- United Kingdom

- /

- Real Estate

- /

- LSE:HWG

Hidden Treasures in the UK Market to Watch This September 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both closing lower amid weak trade data from China. This downturn highlights the importance of identifying resilient stocks that can navigate global economic uncertainties. In this context, we explore three hidden treasures in the UK market worth watching this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector and has a market cap of £1.16 billion.

Operations: Yellow Cake plc generates revenue primarily through holding U3O8 for long-term capital appreciation, with this segment contributing $735.02 million.

Yellow Cake, trading at a low P/E ratio of 2.1x compared to the UK market's 16.5x, has become profitable this year with net income at US$727 million from a previous net loss of US$102.94 million. Despite high non-cash earnings and no debt for the past five years, shareholders faced dilution over the last year. Earnings are forecasted to decline by an average of 91% annually over the next three years, making future prospects uncertain despite current profitability.

- Click here and access our complete health analysis report to understand the dynamics of Yellow Cake.

Gain insights into Yellow Cake's past trends and performance with our Past report.

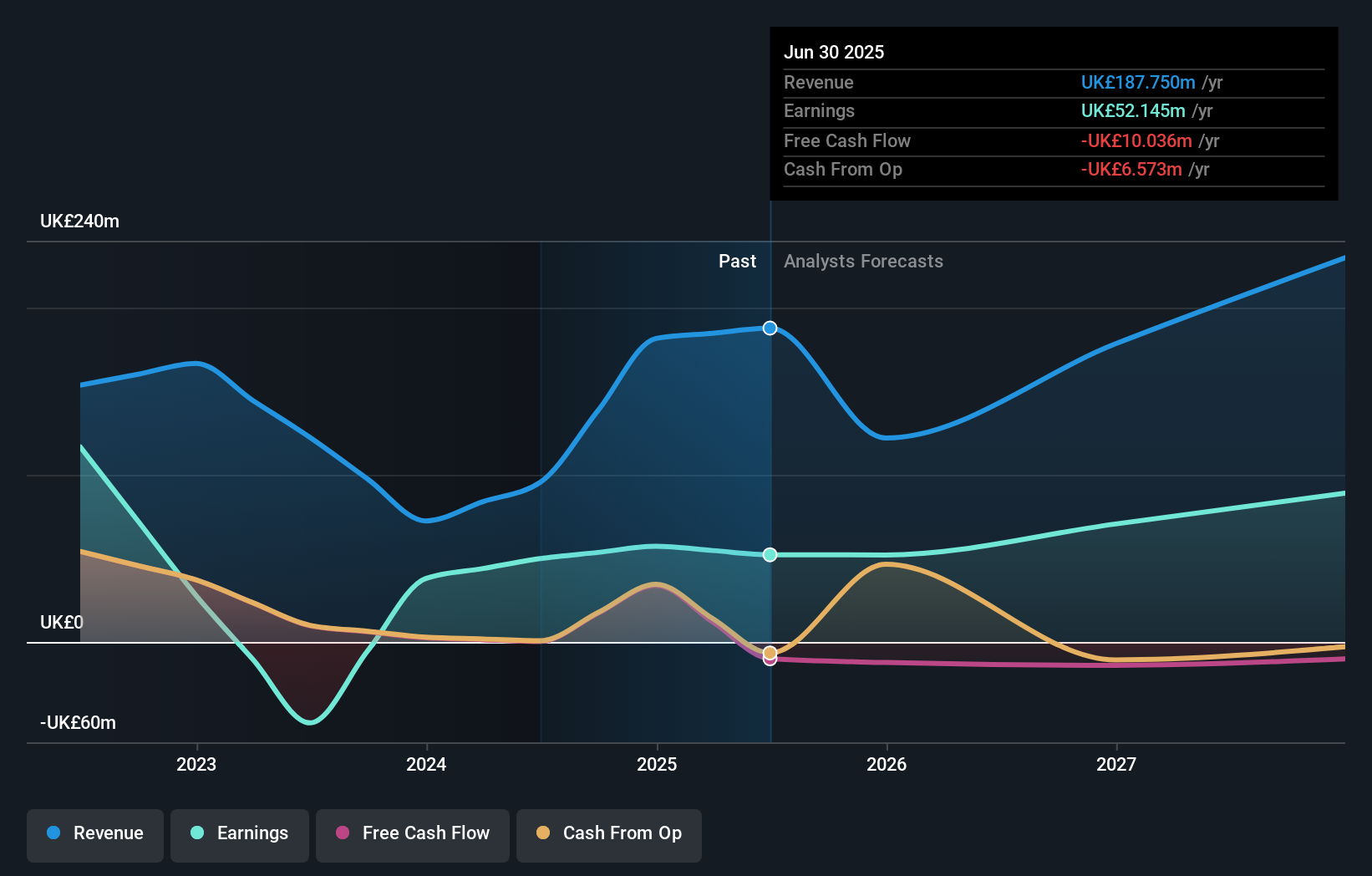

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Harworth Group plc operates as a land and property regeneration company in the North of England and the Midlands, with a market cap of £566.97 million.

Operations: Harworth Group's revenue streams include £23.41 million from Income Generation and £46.73 million from the Sale of Development Properties, with additional contributions of £2.29 million from Other Property Activities.

Harworth Group, a small cap real estate player, reported notable earnings growth of 36.3% over the past year, outpacing the industry average of 5.3%. The company’s net debt to equity ratio has improved from 16.6% to 10% over five years, reflecting prudent financial management. Trading at a P/E ratio of 14.9x compared to the UK market's 16.5x suggests good value for investors. A significant one-off gain of £69.4M impacted its recent financial results positively.

- Dive into the specifics of Harworth Group here with our thorough health report.

Examine Harworth Group's past performance report to understand how it has performed in the past.

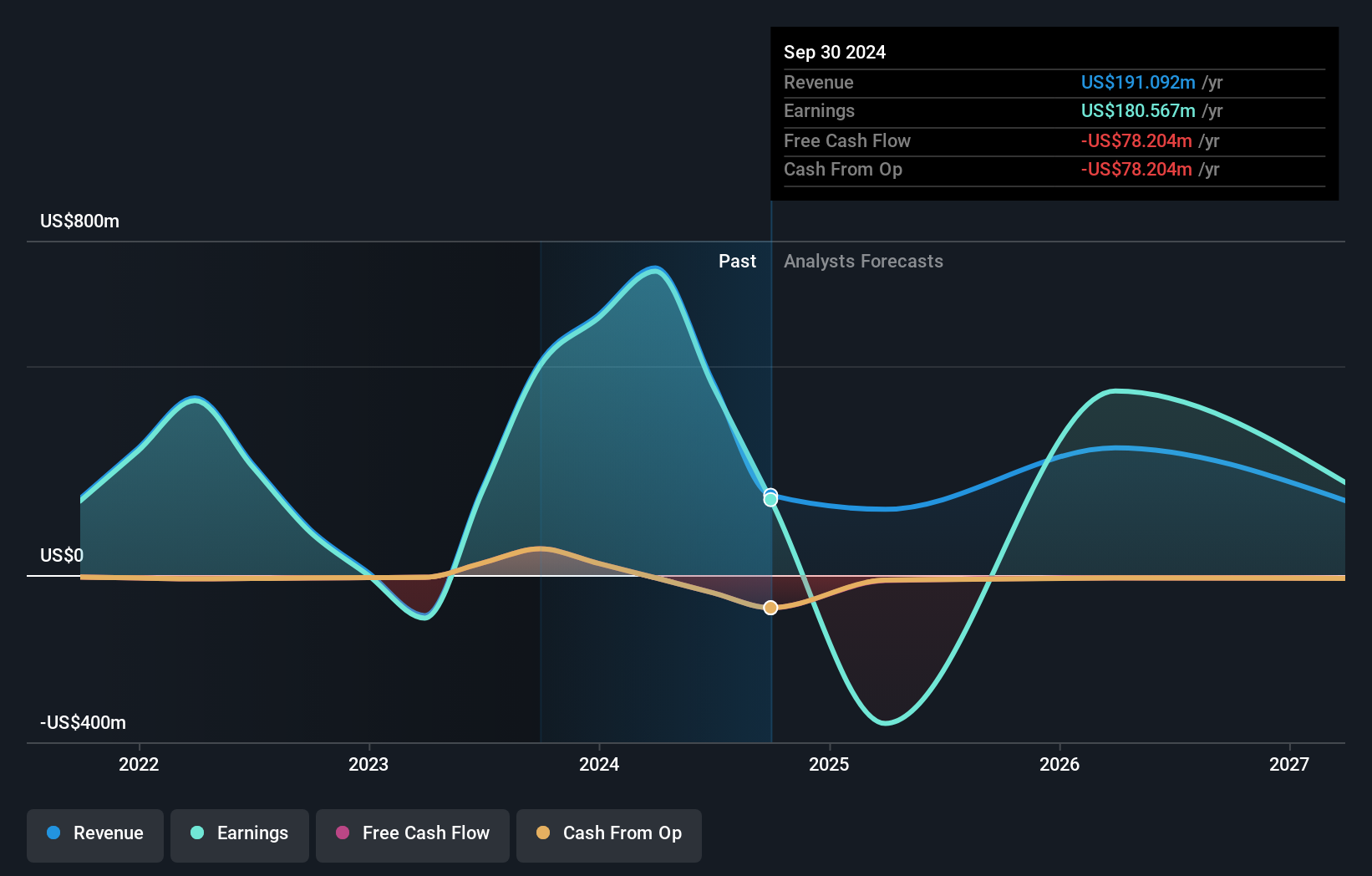

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing activities across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.09 billion.

Operations: Seplat Energy generates revenue primarily from oil ($815.03 million) and gas ($120.87 million) segments. The company's market cap stands at £1.09 billion.

Seplat Energy, a small cap in the UK market, reported robust earnings growth of 207.6% over the past year, significantly outpacing the Oil and Gas industry. The company's net debt to equity ratio stands at a satisfactory 20.6%, though it has risen to 41.5% over five years. Recent unaudited results for H1 2024 showed production averaging 48,407 boepd and sales reaching US$421.64 million with net income of US$40.76 million compared to US$43.51 million last year.

- Click to explore a detailed breakdown of our findings in Seplat Energy's health report.

Assess Seplat Energy's past performance with our detailed historical performance reports.

Next Steps

- Reveal the 81 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harworth Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HWG

Harworth Group

Operates as a land and property regeneration company in the North of England and the Midlands.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives