Stock Analysis

- United Kingdom

- /

- Banks

- /

- LSE:TBCG

UK Growth Companies With At Least 10% Insider Ownership

Reviewed by Simply Wall St

As the FTSE 100 faces challenges, snapping a three-month winning streak amidst political and regulatory uncertainties, investors might look towards more stable investment opportunities. High insider ownership in growth companies can be a reassuring sign in these volatile times, indicating that those who know the company best are personally invested in its success.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 30.1% |

| Directa Plus (AIM:DCTA) | 14.8% | 102.5% |

| Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

| TEAM (AIM:TEAM) | 25.8% | 58.8% |

| Afentra (AIM:AET) | 38.3% | 64.4% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

We're going to check out a few of the best picks from our screener tool.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc is a company that designs, manufactures, and sells scientific instruments, with a market capitalization of approximately £670.77 million.

Operations: The company's revenue is primarily derived from two segments: Vacuum, which generates £63.60 million, and Materials Sciences, contributing £72.50 million.

Insider Ownership: 11.5%

Judges Scientific, a UK-based company, exhibits mixed signals for growth-focused investors with high insider ownership. Despite its profit margins decreasing from 11% to 7% over the past year and carrying a high level of debt, JDG's earnings are expected to outpace the market with an annual growth rate of 25.3%. However, revenue growth projections remain modest at 4.8%. Recent corporate governance changes and a dividend increase might suggest positive internal expectations but significant insider selling raises concerns about commitment levels among top stakeholders.

- Take a closer look at Judges Scientific's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Judges Scientific shares in the market.

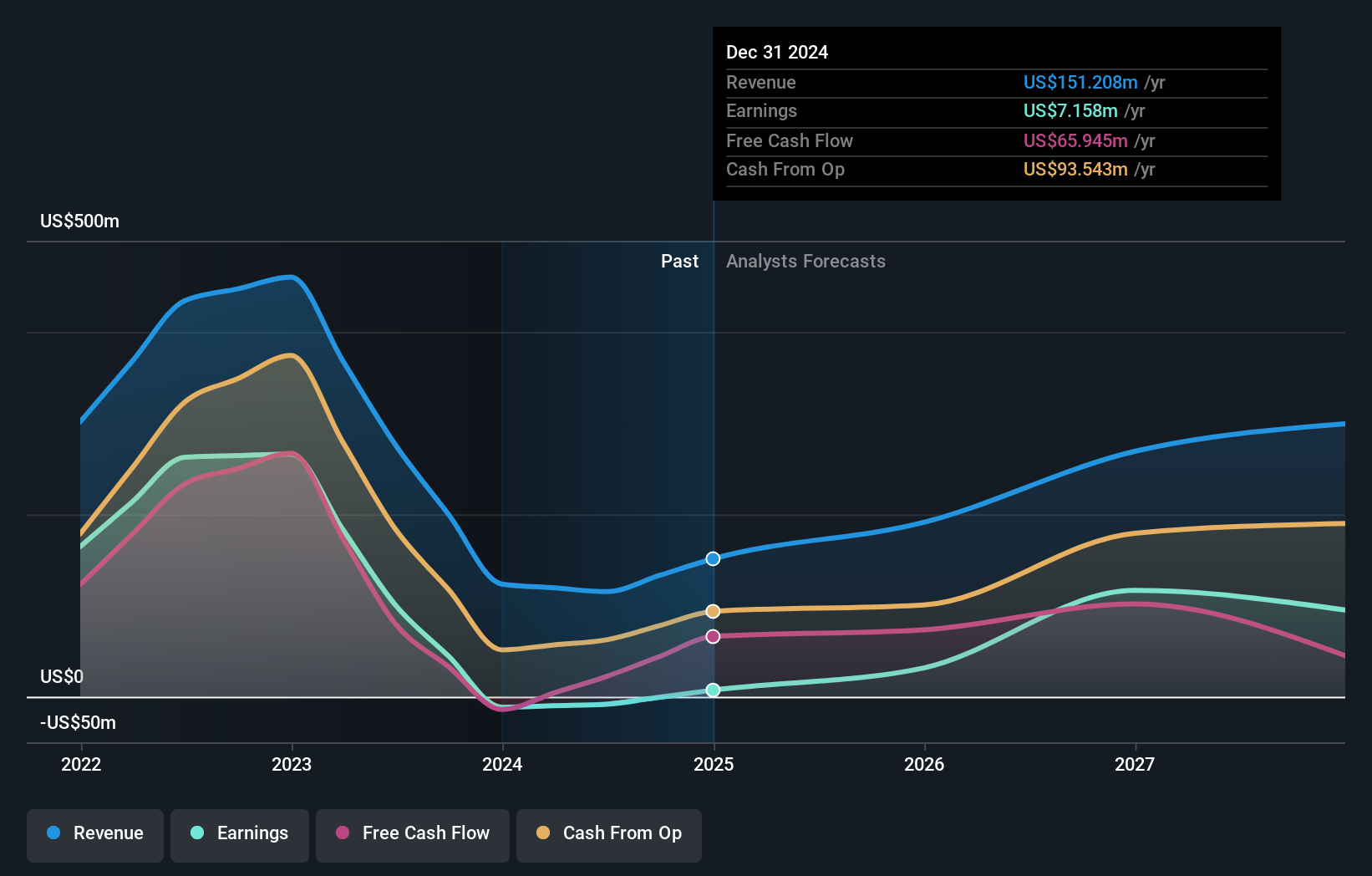

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited is an oil and gas company focused on exploration, development, and production in the Kurdistan Region of Iraq, with a market capitalization of approximately £327.83 million.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling $123.51 million.

Insider Ownership: 10.8%

Gulf Keystone Petroleum, a UK-based oil and gas operator, is poised for significant growth with earnings expected to increase by 47.61% annually and revenue forecasted to grow at 25.1% per year, outpacing the UK market average of 3.5%. Despite trading at 55.6% below its estimated fair value and a highly volatile share price, the company has shown confidence in its prospects through a recent share repurchase program initiated on May 16, 2024, underlining a strategic move to enhance shareholder value amidst growing profitability forecasts over the next three years.

- Click here and access our complete growth analysis report to understand the dynamics of Gulf Keystone Petroleum.

- Our valuation report unveils the possibility Gulf Keystone Petroleum's shares may be trading at a premium.

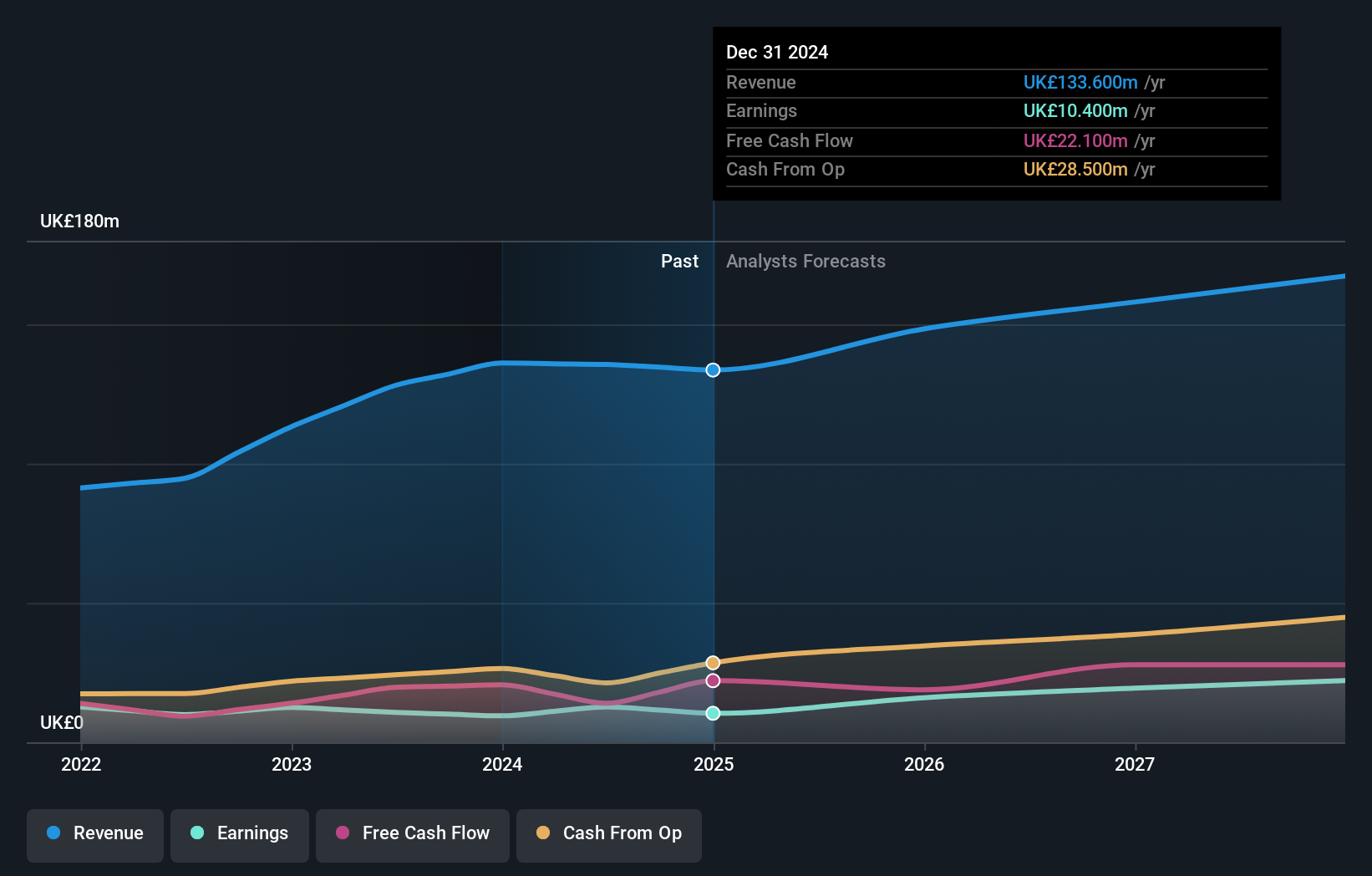

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates in Georgia, Azerbaijan, and Uzbekistan, offering a range of financial services including banking, leasing, insurance, brokerage, and card processing with a market capitalization of approximately £1.38 billion.

Operations: The company generates revenue from diverse financial services such as banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan.

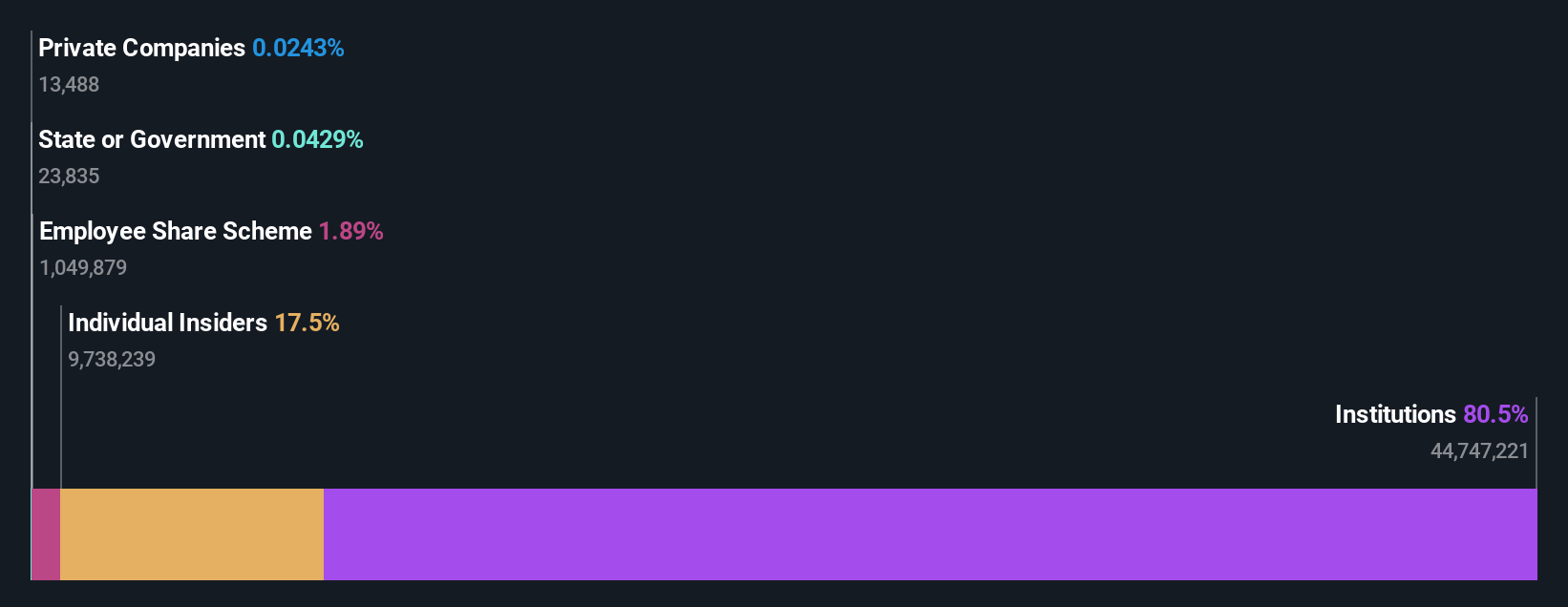

Insider Ownership: 18%

TBC Bank Group, with substantial insider ownership, demonstrates robust financial health with a significant increase in net interest income and net income as reported in Q1 2024. Despite a volatile share price and concerns over bad loans, the bank is trading below its fair value estimate. Recent strategic moves include a GEL 75 million buyback program aimed at shareholder returns and capital structure optimization. Earnings are expected to grow faster than the UK market average, highlighting potential for growth amidst some operational risks.

- Navigate through the intricacies of TBC Bank Group with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility TBC Bank Group's shares may be trading at a discount.

Summing It All Up

- Embark on your investment journey to our 64 Fast Growing UK Companies With High Insider Ownership selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether TBC Bank Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TBCG

TBC Bank Group

Through its subsidiaries, provides banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

Undervalued with reasonable growth potential and pays a dividend.