- United Kingdom

- /

- Oil and Gas

- /

- LSE:PRD

Discover 3 UK Penny Stocks With Market Caps Over £10M

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting challenges in global economic recovery. In such times, investors often seek opportunities in smaller or less-established companies that can offer potential value and growth. Penny stocks, despite being considered a somewhat outdated term, still represent an intriguing investment area where financial strength and growth potential can be found.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.634 | £53.53M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.76 | £284.91M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.85 | £311.03M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £416.99M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.745 | £361.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.598 | £992.98M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £155.66M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.87 | £2.13B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.345 | £37.33M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 386 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Time Finance (AIM:TIME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Time Finance plc, along with its subsidiaries, offers financial products and services to consumers and businesses in the United Kingdom, with a market cap of £51.55 million.

Operations: The company generates revenue of £36.35 million from its operations in the United Kingdom.

Market Cap: £51.55M

Time Finance plc, with a market cap of £51.55 million, presents an intriguing opportunity in the penny stock arena due to its strong financial position and growth trajectory. The company boasts significant earnings growth of 49.5% over the past year, outpacing industry averages, while maintaining high-quality earnings and stable weekly volatility. Its debt management is robust, with more cash than total debt and operating cash flow well covering its obligations. However, its Return on Equity remains low at 9%. Recent strategic moves include potential acquisitions focused on bolstering core business operations, reflecting a proactive approach to expansion.

- Dive into the specifics of Time Finance here with our thorough balance sheet health report.

- Assess Time Finance's future earnings estimates with our detailed growth reports.

Predator Oil & Gas Holdings (LSE:PRD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Predator Oil & Gas Holdings Plc, with a market cap of £18.05 million, is involved in the exploration, appraisal, and development of oil and gas assets across Africa, Europe, and the Caribbean.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £18.05M

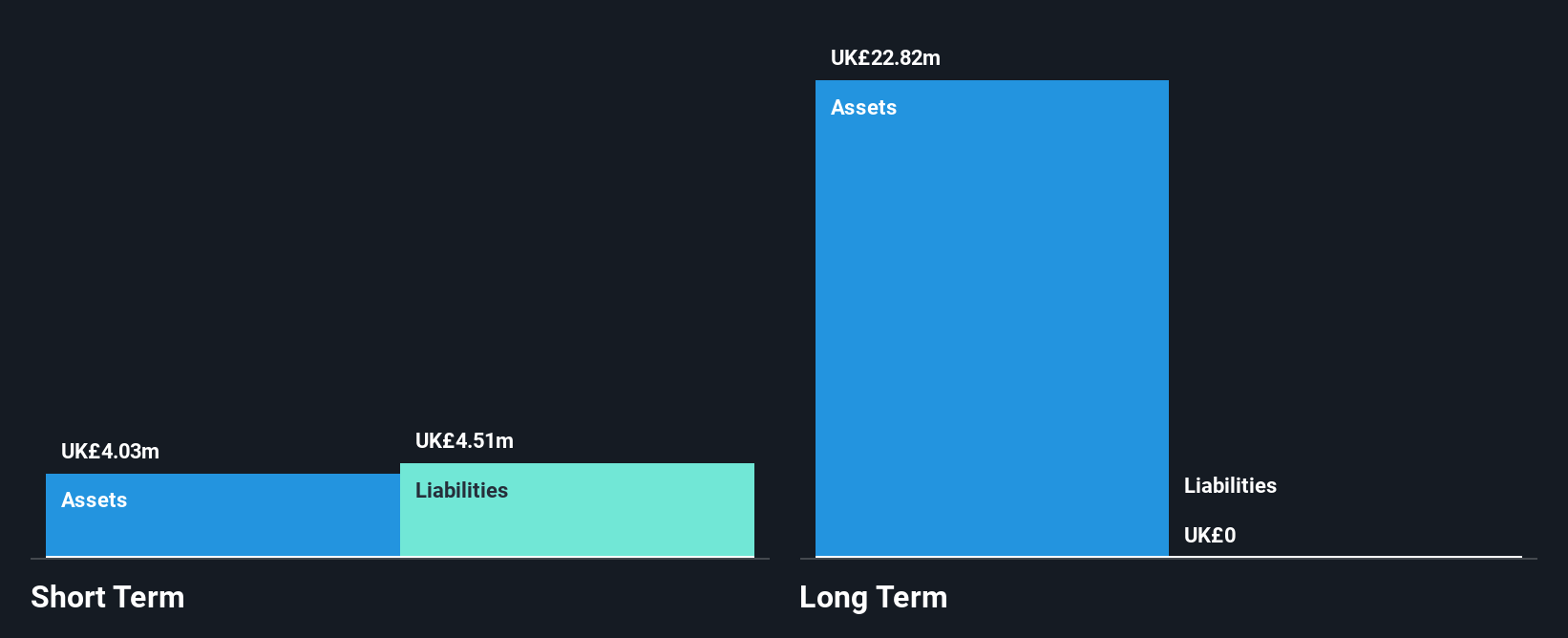

Predator Oil & Gas Holdings Plc, with a market cap of £18.05 million, operates as a pre-revenue entity in the oil and gas sector. Despite reporting a reduced net loss of £2.06 million for 2024, auditors expressed doubts about its ability to continue as a going concern. The company has no debt and maintains sufficient cash runway for over two years if current free cash flow trends persist. Recent drilling results in Morocco revealed promising geological formations, though further evaluation is needed. A follow-on equity offering raised £2 million to support ongoing exploration activities and potential seismic projects.

