- United Kingdom

- /

- Professional Services

- /

- AIM:NBB

3 UK Penny Stocks With Market Caps Under £30M

Reviewed by Simply Wall St

In the last week, the UK market has been flat, but it is up 8.5% over the past year with earnings expected to grow by 15% per annum in the coming years. Penny stocks may be a throwback term, but they continue to offer compelling opportunities for growth at lower price points, especially when these companies have strong balance sheets and solid fundamentals. This article highlights three UK penny stocks that stand out as hidden gems with potential for impressive returns amidst current market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.16 | £806.27M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.235 | £68.45M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.015 | £78.01M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £183.61M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.125 | £98.14M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.28 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £174.47M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.46 | £443.08M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.416 | $249.68M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Norman Broadbent (AIM:NBB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Norman Broadbent plc, along with its subsidiaries, offers professional services both in the United Kingdom and internationally, with a market cap of £2.87 million.

Operations: The company generates its revenue primarily from the United Kingdom, accounting for £8.50 million, with an additional £2.80 million coming from international markets.

Market Cap: £2.87M

Norman Broadbent plc, with a market cap of £2.87 million, has recently become profitable, marking a significant turnaround in its financial performance. The company generates substantial revenue from the UK (£8.50 million) and internationally (£2.80 million), indicating diversified income streams. Despite this progress, shareholders experienced dilution over the past year with shares outstanding increasing by 3.3%. The firm maintains an experienced board and management team but faces challenges such as high net debt to equity (48.5%) and short-term liabilities equaling short-term assets (£2.4M). Its share price remains volatile compared to most UK stocks.

- Dive into the specifics of Norman Broadbent here with our thorough balance sheet health report.

- Evaluate Norman Broadbent's historical performance by accessing our past performance report.

Shield Therapeutics (AIM:STX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shield Therapeutics plc is a commercial stage specialty pharmaceutical company that focuses on the commercialization of pharmaceuticals to treat unmet medical needs, with a market cap of £22.48 million.

Operations: The company generates revenue from its pharmaceutical product Feraccru®/Accrufer®, totaling $21.47 million.

Market Cap: £22.48M

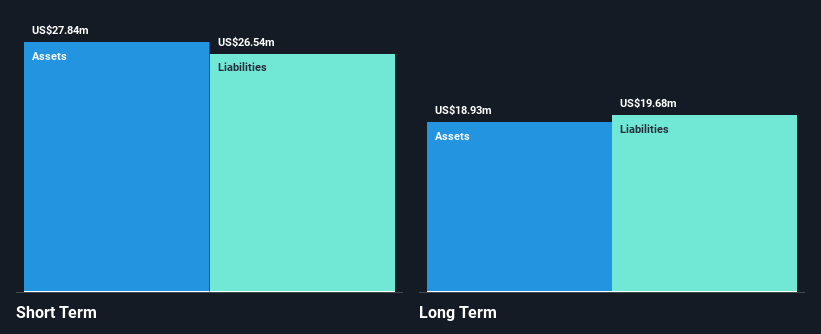

Shield Therapeutics plc, with a market cap of £22.48 million, is navigating financial challenges typical of penny stocks. Despite generating US$21.47 million in revenue from its pharmaceutical product Feraccru®/Accrufer®, the company remains unprofitable and faces increasing losses over five years at 41.1% annually. The recent £8.69 million equity offering aims to bolster its cash runway beyond four months, though high net debt to equity (2140.5%) persists as a concern. While short-term assets exceed liabilities, share price volatility and an inexperienced management team add layers of risk for investors considering this stock's potential growth trajectory amidst industry competition.

- Take a closer look at Shield Therapeutics' potential here in our financial health report.

- Explore Shield Therapeutics' analyst forecasts in our growth report.

Tanfield Group (AIM:TAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tanfield Group PLC is an investment company with a market cap of £6.13 million, holding a 49% interest in Snorkel International Holdings LLC, which manufactures various types of aerial lifts such as scissor lifts and boom lifts.

Operations: Tanfield Group does not report any specific revenue segments.

Market Cap: £6.13M

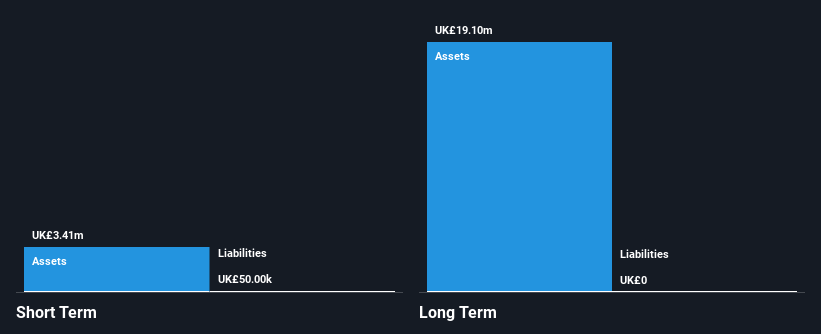

Tanfield Group PLC, with a market cap of £6.13 million, is pre-revenue and unprofitable but has reduced its losses over the past five years by 44.9% annually. The company holds a 49% interest in Snorkel International Holdings LLC and remains debt-free, which provides some financial stability. Its short-term assets (£3.4M) comfortably cover short-term liabilities (£50K), though there's insufficient data on cash runway or management experience to fully assess operational resilience. Recent earnings showed a narrowed net loss of £0.097 million for H1 2024, reflecting improved cost management despite ongoing profitability challenges typical of penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Tanfield Group.

- Examine Tanfield Group's past performance report to understand how it has performed in prior years.

Taking Advantage

- Click here to access our complete index of 470 UK Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norman Broadbent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NBB

Norman Broadbent

Provides professional services in the United Kingdom and internationally.

Good value with adequate balance sheet.