- United Kingdom

- /

- Oil and Gas

- /

- LSE:CNE

The Cairn Energy (LON:CNE) Share Price Is Down 20% So Some Shareholders Are Getting Worried

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term Cairn Energy PLC (LON:CNE) shareholders have had that experience, with the share price dropping 20% in three years, versus a market return of about 22%. And the share price decline continued over the last week, dropping some 5.5%.

View our latest analysis for Cairn Energy

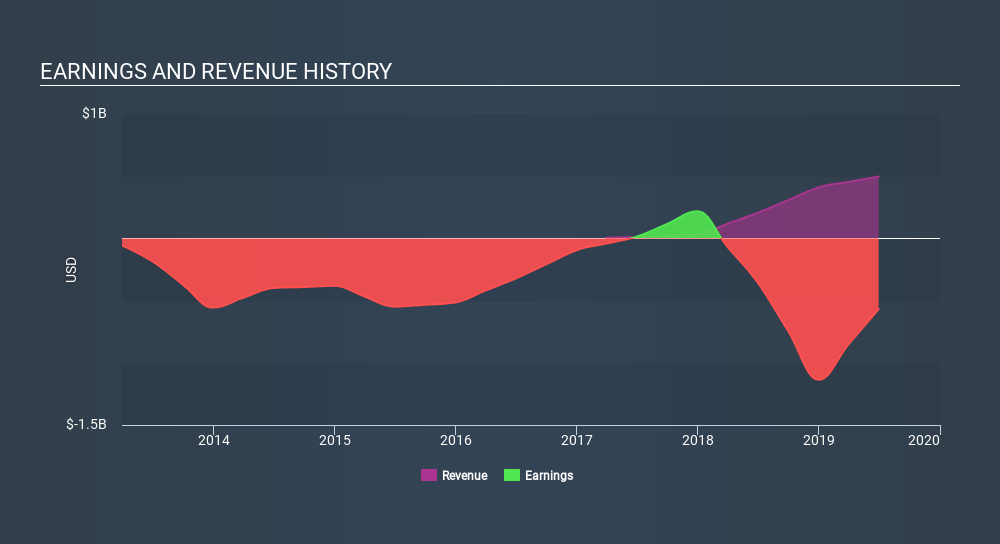

Cairn Energy wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Cairn Energy is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Cairn Energy stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Cairn Energy shareholders gained a total return of 10% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 1.5% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. Before spending more time on Cairn Energy it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:CNE

Capricorn Energy

An independent energy company, engages in the exploration, development, production, and sale of oil and gas worldwide.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives