- United Kingdom

- /

- Oil and Gas

- /

- LSE:GENL

Restore And 2 Other Undervalued Small Caps In United Kingdom With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, yet it has seen a 7.5% increase over the past year with earnings forecasted to grow by 14% annually. In such a dynamic environment, identifying small-cap stocks that are potentially undervalued and exhibit insider buying can be an intriguing strategy for investors seeking opportunities in this space.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 17.9x | 0.6x | 37.84% | ★★★★★★ |

| Bytes Technology Group | 25.1x | 5.7x | 9.61% | ★★★★★☆ |

| NWF Group | 8.5x | 0.1x | 36.18% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 26.24% | ★★★★★☆ |

| Essentra | 721.2x | 1.4x | 26.84% | ★★★★☆☆ |

| Genus | 170.1x | 2.0x | -1.50% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 40.05% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 39.19% | ★★★★☆☆ |

| Oxford Instruments | 22.6x | 2.4x | -26.71% | ★★★☆☆☆ |

| Petra Diamonds | NA | 0.3x | -42.95% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Restore (AIM:RST)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Restore is a company specializing in secure lifecycle services and digital & information management, with a market cap of £0.65 billion.

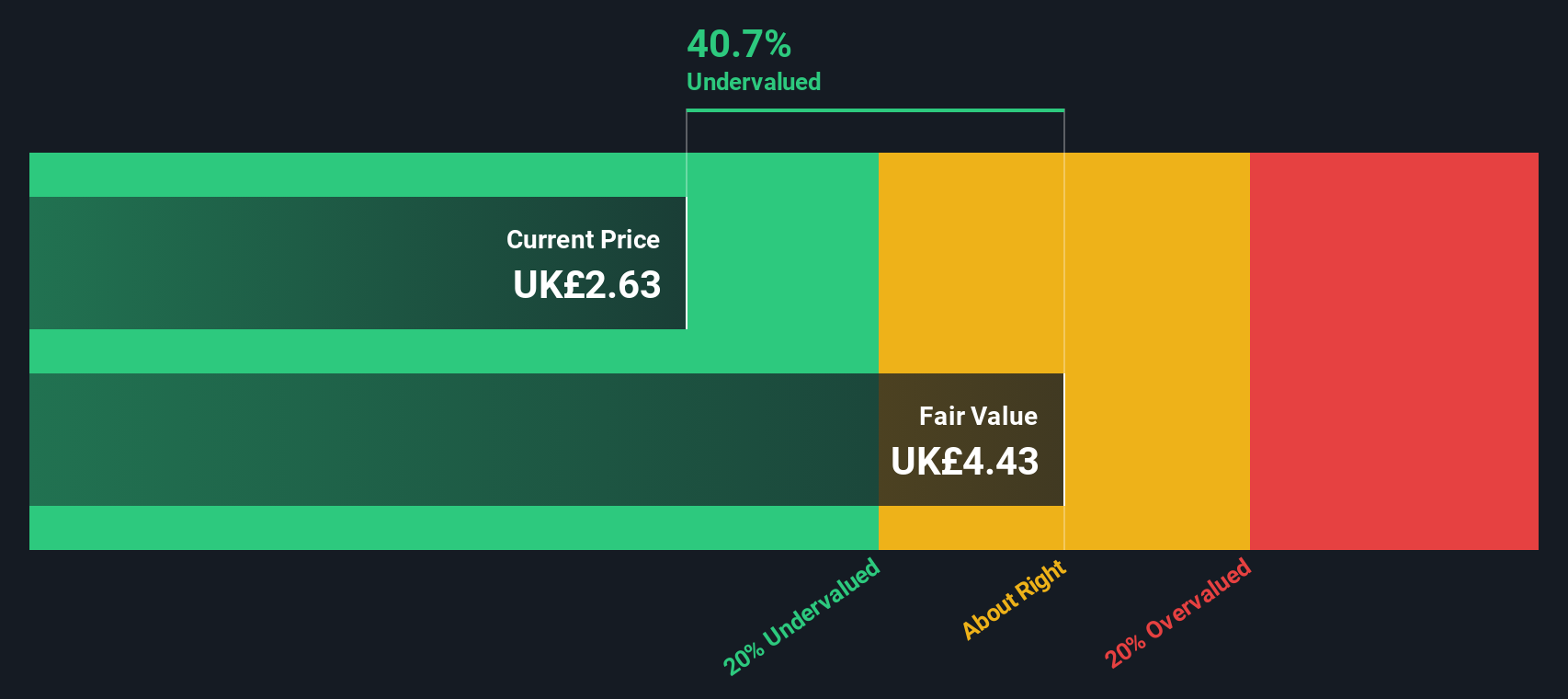

Operations: Secure Lifecycle Services and Digital & Information Management are the primary revenue streams, contributing £104.4 million and £172.5 million respectively. The company experienced fluctuations in its net income margin, with recent figures showing a decline to -11.08% as of December 2023, before improving to 1.37% by June 2024. Operating expenses and non-operating expenses have been significant cost factors impacting overall profitability.

PE: 90.1x

Restore has demonstrated insider confidence with Charles Skinner purchasing 100,000 shares for £280,000 in a transaction reflecting a 6% increase in their stake. Recent earnings results show improvement, with net income at £6.4 million compared to a loss last year. The company declared an increased interim dividend of 2 pence per share. Despite higher-risk funding and interest coverage concerns, the forecasted annual earnings growth of nearly 49% suggests potential for future value appreciation.

- Get an in-depth perspective on Restore's performance by reading our valuation report here.

Evaluate Restore's historical performance by accessing our past performance report.

Genel Energy (LSE:GENL)

Simply Wall St Value Rating: ★★★☆☆☆

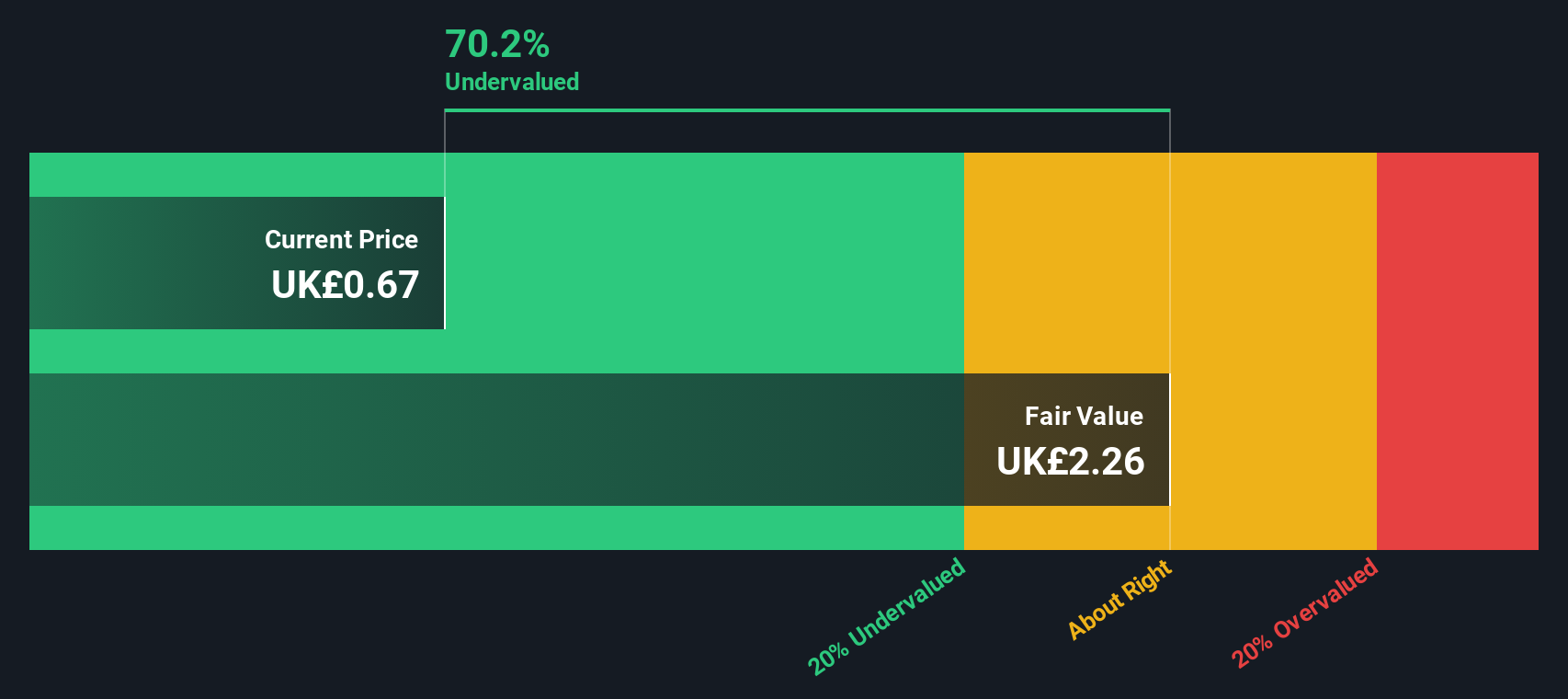

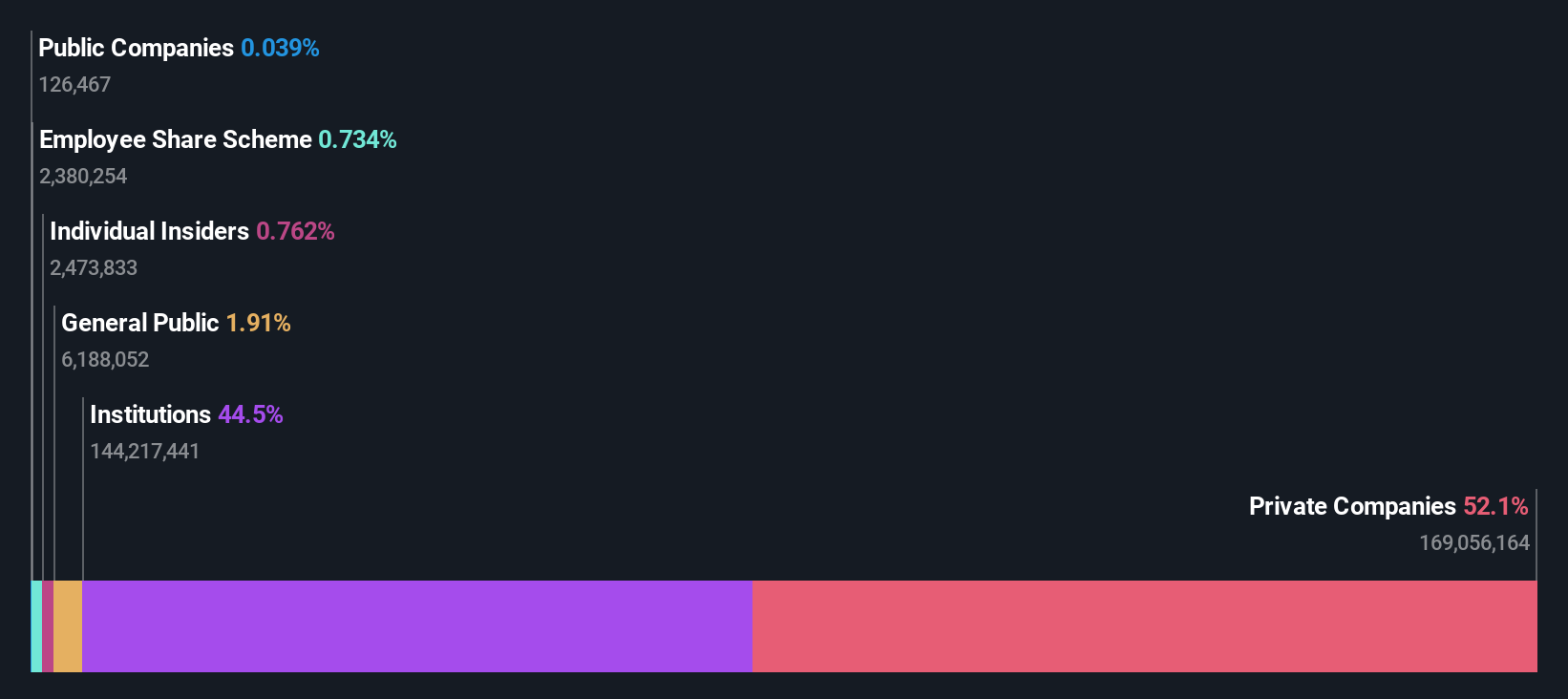

Overview: Genel Energy is an independent oil and gas exploration and production company with a market cap of £0.32 billion, primarily focused on operations in the Kurdistan Region of Iraq.

Operations: Genel Energy's primary revenue stream is derived from production activities, with a recent gross profit margin of 80.11%. The company incurs costs including cost of goods sold (COGS) at $14.8 million and operating expenses totaling $68.3 million, which contribute to its net income loss of $33.5 million as of the latest period ending in October 2024.

PE: -8.4x

Genel Energy, a smaller player in the UK market, has caught attention with insider confidence as Yetik Mert purchased 107,000 shares for US$91,774 between July and October 2024. Despite a net loss of US$21.9 million for the first half of 2024, down from US$40.7 million last year, production increased to 19,510 bopd from 13,440 bopd. Recent board appointments bring strategic expertise that could shape future growth amidst external borrowing challenges as their sole funding source.

- Unlock comprehensive insights into our analysis of Genel Energy stock in this valuation report.

Examine Genel Energy's past performance report to understand how it has performed in the past.

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Harworth Group is a UK-based company specializing in land and property regeneration, with a focus on income generation and capital growth through various property activities, and it has a market capitalization of approximately £0.46 billion.

Operations: The company generates revenue primarily through the sale of development properties, income generation, and other property activities. Over recent periods, the gross profit margin has shown variability, with a notable increase to 54.39% in June 2023 before declining to 11.43% by October 2024. Operating expenses have consistently risen over time, impacting profitability alongside fluctuating non-operating expenses.

PE: 12.0x

Harworth Group, recently added to several FTSE indices on September 17, 2024, showcases promising growth potential with a significant increase in sales and net income for the first half of 2024 compared to the previous year. Sales rose to £41.31 million from £18.24 million, while net income jumped to £14.78 million from £2.85 million. Insider confidence is evident as Alastair Lyons purchased 50,000 shares for approximately £80,000 in recent months, indicating belief in its prospects despite reliance on external borrowing for funding.

- Click here to discover the nuances of Harworth Group with our detailed analytical valuation report.

Gain insights into Harworth Group's historical performance by reviewing our past performance report.

Seize The Opportunity

- Click through to start exploring the rest of the 24 Undervalued UK Small Caps With Insider Buying now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GENL

Genel Energy

Through its subsidiaries, operates as an independent oil and gas exploration and production company.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives