- United Kingdom

- /

- Software

- /

- AIM:ESYS

Discover UK Penny Stocks Worth Watching In May 2025

Reviewed by Simply Wall St

The UK market has faced challenges recently, with the FTSE 100 index slipping due to weak trade data from China, highlighting global economic interdependencies. In such fluctuating conditions, investors often look beyond established giants to discover opportunities in smaller or newer companies. Penny stocks, while sometimes considered a niche area of investment, can offer unique growth prospects when supported by strong financials and resilience.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.88 | £297.21M | ✅ 5 ⚠️ 1 View Analysis > |

| One Media iP Group (AIM:OMIP) | £0.0375 | £8.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.80 | £306.99M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.755 | £424.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.04 | £389.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Character Group (AIM:CCT) | £2.44 | £44.6M | ✅ 2 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.6M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.008 | £2.2B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.35 | £37.87M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 394 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

essensys (AIM:ESYS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Essensys plc provides software and technology solutions for critical software-as-a-service platforms targeting the flexible workspace segment of the real estate industry across North America, the United Kingdom, Europe, and the Asia-Pacific region, with a market cap of £19.09 million.

Operations: The company's revenue is generated from the provision of software and technology platforms, amounting to £22.82 million.

Market Cap: £19.09M

Essensys, with a market cap of £19.09 million, operates in the flexible workspace segment and recently launched "elumo," an innovative solution for managing meeting spaces. Despite being unprofitable, it maintains a positive cash flow and has sufficient cash runway for over three years. The company's short-term assets exceed both its short- and long-term liabilities, indicating financial stability despite declining revenues (£10.43 million) and ongoing net losses (£1.94 million) as of January 2025. Leadership changes are underway with James Lowery succeeding founder Mark Furness as CEO, potentially bringing fresh strategic direction to the company.

- Unlock comprehensive insights into our analysis of essensys stock in this financial health report.

- Gain insights into essensys' future direction by reviewing our growth report.

Naked Wines (AIM:WINE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Naked Wines plc operates as a direct-to-consumer wine retailer in Australia, the United Kingdom, and the United States, with a market capitalization of £56.24 million.

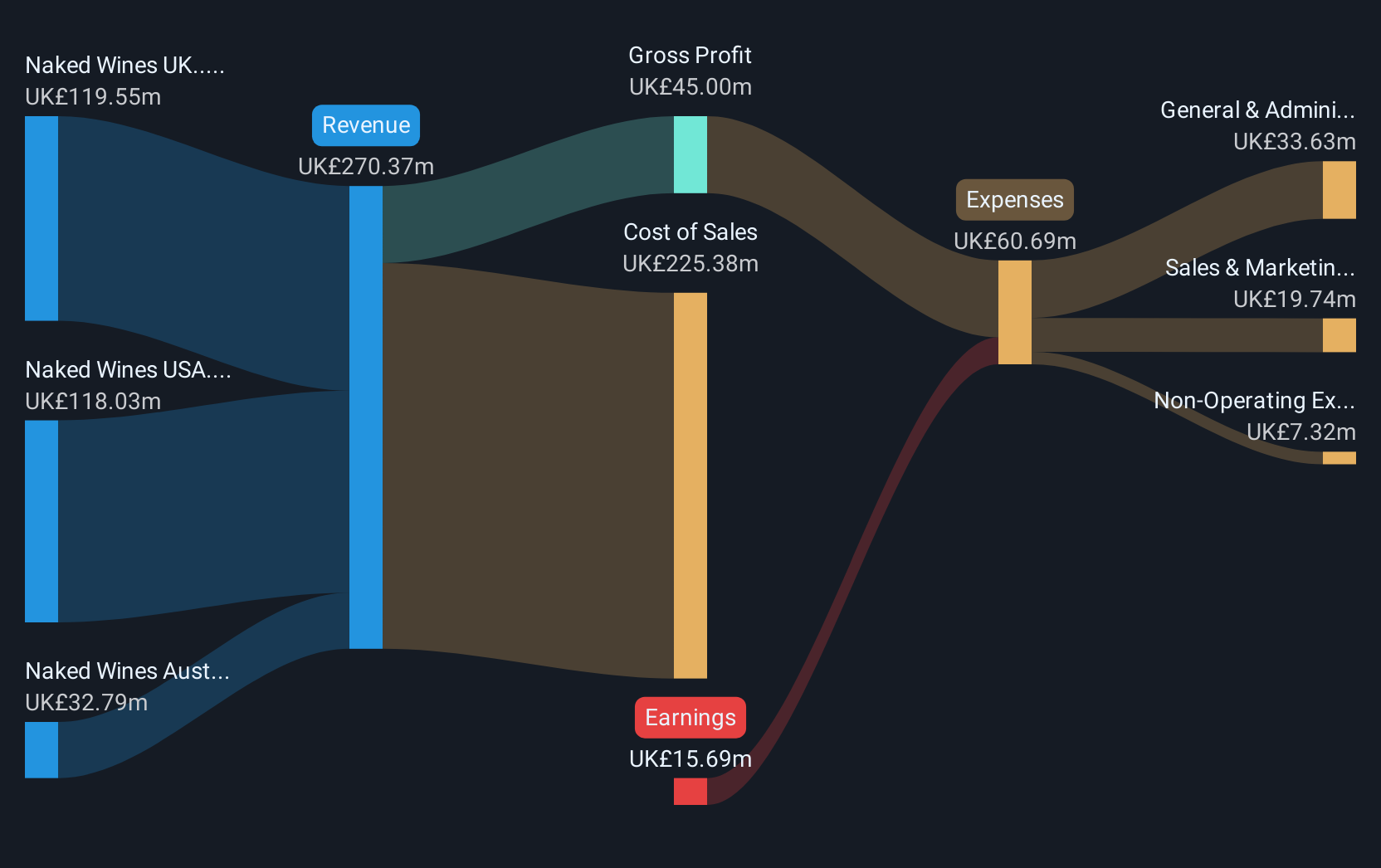

Operations: The company generates its revenue from three primary markets: £119.55 million from the UK, £118.03 million from the USA, and £32.79 million from Australia.

Market Cap: £56.24M

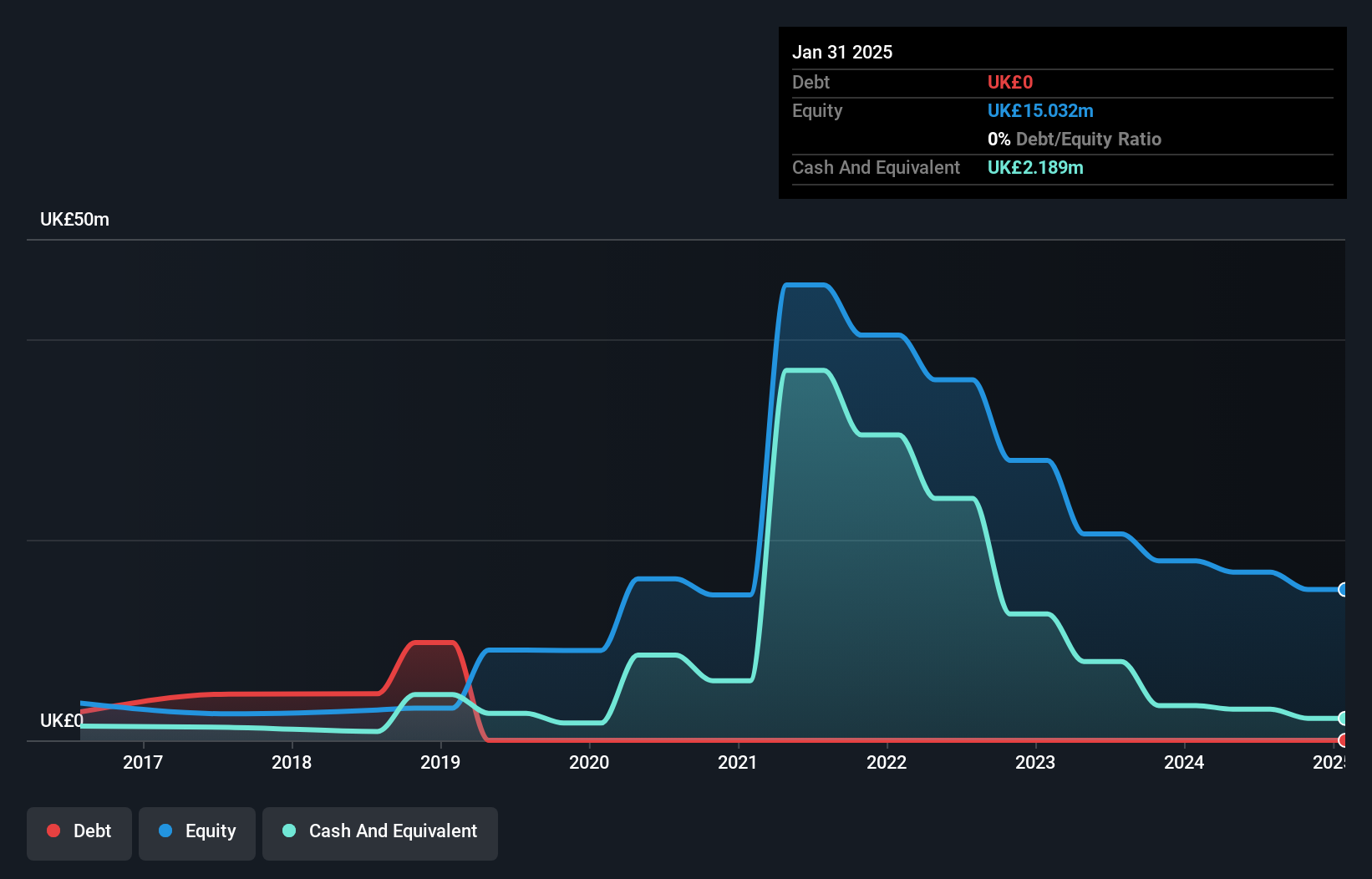

Naked Wines plc, with a market cap of £56.24 million, operates across the UK, USA, and Australia, generating substantial revenues from these markets. Despite being unprofitable and having a negative return on equity of -23.31%, the company maintains financial resilience with short-term assets (£178.8M) exceeding liabilities and more cash than debt. Recent strategic shifts include leadership changes following Rowan Gormley's departure as Non-Executive Chairman. The company reiterated its revenue guidance for 2025 between £240 million to £270 million, underscoring its commitment to growth despite heightened share price volatility and ongoing losses over recent years.

- Click here to discover the nuances of Naked Wines with our detailed analytical financial health report.

- Explore Naked Wines' analyst forecasts in our growth report.

Cadogan Energy Solutions (LSE:CAD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cadogan Energy Solutions PLC, with a market cap of £12.56 million, operates in Ukraine where it focuses on the exploration, development, and production of natural gas, oil, and condensate.

Operations: The company generates revenue of $9.15 million from its exploration and production activities.

Market Cap: £12.56M

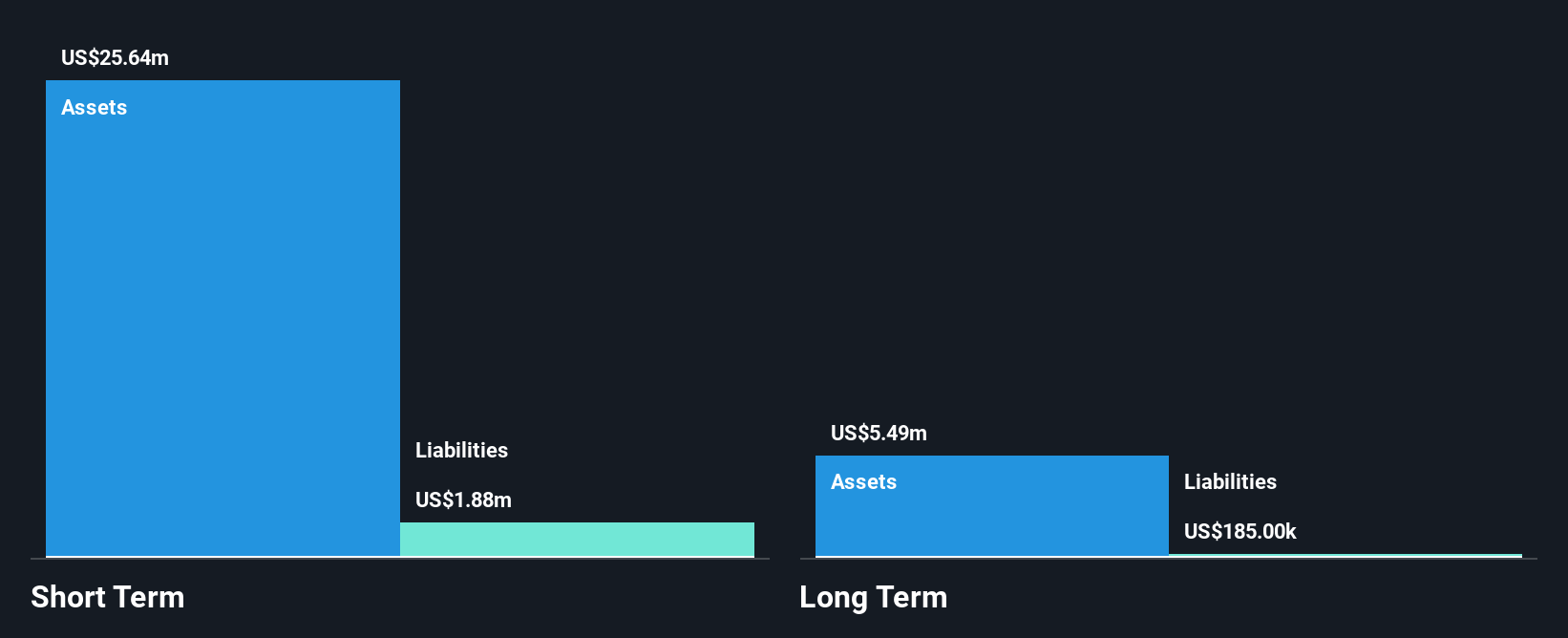

Cadogan Energy Solutions PLC, with a market cap of £12.56 million, faces challenges typical of penny stocks. Despite generating US$9.15 million in revenue from its Ukrainian operations, the company reported a net loss of US$6.23 million for 2024, reflecting its unprofitable status and negative return on equity (-21.44%). The stock's high volatility over recent months underscores investor caution amidst financial instability. Positively, Cadogan remains debt-free with short-term assets significantly exceeding both short and long-term liabilities ($25.6M vs $1.9M and $185K respectively), offering some financial buffer as it navigates its strategic path forward in the energy sector.

- Dive into the specifics of Cadogan Energy Solutions here with our thorough balance sheet health report.

- Learn about Cadogan Energy Solutions' historical performance here.

Seize The Opportunity

- Dive into all 394 of the UK Penny Stocks we have identified here.

- Curious About Other Options? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ESYS

essensys

Engages in the provision of software and technology for critical software-as-a-service platforms to the flexible workspace segment of the real estate industry in North America, the United Kingdom, Europe, and the Asia-Pacific region.

Good value with adequate balance sheet.

Market Insights

Community Narratives