- United Kingdom

- /

- Oil and Gas

- /

- AIM:SQZ

UK Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

The London markets have recently faced challenges, with the FTSE 100 index faltering due to weak trade data from China, reflecting broader global economic uncertainties. Despite these headwinds, certain investment areas continue to attract attention. Penny stocks, often associated with smaller or newer companies, remain a relevant investment area for those seeking growth opportunities at lower price points. When these stocks are supported by strong financial health and sound fundamentals, they can offer significant potential without many of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.08 | £465.29M | ✅ 5 ⚠️ 0 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.72 | £131.73M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.905 | £13.66M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.04 | £25.89M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.68 | $395.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.48 | £182.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.445 | £69.79M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.52 | £44.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

IG Design Group (AIM:IGR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IG Design Group plc designs, produces, and distributes gift packaging, party goods, craft items, stationery, and homeware consumables across the Americas, the United Kingdom, Netherlands, and internationally with a market cap of £49.56 million.

Operations: Revenue segments for IG Design Group are not reported.

Market Cap: £49.56M

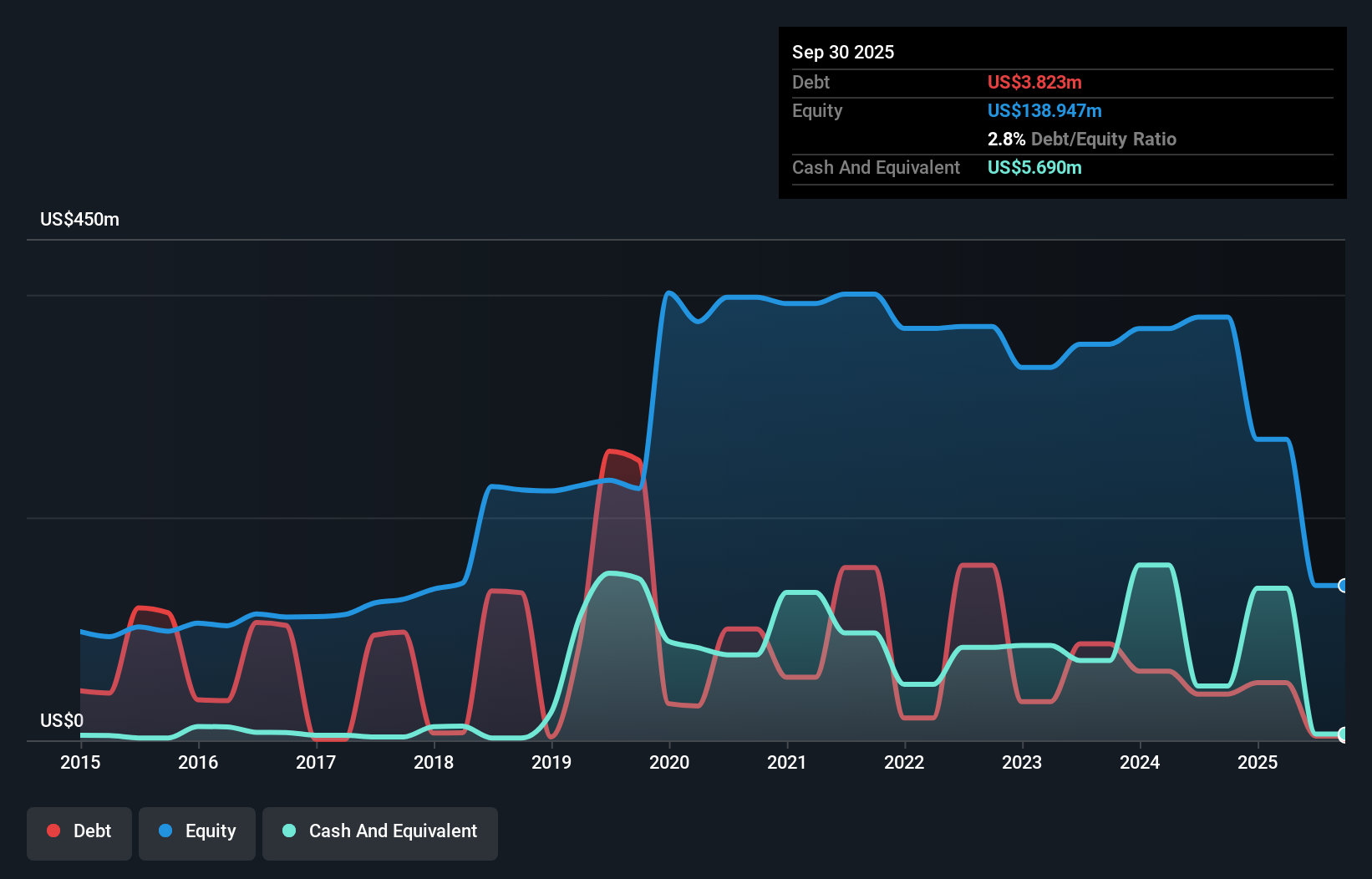

IG Design Group, with a market cap of £49.56 million, has faced challenges as it remains unprofitable and has seen increasing losses over the past five years. Despite this, the company maintains strong financial health with short-term assets exceeding liabilities and more cash than total debt. Recent earnings reports show a decline in sales to US$131.4 million for H1 2025 and a net loss of US$146.42 million compared to the previous year's profit. Volatility has decreased significantly, suggesting some stability in stock performance despite ongoing profitability issues. The management team is experienced but recent executive changes may impact future strategies.

- Click here and access our complete financial health analysis report to understand the dynamics of IG Design Group.

- Understand IG Design Group's earnings outlook by examining our growth report.

Serica Energy (AIM:SQZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Serica Energy plc, along with its subsidiaries, focuses on identifying, acquiring, and exploiting oil and gas reserves in the United Kingdom and has a market cap of £694.87 million.

Operations: The company generates revenue of $570.52 million from its oil and gas exploration, development, production, and related activities.

Market Cap: £694.87M

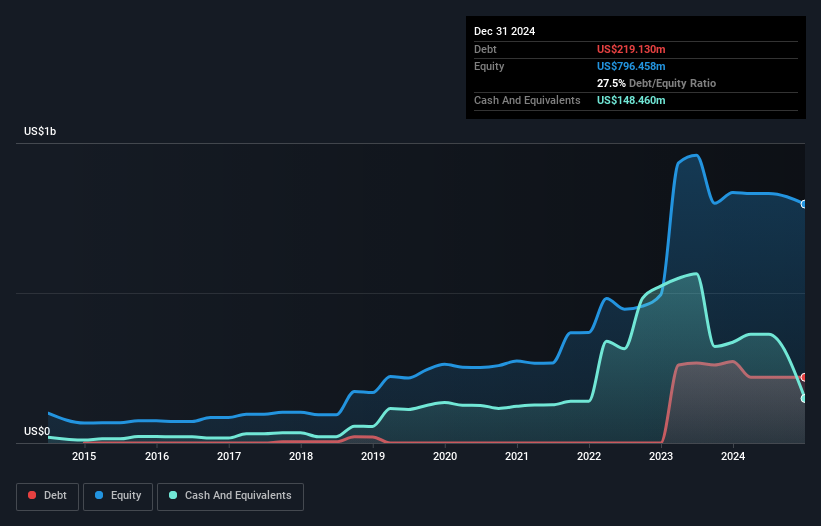

Serica Energy, with a market cap of £694.87 million, is navigating the volatile landscape of penny stocks with mixed financial health. The company generates significant revenue of US$570.52 million from its oil and gas operations but remains unprofitable, impacting its return on equity negatively at -4.59%. Despite high volatility in share price over recent months, Serica's interest payments are well-covered by EBIT (8.2x), and short-term assets exceed liabilities by a comfortable margin ($372.1M vs $216.3M). Recent acquisitions like the 40% stake in P2530 highlight strategic growth moves amidst ongoing operational challenges such as temporary production halts at Triton FPSO.

- Click here to discover the nuances of Serica Energy with our detailed analytical financial health report.

- Explore Serica Energy's analyst forecasts in our growth report.

Focusrite (AIM:TUNE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Focusrite plc develops, manufactures, and markets professional audio and electronic music products across North America, Europe, the Middle East, Africa, and globally with a market cap of £130.66 million.

Operations: The company generates revenue through its various segments, including Sonnox (£2.46 million), ADAM Audio (£25.58 million), Sequential (£9.84 million), Audio Reproduction (£45.88 million), and Focusrite Novation (£85.16 million).

Market Cap: £130.66M

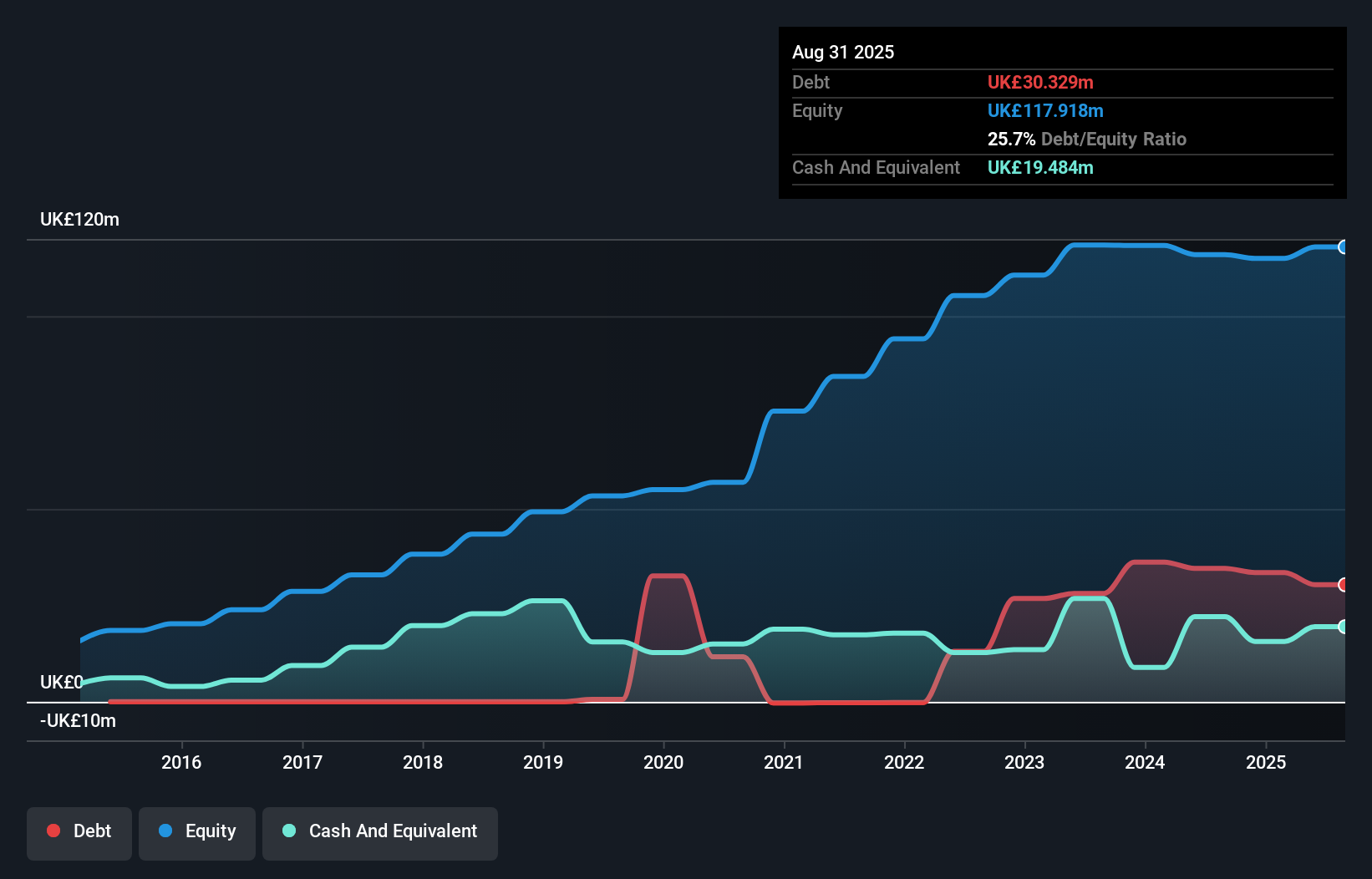

Focusrite plc, with a market cap of £130.66 million, shows a promising trajectory in the realm of penny stocks. The company reported significant revenue growth to £168.91 million for the year ending August 2025, alongside an impressive earnings increase of 105.8% over the past year, surpassing industry averages. Despite its volatile share price and low return on equity (4.6%), Focusrite maintains financial stability with short-term assets (£104.2M) comfortably covering liabilities (£33.5M). Additionally, its debt is well-managed with operating cash flow covering 73.8% of it, and recent dividend affirmations underscore shareholder value focus amidst global operations expansion.

- Take a closer look at Focusrite's potential here in our financial health report.

- Assess Focusrite's future earnings estimates with our detailed growth reports.

Key Takeaways

- Click this link to deep-dive into the 306 companies within our UK Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SQZ

Serica Energy

Serica Energy plc, together with its subsidiaries, identifies, acquires, and exploits oil and gas reserves oil in the United Kingdom.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026