- United Kingdom

- /

- Metals and Mining

- /

- AIM:CMET

3 UK Penny Stocks Under £60M Market Cap To Consider

Reviewed by Simply Wall St

The United Kingdom market has stayed flat over the past week, but it has risen 8.5% in the last year, with earnings expected to grow by 15% annually in the coming years. In such a climate, identifying stocks with strong financials can be crucial for investors seeking value and growth opportunities. Penny stocks, despite their somewhat outdated name, remain relevant as they often represent smaller or newer companies that could offer significant potential when backed by solid financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.16 | £806.27M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.235 | £68.45M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.015 | £78.01M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £183.61M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.125 | £98.14M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.28 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £174.47M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.46 | £443.08M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.416 | $249.68M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Capital Metals (AIM:CMET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Capital Metals plc is involved in the exploration, evaluation, and development of mineral sand resources in the United Kingdom and Sri Lanka, with a market capitalization of £13.32 million.

Operations: Revenue Segments: No revenue segments have been reported.

Market Cap: £13.32M

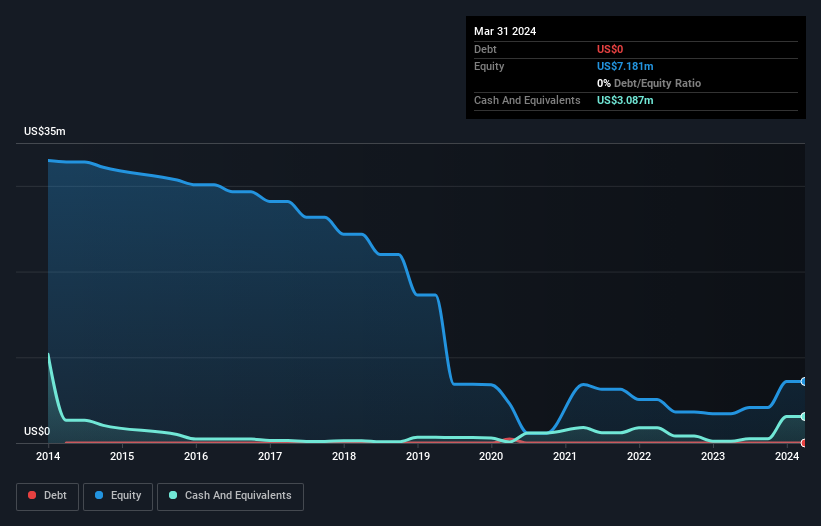

Capital Metals is a pre-revenue company with a market capitalization of £13.32 million, focusing on mineral sands development. Recent updates highlight efforts to reduce initial capital expenditure to $20.9 million and expedite cash flow through strategic partnerships, potentially avoiding equity raises. Despite being debt-free and having sufficient cash runway for over two years, the company faces going concern doubts from auditors. Its board is experienced, but management tenure suggests recent changes. Shareholder dilution occurred last year with increased shares outstanding by 7.8%. The company's share price has been highly volatile recently, reflecting its speculative nature in the penny stock category.

- Dive into the specifics of Capital Metals here with our thorough balance sheet health report.

- Understand Capital Metals' track record by examining our performance history report.

Time Finance (AIM:TIME)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Time Finance plc, along with its subsidiaries, offers financial products and services to consumers and businesses in the United Kingdom, with a market cap of £53.39 million.

Operations: The company generates revenue through its Asset Finance segment, which accounts for £18.75 million, and its Invoice Finance segment, contributing £14.32 million.

Market Cap: £53.39M

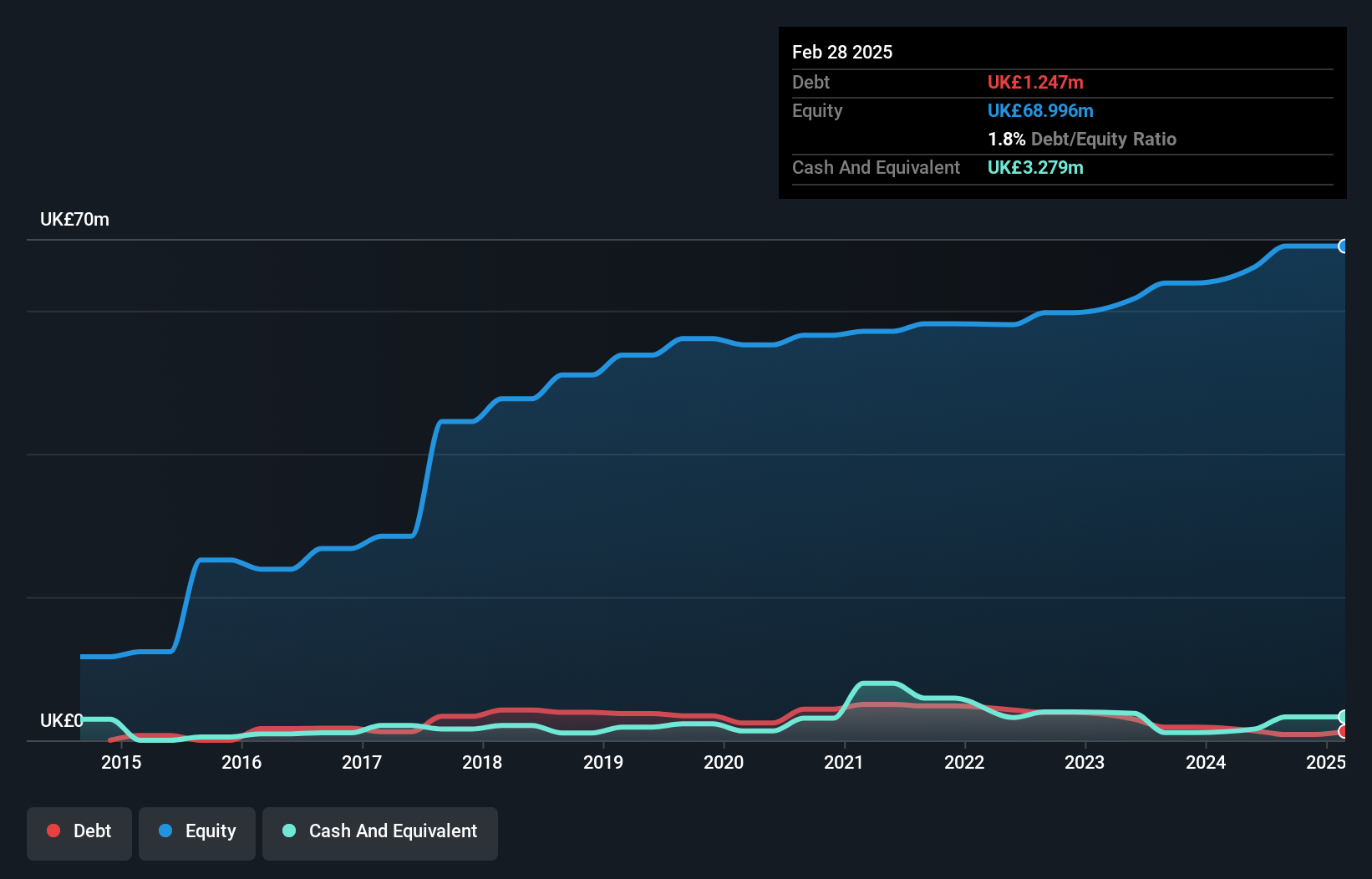

Time Finance plc, with a market cap of £53.39 million, shows promising financial growth and stability in the penny stock sector. The company reported an increase in revenue to £33.23 million for the year ending May 31, 2024, up from £26.97 million the previous year, while net income rose to £4.44 million from £3.45 million. Its earnings growth of 32.3% outpaced industry averages and its debt-to-equity ratio has improved significantly over five years to 2%. Despite recent share price volatility and low return on equity at 6.7%, Time Finance maintains strong asset coverage over liabilities and trades at a favorable P/E ratio of 12x compared to the UK market average.

- Click here to discover the nuances of Time Finance with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Time Finance's future.

Van Elle Holdings (AIM:VANL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Van Elle Holdings plc is a geotechnical and ground engineering contractor operating in the United Kingdom with a market cap of £41.66 million.

Operations: The company's revenue is generated from three main segments: General Piling (£56.69 million), Specialist Piling & Rail (£43.87 million), and Ground Engineering Services (£38.32 million).

Market Cap: £41.66M

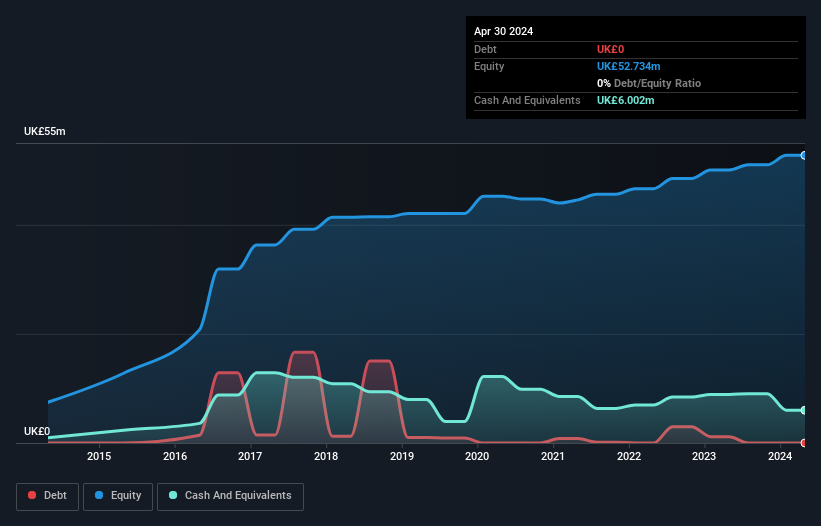

Van Elle Holdings plc, with a market cap of £41.66 million, operates without debt, enhancing its financial stability in the penny stock domain. The company has shown significant earnings growth over five years at 37.7% annually, although recent earnings declined by 9.9%. Its short-term assets (£50M) comfortably cover both short-term (£34.8M) and long-term liabilities (£11.3M). Despite a low return on equity of 8%, Van Elle trades at a substantial discount to estimated fair value and maintains high-quality past earnings. Recent strategic contracts in Canada could bolster future revenue streams significantly beyond CAD 50 million through to 2028.

- Click here and access our complete financial health analysis report to understand the dynamics of Van Elle Holdings.

- Assess Van Elle Holdings' future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Reveal the 470 hidden gems among our UK Penny Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CMET

Capital Metals

Engages in the exploration, evaluation, and development of mineral sand resources in the United Kingdom and Sri Lanka.

Flawless balance sheet low.

Market Insights

Community Narratives