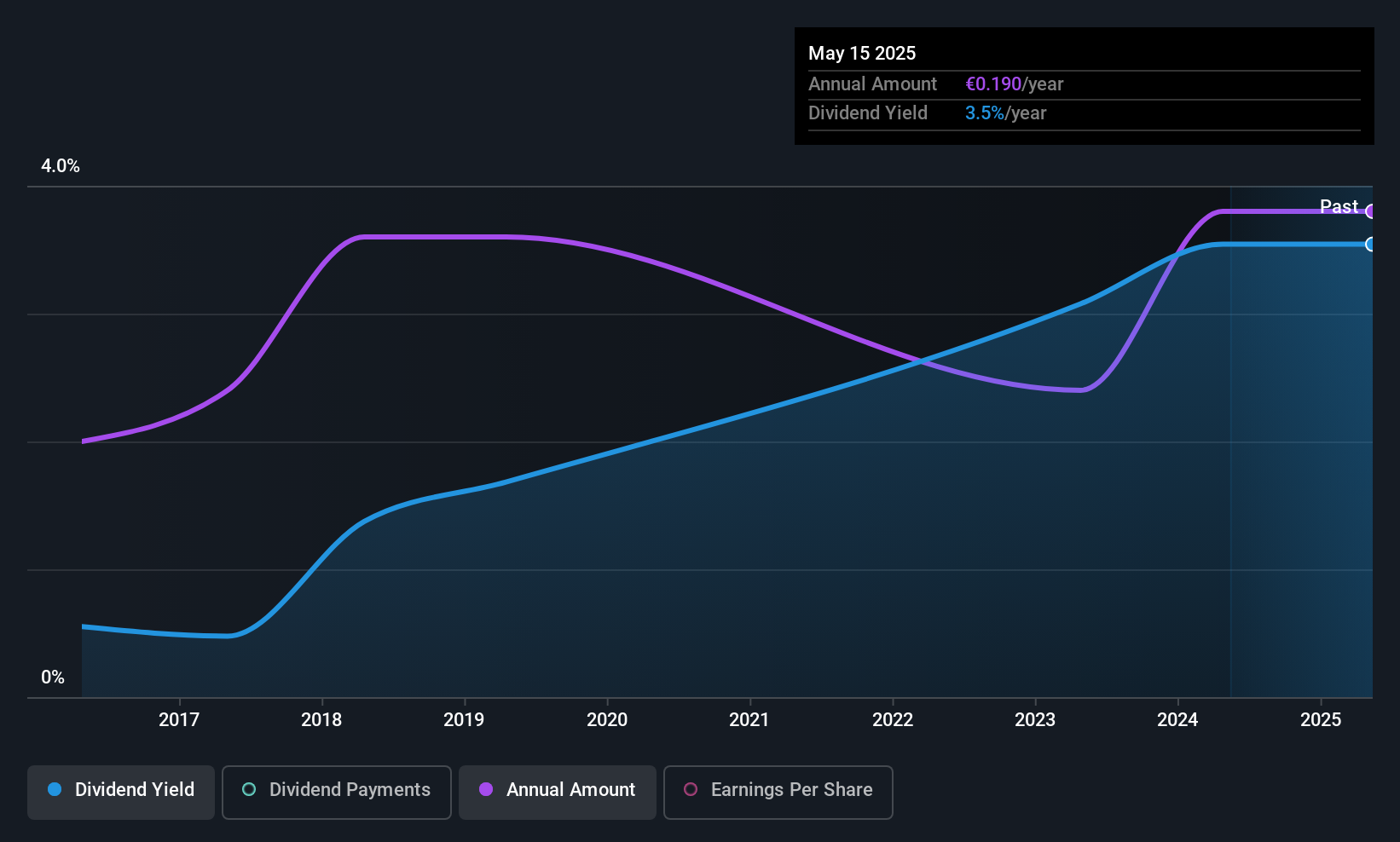

Dividend Yield: 3.9%

Multitude's dividend payments are well-covered by earnings with a low payout ratio of 23.5% and cash flows at 5.1%, indicating sustainability despite a historically volatile dividend track record. The company's dividends have increased over the past decade, though not consistently, and currently yield 3.93%, below the UK market's top tier. Recent guidance projects significant profit growth, with expected net profits reaching €30 million in 2026 and annual growth of around 20% thereafter, supporting potential future dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Multitude.

- Our valuation report unveils the possibility Multitude's shares may be trading at a discount.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £467 million.

Operations: Foresight Group Holdings Limited generates its revenue from three main segments: Infrastructure (£95.89 million), Private Equity (£50.52 million), and Foresight Capital Management (£7.58 million).

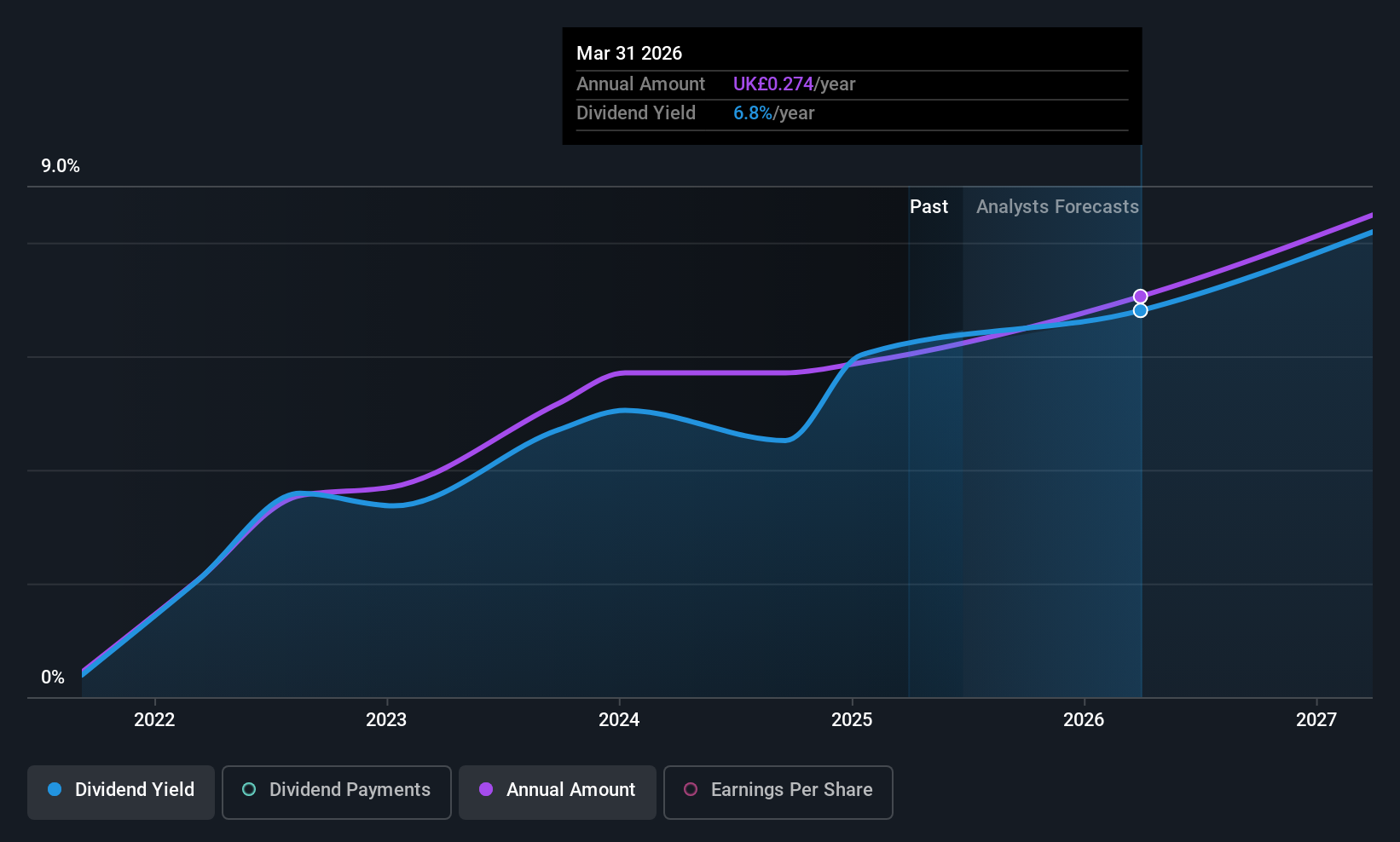

Dividend Yield: 5.9%

Foresight Group Holdings' dividend yield of 5.91% places it among the top 25% in the UK market, though its dividend history is under a decade. The company maintains stable payouts with an earnings payout ratio of 83.8% and a cash payout ratio of 66.2%, indicating sustainability from both profits and cash flows. Recent earnings growth of 25.8% supports future prospects, but investors should note dividends have only been paid for four years.

- Take a closer look at Foresight Group Holdings' potential here in our dividend report.

- The valuation report we've compiled suggests that Foresight Group Holdings' current price could be quite moderate.

Seplat Energy (LSE:SEPL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Seplat Energy Plc is an independent energy company involved in oil and gas exploration, production, and gas processing across Nigeria, Bahamas, Italy, Switzerland, England, and Singapore with a market cap of £1.49 billion.

Operations: Seplat Energy's revenue is primarily derived from its oil segment, which generated $2.37 billion, and its gas segment, contributing $173.93 million.

Dividend Yield: 7.9%

Seplat Energy's dividend yield of 7.89% ranks it in the top 25% of UK payers, supported by a payout ratio of 50.8% and a cash payout ratio of 21.2%, indicating strong coverage from earnings and cash flows. However, dividends have been volatile over the past decade despite recent increases, including an interim and special dividend for Q3 2025. Recent earnings growth bolsters its financial health, yet future forecasts suggest potential challenges ahead.

- Get an in-depth perspective on Seplat Energy's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Seplat Energy is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Get an in-depth perspective on all 48 Top UK Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:0R4W

Multitude

Provides digital lending and online banking services in Finland.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026