- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRN

Kitwave Group And 2 Promising Small Caps With Growth Potential

Reviewed by Simply Wall St

In the current UK market landscape, small-cap stocks are gaining attention as the FTSE 100 and FTSE 250 indices face headwinds from global economic challenges, particularly those stemming from China's sluggish recovery. Amidst this backdrop, identifying promising small caps with solid fundamentals and growth potential becomes crucial for investors seeking opportunities beyond the bluechip index's volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Kitwave Group (AIM:KITW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kitwave Group plc operates as a wholesale business in the United Kingdom with a market capitalization of £269.87 million.

Operations: Kitwave Group generates revenue from three primary segments: Ambient (£225.98 million), Foodservice (£191.60 million), and Frozen & Chilled (£229.17 million).

Kitwave Group, a nimble player in the UK market, has shown impressive earnings growth of 40% annually over five years, though recent growth of 8.7% lags behind its industry. The company has transitioned from negative to positive shareholder equity, marking financial improvement despite a high net debt to equity ratio of 56.6%. With earnings forecasted to grow at over 18% per year and trading significantly below estimated fair value, Kitwave seems poised for future potential despite recent shareholder dilution through a £31 million equity offering.

- Navigate through the intricacies of Kitwave Group with our comprehensive health report here.

Gain insights into Kitwave Group's past trends and performance with our Past report.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that functions as a home and community builder in Ireland, with a market capitalization of £1.07 billion.

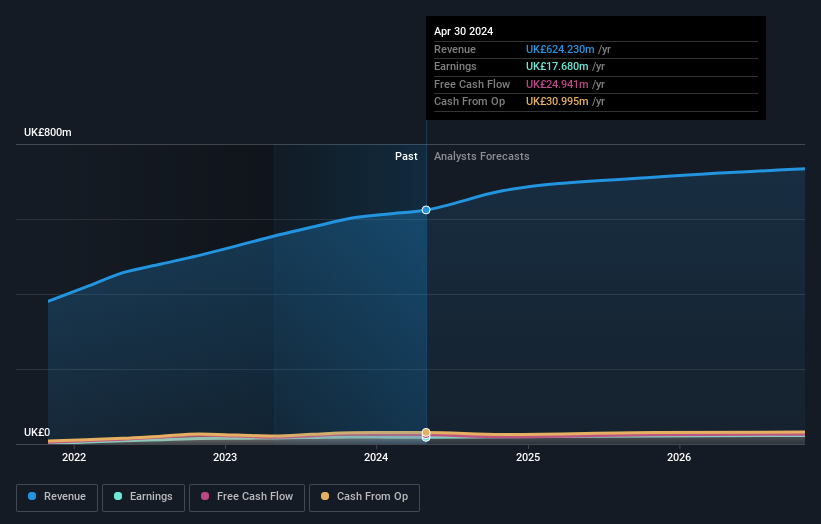

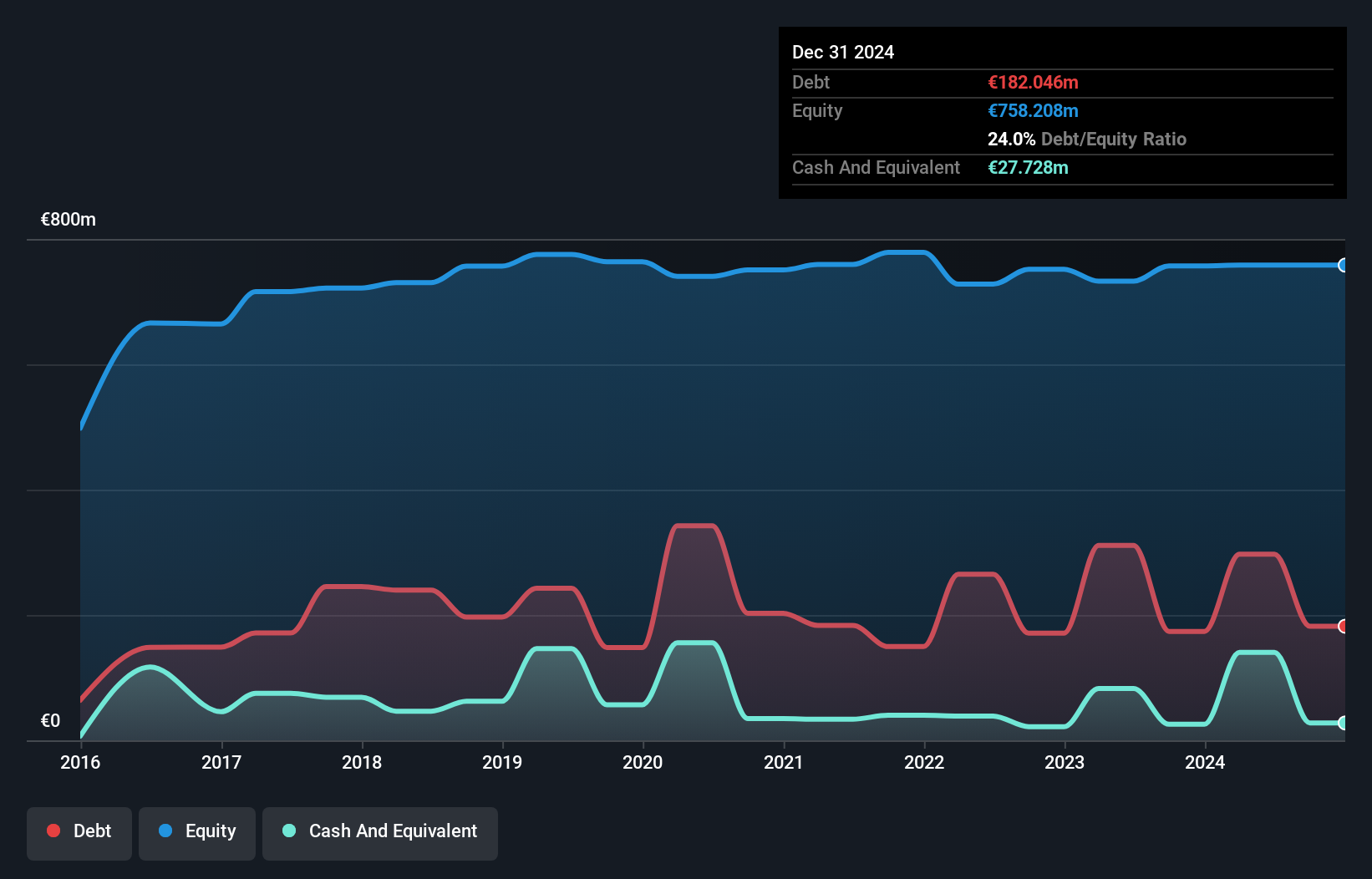

Operations: Cairn Homes generates revenue primarily from its building and property development segment, amounting to €813.40 million.

Cairn Homes, a notable player in the UK market, has demonstrated robust growth with earnings rising 49.5% over the past year, outpacing its industry peers. The company trades at a favorable price-to-earnings ratio of 11.4x compared to the UK market average of 16.4x, highlighting its relative value appeal. Recent buybacks saw Cairn repurchase shares worth €70 million, reflecting confidence in its financial health and future prospects amid strong sales growth from €219.54 million to €366.13 million year-on-year.

- Take a closer look at Cairn Homes' potential here in our health report.

Understand Cairn Homes' track record by examining our Past report.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market capitalization of £1.25 billion.

Operations: Seplat Energy generates revenue primarily from oil and gas, with oil contributing $815.03 million and gas $120.87 million.

Seplat Energy, a nimble player in the energy sector, has shown impressive earnings growth of 207.6% over the past year, outpacing its industry peers. The company boasts a satisfactory net debt to equity ratio of 20.6%, reflecting prudent financial management. Recent results highlight a turnaround with Q2 net income at US$39.72 million from a loss last year, despite sales dipping to US$421.64 million for six months ending June 2024 compared to prior periods.

- Delve into the full analysis health report here for a deeper understanding of Seplat Energy.

Examine Seplat Energy's past performance report to understand how it has performed in the past.

Summing It All Up

- Gain an insight into the universe of 81 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRN

Cairn Homes

A holding company, operates as a home and community builder in Ireland.

Solid track record with excellent balance sheet.