- United Kingdom

- /

- Oil and Gas

- /

- LSE:CAD

Investors Still Aren't Entirely Convinced By Cadogan Energy Solutions PLC's (LON:CAD) Revenues Despite 77% Price Jump

Cadogan Energy Solutions PLC (LON:CAD) shareholders have had their patience rewarded with a 77% share price jump in the last month. The last month tops off a massive increase of 143% in the last year.

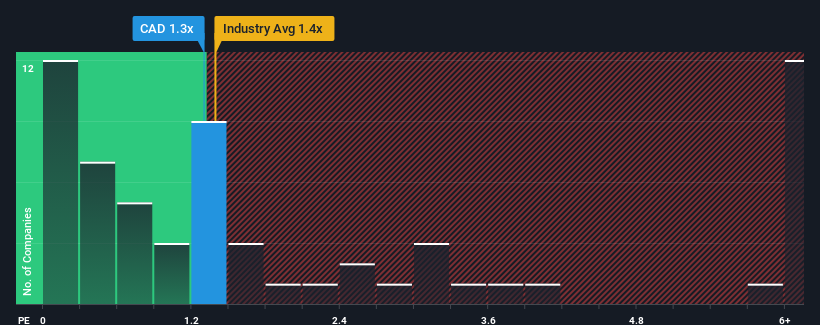

Although its price has surged higher, you could still be forgiven for feeling indifferent about Cadogan Energy Solutions' P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Oil and Gas industry in the United Kingdom is also close to 1.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Cadogan Energy Solutions

How Cadogan Energy Solutions Has Been Performing

Recent times have been quite advantageous for Cadogan Energy Solutions as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Cadogan Energy Solutions will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Cadogan Energy Solutions, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Cadogan Energy Solutions' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 61%. As a result, it also grew revenue by 21% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 2.0% shows it's a great look while it lasts.

In light of this, it's peculiar that Cadogan Energy Solutions' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Cadogan Energy Solutions appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Cadogan Energy Solutions revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 3 warning signs we've spotted with Cadogan Energy Solutions (including 1 which shouldn't be ignored).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CAD

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives