- United Kingdom

- /

- Energy Services

- /

- AIM:CSC

Why We're Not Concerned About Pressure Technologies plc's (LON:PRES) Share Price

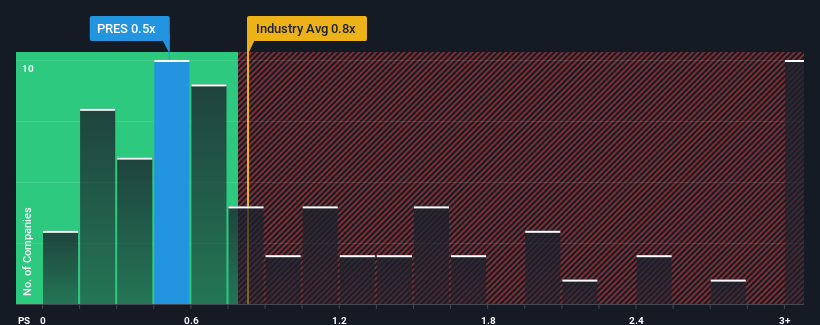

There wouldn't be many who think Pressure Technologies plc's (LON:PRES) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Energy Services industry in the United Kingdom is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Pressure Technologies

How Pressure Technologies Has Been Performing

Pressure Technologies certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Pressure Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Pressure Technologies' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. The latest three year period has also seen a 26% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 7.1% over the next year. With the industry predicted to deliver 7.9% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Pressure Technologies' P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Pressure Technologies' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Pressure Technologies maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 3 warning signs for Pressure Technologies (1 makes us a bit uncomfortable!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CSC

Chesterfield Special Cylinders Holdings

Through its subsidiaries, design, manufactures, and reconditions high pressure gas cylinders.

Flawless balance sheet with concerning outlook.

Market Insights

Community Narratives