- United Kingdom

- /

- Oil and Gas

- /

- LSE:HBR

Here's Why Harbour Energy (LON:HBR) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Harbour Energy (LON:HBR). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Harbour Energy

How Quickly Is Harbour Energy Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Harbour Energy's EPS has grown 21% each year, compound, over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Unfortunately, revenue is down and so are margins. Shareholders will be hoping for a change in fortunes if they're looking for profit growth.

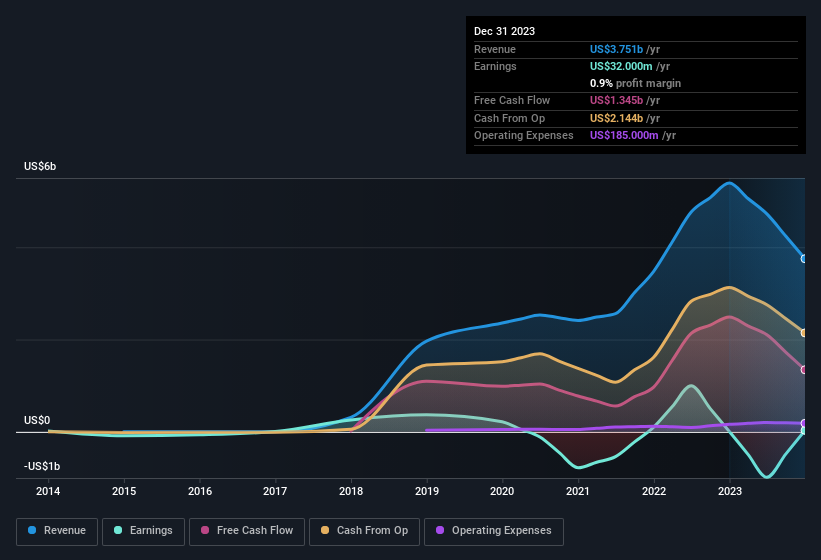

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Harbour Energy's future profits.

Are Harbour Energy Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in Harbour Energy will be more than happy to see insiders committing themselves to the company, spending US$274k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by CEO & Director Linda Cook for UK£246k worth of shares, at about UK£2.85 per share.

The good news, alongside the insider buying, for Harbour Energy bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at US$27m. That's a lot of money, and no small incentive to work hard. Despite being just 1.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Harbour Energy To Your Watchlist?

You can't deny that Harbour Energy has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 1 warning sign for Harbour Energy that you should be aware of.

The good news is that Harbour Energy is not the only stock with insider buying. Here's a list of small cap, undervalued companies in GB with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Harbour Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HBR

Harbour Energy

Engages in the acquisition, exploration, development, and production of oil and gas reserves.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives