- United Kingdom

- /

- Pharma

- /

- LSE:AZN

3 UK Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and broader global economic concerns. As investors navigate these uncertain conditions, identifying stocks that are trading below their intrinsic value can present potential opportunities for those seeking to capitalize on mispriced assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.382 | £0.76 | 49.8% |

| GlobalData (AIM:DATA) | £2.02 | £3.71 | 45.6% |

| AstraZeneca (LSE:AZN) | £119.46 | £237.15 | 49.6% |

| Tracsis (AIM:TRCS) | £5.42 | £10.01 | 45.9% |

| Franchise Brands (AIM:FRAN) | £1.46 | £2.63 | 44.5% |

| Redcentric (AIM:RCN) | £1.325 | £2.44 | 45.8% |

| Videndum (LSE:VID) | £2.525 | £4.99 | 49.4% |

| Foxtons Group (LSE:FOXT) | £0.62 | £1.19 | 47.9% |

| SysGroup (AIM:SYS) | £0.335 | £0.65 | 48.7% |

| Hochschild Mining (LSE:HOC) | £1.908 | £3.53 | 46% |

Let's take a closer look at a couple of our picks from the screened companies.

AstraZeneca (LSE:AZN)

Overview: AstraZeneca PLC is a biopharmaceutical company engaged in the discovery, development, manufacture, and commercialization of prescription medicines, with a market cap of approximately £185.20 billion.

Operations: AstraZeneca's revenue segment is primarily derived from its biopharmaceuticals division, which generated $49.13 billion.

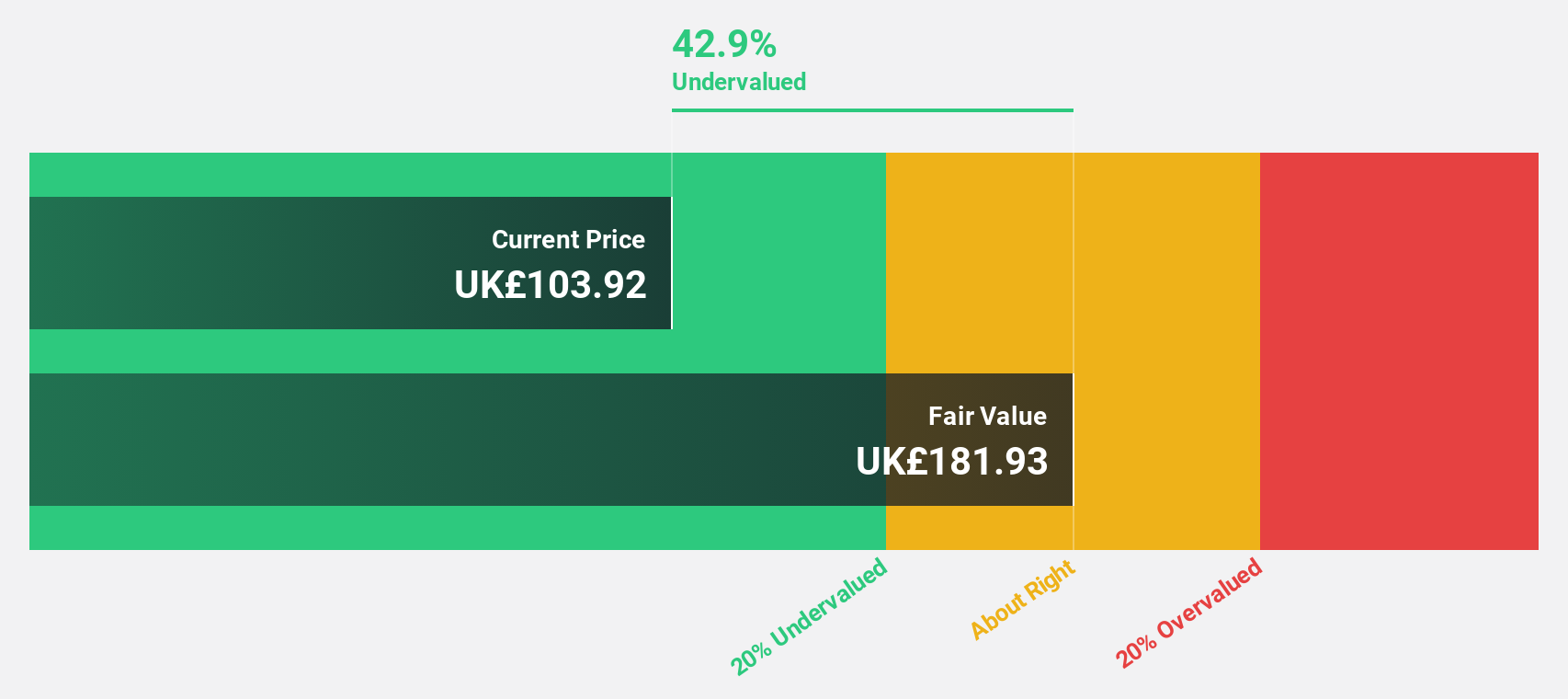

Estimated Discount To Fair Value: 49.6%

AstraZeneca is trading at £119.46, significantly below its estimated fair value of £237.15, suggesting potential undervaluation based on discounted cash flow analysis. Despite high debt levels and moderate earnings growth forecasts of 16.5% annually, the stock's price reflects a substantial discount to intrinsic value. Recent strategic alliances and clinical advancements in oncology indicate robust operational momentum, potentially enhancing future cash flows despite current financial constraints.

- Insights from our recent growth report point to a promising forecast for AstraZeneca's business outlook.

- Get an in-depth perspective on AstraZeneca's balance sheet by reading our health report here.

Gulf Keystone Petroleum (LSE:GKP)

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq with a market cap of £256.79 million.

Operations: The company's revenue is primarily derived from its exploration and production activities in oil and gas, amounting to $115.15 million.

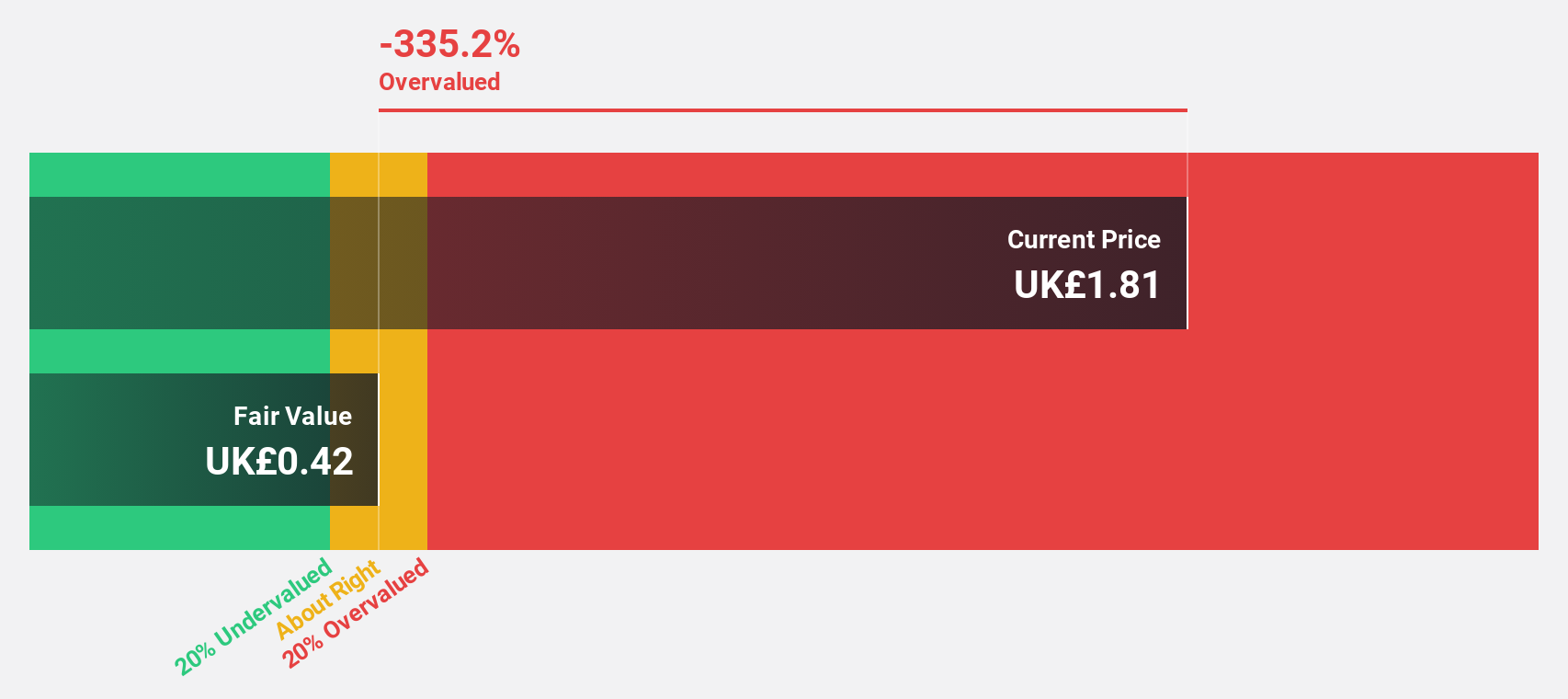

Estimated Discount To Fair Value: 42.5%

Gulf Keystone Petroleum is trading at £1.18, well below its estimated fair value of £2.06, indicating significant undervaluation based on discounted cash flow analysis. The company is forecast to become profitable within three years, with revenue growth expected to outpace the UK market substantially at 42.8% per year. Recent board changes include appointing two experienced Non-Executive Directors, potentially strengthening governance and strategic oversight amid ongoing share buybacks and improving earnings performance.

- According our earnings growth report, there's an indication that Gulf Keystone Petroleum might be ready to expand.

- Dive into the specifics of Gulf Keystone Petroleum here with our thorough financial health report.

W.A.G payment solutions (LSE:WPS)

Overview: W.A.G payment solutions plc operates an integrated payments and mobility platform targeting the commercial road transportation industry primarily in Europe, with a market cap of £565.37 million.

Operations: The company's revenue is derived from its Payment Solutions segment, which generated €2.10 billion, and its Mobility Solutions segment, which contributed €124.13 million.

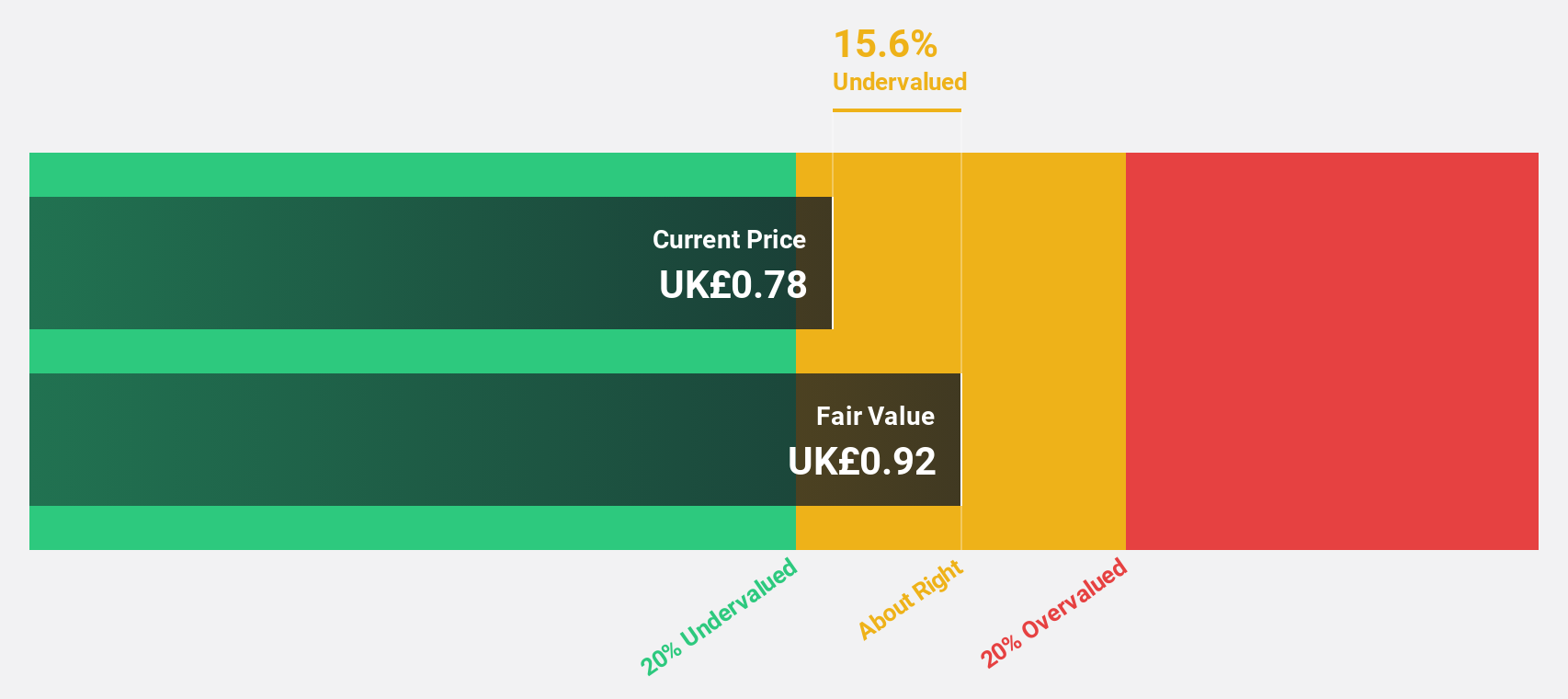

Estimated Discount To Fair Value: 12.5%

W.A.G payment solutions is trading at £0.82, slightly below its estimated fair value of £0.94, suggesting some undervaluation based on cash flow analysis. The company reported H1 2024 sales of €1.15 billion but saw a decline in net income to €2.43 million from the previous year, indicating challenges in profitability despite revenue growth forecasts exceeding the UK market rate at 8.9% annually. Analysts anticipate a stock price increase by 44.3%.

- Our expertly prepared growth report on W.A.G payment solutions implies its future financial outlook may be stronger than recent results.

- Take a closer look at W.A.G payment solutions' balance sheet health here in our report.

Where To Now?

- Unlock our comprehensive list of 60 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives