- United Kingdom

- /

- Energy Services

- /

- LSE:GMS

Additional Considerations Required While Assessing Gulf Marine Services' (LON:GMS) Strong Earnings

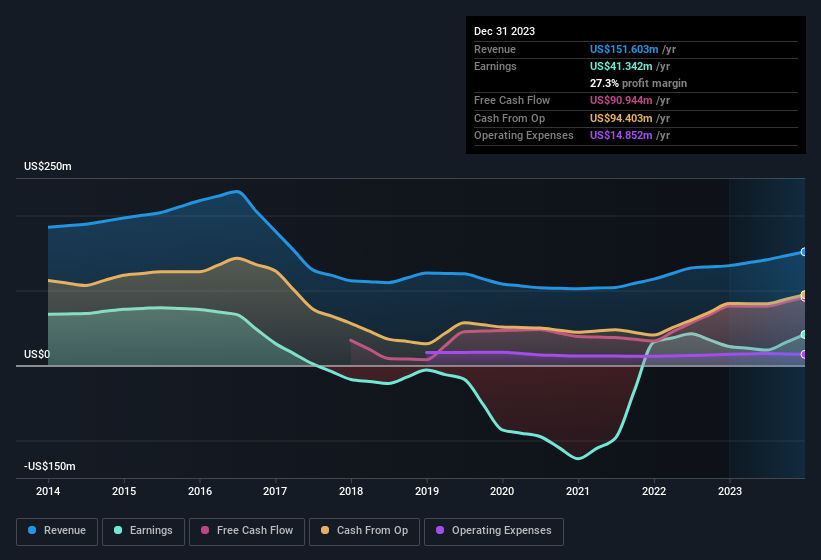

Despite posting some strong earnings, the market for Gulf Marine Services PLC's (LON:GMS) stock hasn't moved much. We did some digging, and we found some concerning factors in the details.

Check out our latest analysis for Gulf Marine Services

The Impact Of Unusual Items On Profit

For anyone who wants to understand Gulf Marine Services' profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from US$33m worth of unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. We can see that Gulf Marine Services' positive unusual items were quite significant relative to its profit in the year to December 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Gulf Marine Services' Profit Performance

As we discussed above, we think the significant positive unusual item makes Gulf Marine Services' earnings a poor guide to its underlying profitability. As a result, we think it may well be the case that Gulf Marine Services' underlying earnings power is lower than its statutory profit. But at least holders can take some solace from the 63% EPS growth in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Every company has risks, and we've spotted 3 warning signs for Gulf Marine Services (of which 1 can't be ignored!) you should know about.

Today we've zoomed in on a single data point to better understand the nature of Gulf Marine Services' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GMS

Gulf Marine Services

Operates self-propelled self-elevating support vessels (SESVs) in the United Arab Emirates, the Kingdom of Saudi Arabia, Qatar, and Europe.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026