- United Kingdom

- /

- Oil and Gas

- /

- AIM:UOG

Is United Oil & Gas' (LON:UOG) 258% Share Price Increase Well Justified?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right stock, you can make a lot more than 100%. Take, for example United Oil & Gas Plc (LON:UOG). Its share price is already up an impressive 258% in the last twelve months. On top of that, the share price is up 111% in about a quarter. However, the stock hasn't done so well in the longer term, with the stock only up 2.1% in three years.

View our latest analysis for United Oil & Gas

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

United Oil & Gas went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

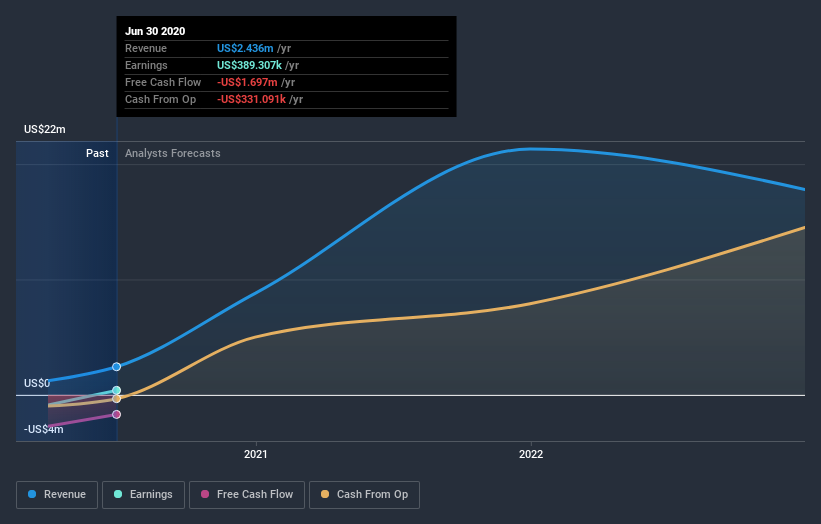

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that United Oil & Gas has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Pleasingly, United Oil & Gas' total shareholder return last year was 258%. That's better than the annualized TSR of 0.7% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. It's always interesting to track share price performance over the longer term. But to understand United Oil & Gas better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with United Oil & Gas , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade United Oil & Gas, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:UOG

United Oil & Gas

Engages in the exploration, development, and production of oil and gas in the United Kingdom, Egypt, Europe, and Latin America.

Excellent balance sheet moderate.

Market Insights

Community Narratives