- Click here to discover the nuances of Predator Oil & Gas Holdings with our detailed analytical financial health report.

- Evaluate Predator Oil & Gas Holdings' historical performance by accessing our past performance report.

QinetiQ Group (LSE:QQ.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: QinetiQ Group plc is a science and engineering company serving the defense, security, and infrastructure markets across the UK, US, Australia, and internationally with a market cap of £2.13 billion.

Operations: The company's revenue is primarily generated from EMEA Services, contributing £1.48 billion, and Global Solutions, which accounts for £495.4 million.

Market Cap: £2.13B

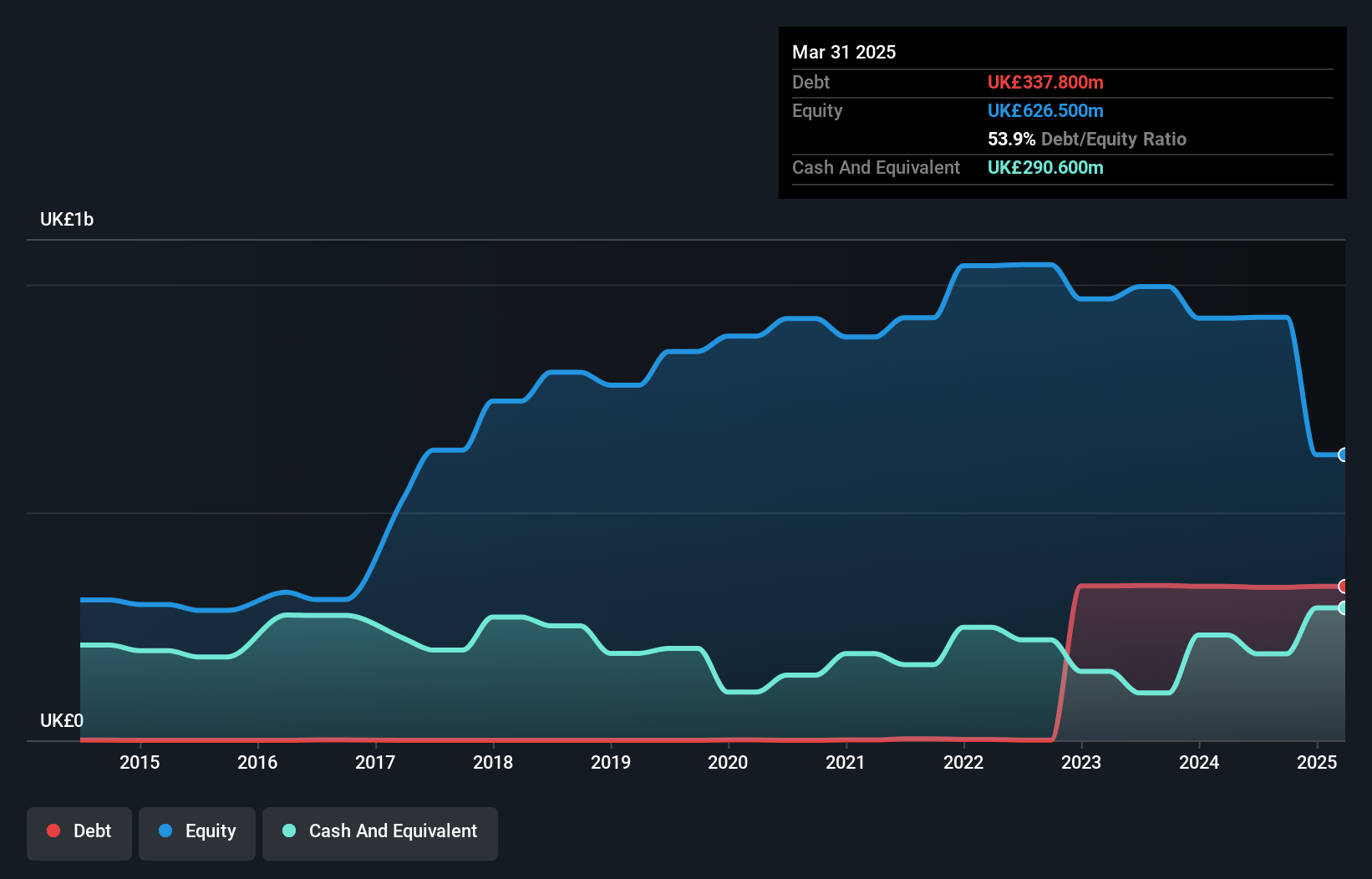

QinetiQ Group plc, with a market cap of £2.13 billion, is not typically classified as a penny stock but offers insights into smaller-scale investments due to its financial dynamics. The company demonstrates a satisfactory net debt to equity ratio of 15.7% and strong interest coverage at 14.4x EBIT, indicating solid financial health. Despite experiencing high share price volatility recently, QinetiQ trades at 53.6% below estimated fair value and shows promising earnings growth potential with forecasts of 27.37% annually. However, its Return on Equity remains low at 15%, and the board's average tenure suggests inexperience which may impact strategic decisions moving forward.

- Jump into the full analysis health report here for a deeper understanding of QinetiQ Group.

- Gain insights into QinetiQ Group's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Unlock our comprehensive list of 386 UK Penny Stocks by clicking here.

- Contemplating Other Strategies? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PRD

Predator Oil & Gas Holdings

Engages in the exploration, appraisal, and development of oil and gas assets in Africa, Europe, and the Caribbean.

Excellent balance sheet slight.

Market Insights

Community Narratives