- United Kingdom

- /

- Metals and Mining

- /

- AIM:XTR

3 UK Penny Stocks With At Least £5M Market Cap

Reviewed by Simply Wall St

The United Kingdom's stock market has recently been impacted by global economic concerns, particularly the faltering recovery of China's economy, which has affected major indices like the FTSE 100 and FTSE 250. Despite these challenges, there are still opportunities to be found in niche areas of the market. Penny stocks, often associated with smaller or newer companies, can offer potential for growth when supported by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Supreme (AIM:SUP) | £1.815 | £211.65M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.455 | £356.81M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.865 | £384.4M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.91 | £68.92M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.35 | £208.21M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.485 | £189.12M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.31 | £111.84M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.35 | £207.28M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.46 | $267.41M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Arcontech Group (AIM:ARC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arcontech Group plc develops and sells proprietary software across various regions including the United Kingdom, Europe, Africa, North America, Australia, and the Asia Pacific with a market capitalization of £16.11 million.

Operations: The company generates revenue from software development and licence fees amounting to £2.91 million.

Market Cap: £16.11M

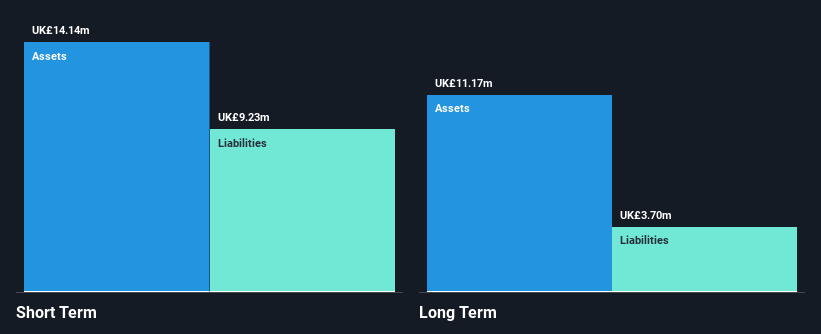

Arcontech Group plc, with a market cap of £16.11 million, generates revenue primarily from software development and license fees totaling £2.91 million. The company is debt-free and its short-term assets significantly exceed both short and long-term liabilities, indicating strong financial health. Despite a stable earnings growth of 8.9%, it lags behind the broader software industry growth rate and faces forecasted earnings declines over the next three years. However, Arcontech offers high-quality past earnings and trades at a discount to estimated fair value, presenting potential relative value compared to peers despite an unstable dividend track record.

- Dive into the specifics of Arcontech Group here with our thorough balance sheet health report.

- Gain insights into Arcontech Group's outlook and expected performance with our report on the company's earnings estimates.

Pressure Technologies (AIM:PRES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pressure Technologies plc designs, manufactures, and sells high pressure systems for various sectors including oil and gas, defense, industrial gases, and hydrogen energy across multiple international markets with a market cap of £13.53 million.

Operations: The company generates revenue through its Cylinders segment, which accounts for £18.34 million, and its Precision Machined Components segment, contributing £14.88 million.

Market Cap: £13.53M

Pressure Technologies plc, with a market cap of £13.53 million, generates revenue primarily from its Cylinders and Precision Machined Components segments. Although currently unprofitable, the company has reduced losses by 12.2% annually over the past five years and maintains a positive free cash flow that supports a cash runway exceeding three years. The board's experienced tenure contrasts with the relatively new management team averaging 1.5 years in position. Short-term assets cover both short- and long-term liabilities comfortably, while debt levels have decreased significantly over time, enhancing financial stability despite its negative return on equity.

- Navigate through the intricacies of Pressure Technologies with our comprehensive balance sheet health report here.

- Evaluate Pressure Technologies' prospects by accessing our earnings growth report.

Xtract Resources (AIM:XTR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xtract Resources Plc, with a market cap of £5.57 million, operates as a resource development and mining company alongside its subsidiaries.

Operations: Xtract Resources Plc has not reported any specific revenue segments.

Market Cap: £5.57M

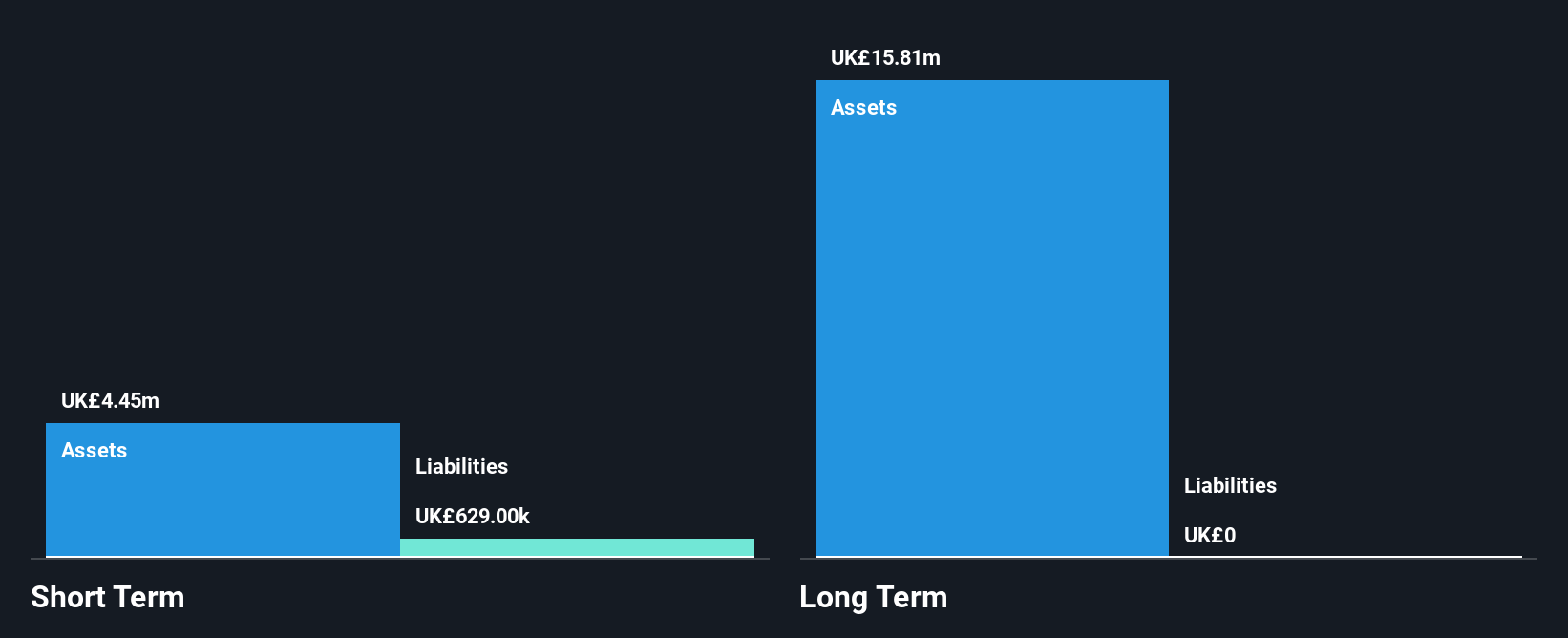

Xtract Resources Plc, with a market cap of £5.57 million, is pre-revenue and currently unprofitable but has reduced losses by 0.7% annually over the past five years. The company benefits from being debt-free and having sufficient cash runway exceeding three years, supported by positive free cash flow. Recent developments include an exclusive collaboration agreement with Chilibwe Mining Limited for a Zambian exploration project, although it faces legal challenges regarding licence disputes. The board's average tenure of 7.5 years indicates experienced governance amidst high share price volatility compared to most UK stocks.

- Jump into the full analysis health report here for a deeper understanding of Xtract Resources.

- Learn about Xtract Resources' historical performance here.

Key Takeaways

- Investigate our full lineup of 470 UK Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:XTR

Xtract Resources

Operates as a resource, development, and mining company.

Flawless balance sheet and good value.