- United Kingdom

- /

- Media

- /

- AIM:PEBB

Discover UK Penny Stocks: Pebble Group And 2 More To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In such a climate, investors might find potential in lesser-known opportunities that offer unique growth prospects. Penny stocks, often smaller or newer companies, remain relevant as they can provide a mix of affordability and potential for growth when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.772 | £65.02M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.77 | £285.64M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.37 | £171.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.795 | £427.27M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.25 | £409.75M | ✅ 2 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.45 | £184.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.88 | £1.17B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.968 | £154.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.40 | £43.28M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 400 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Pebble Group (AIM:PEBB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Pebble Group plc operates in the promotional merchandise industry by providing technology solutions, products, and services across the UK, Continental Europe, North America, and internationally with a market cap of £61.54 million.

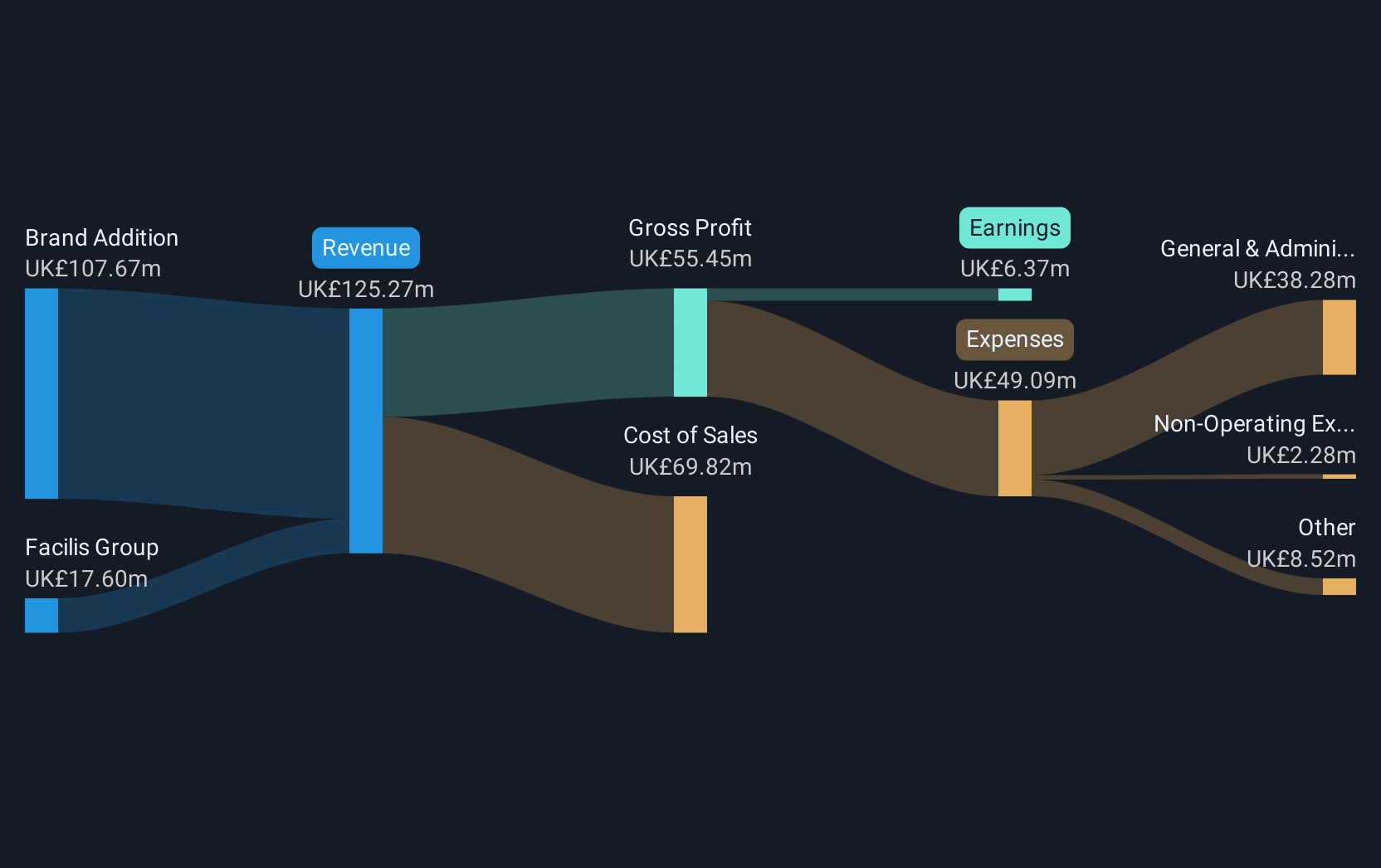

Operations: The company's revenue is derived from two main segments: Facilis Group, generating £17.60 million, and Brand Addition, contributing £107.67 million.

Market Cap: £61.54M

Pebble Group plc, with a market cap of £61.54 million, operates in the promotional merchandise industry and reported sales of £125.27 million for 2024. The company has shown steady profit growth over five years, averaging 40.1% annually, although recent earnings growth was below its historical average at 9.9%. Pebble Group remains debt-free and has robust short-term asset coverage over liabilities (£59.3M vs £30.2M). Despite trading significantly below estimated fair value, analysts forecast a decline in earnings by an average of 1.7% per year over the next three years while maintaining stable weekly volatility (5%).

- Click to explore a detailed breakdown of our findings in Pebble Group's financial health report.

- Review our growth performance report to gain insights into Pebble Group's future.

Hunting (LSE:HTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hunting PLC, with a market cap of £410.15 million, operates globally by manufacturing components, technology systems, and precision parts.

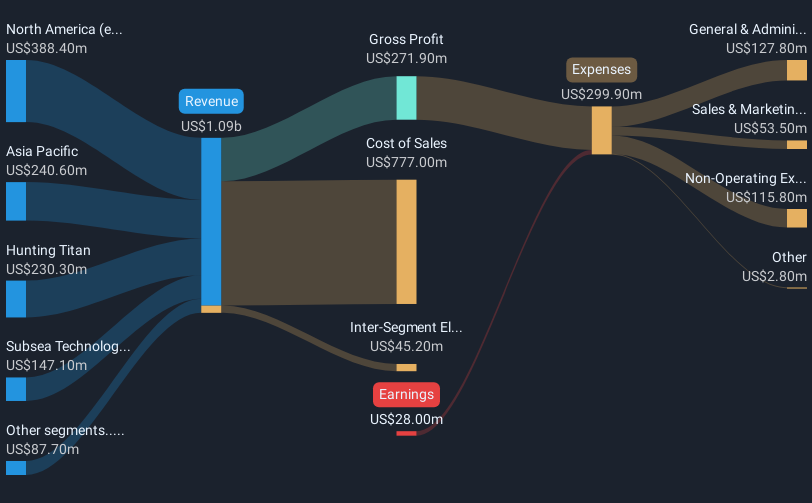

Operations: The company's revenue is derived from several segments: Asia Pacific ($240.6 million), Hunting Titan ($230.3 million), Subsea Technologies ($147.1 million), North America excluding Subsea Technologies ($388.4 million), and Europe, Middle East and Africa (EMEA) with $87.7 million in revenue.

Market Cap: £410.15M

Hunting PLC, with a market cap of £410.15 million, operates globally in manufacturing components and technology systems. Despite being unprofitable, it has reduced losses by 55.9% annually over five years and maintains a strong cash position exceeding its debt. The company is trading at a significant discount to its estimated fair value and has sufficient cash runway for over three years. Recent developments include acquiring Organic Oil Recovery technology for $17.5 million and securing substantial contracts in the North Sea and Gulf of Mexico, reflecting strategic growth initiatives despite recent insider selling activity.

- Click here to discover the nuances of Hunting with our detailed analytical financial health report.

- Evaluate Hunting's prospects by accessing our earnings growth report.

S4 Capital (LSE:SFOR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: S4 Capital plc, with a market cap of £170.91 million, offers digital advertising and marketing services across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

Operations: The company's revenue is derived from three primary segments: Content (£566.7 million), Technology Services (£86.5 million), and Data & Digital Media (£195 million).

Market Cap: £170.91M

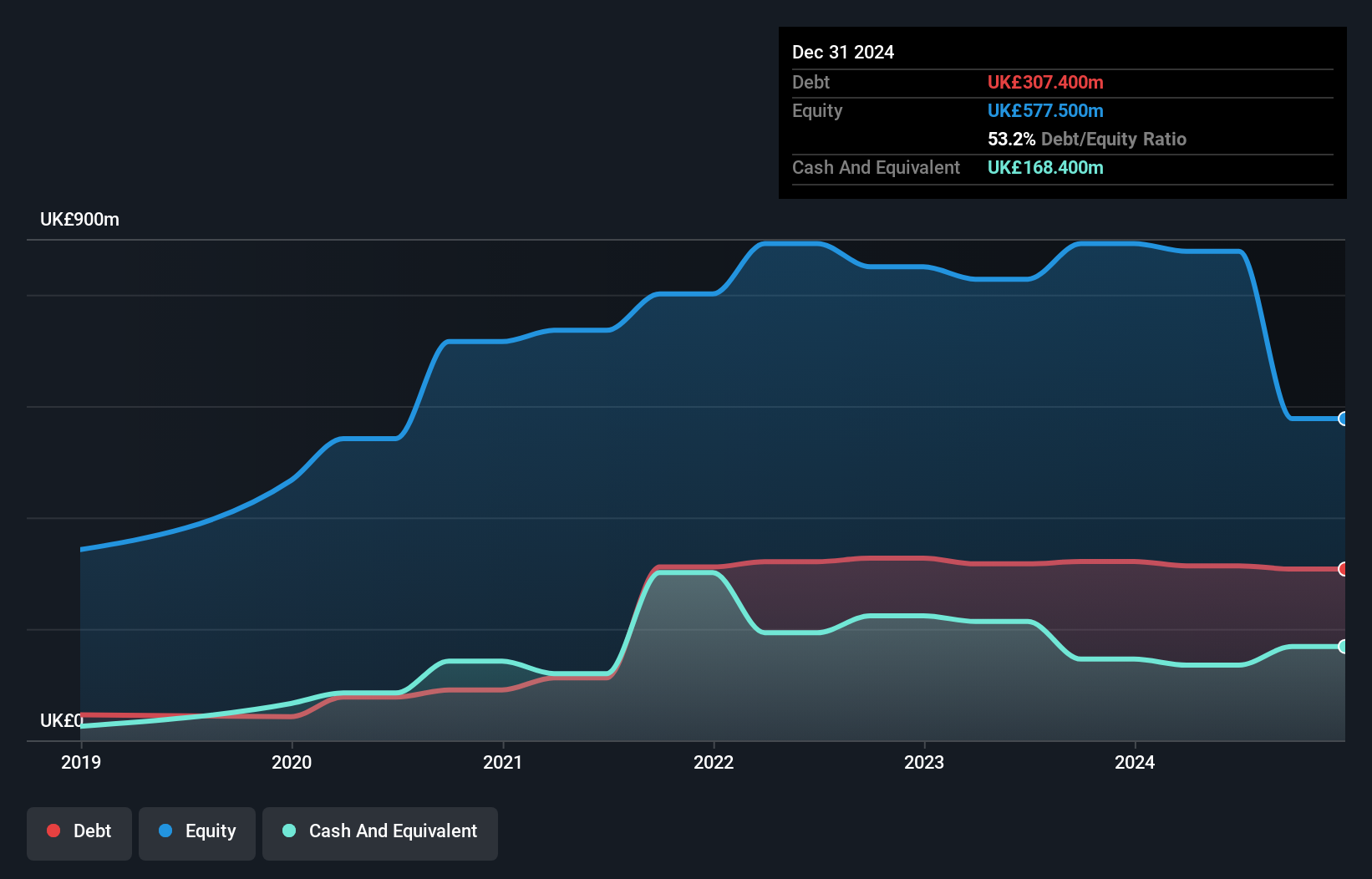

S4 Capital plc, with a market cap of £170.91 million, is navigating challenges as it remains unprofitable and has seen losses increase by 40.9% annually over the past five years. Despite this, the company shows potential with its strategic focus on AI-driven innovation through its Monks brand and recent leadership changes aimed at enhancing governance and operational efficiency. The company maintains a satisfactory net debt to equity ratio of 24.1% and covers both short-term and long-term liabilities with assets totaling £628.8 million, offering some financial stability amid high share price volatility in recent months.

- Click here and access our complete financial health analysis report to understand the dynamics of S4 Capital.

- Gain insights into S4 Capital's future direction by reviewing our growth report.

Next Steps

- Unlock more gems! Our UK Penny Stocks screener has unearthed 397 more companies for you to explore.Click here to unveil our expertly curated list of 400 UK Penny Stocks.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PEBB

Pebble Group

Engages in the sale of technology solutions, products, and other services to the promotional merchandise industry in the United Kingdom, Continental Europe, North America, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives