- United Kingdom

- /

- Oil and Gas

- /

- AIM:CASP

Caspian Sunrise plc's (LON:CASP) Stock's On An Uptrend: Are Strong Financials Guiding The Market?

Caspian Sunrise (LON:CASP) has had a great run on the share market with its stock up by a significant 15% over the last week. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Particularly, we will be paying attention to Caspian Sunrise's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Caspian Sunrise

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Caspian Sunrise is:

17% = US$10m ÷ US$61m (Based on the trailing twelve months to June 2023).

The 'return' is the income the business earned over the last year. So, this means that for every £1 of its shareholder's investments, the company generates a profit of £0.17.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Caspian Sunrise's Earnings Growth And 17% ROE

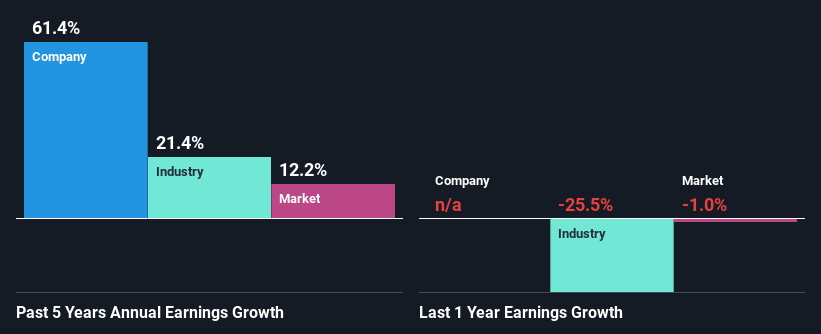

To start with, Caspian Sunrise's ROE looks acceptable. Even when compared to the industry average of 17% the company's ROE looks quite decent. This certainly adds some context to Caspian Sunrise's exceptional 61% net income growth seen over the past five years. However, there could also be other drivers behind this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

Next, on comparing with the industry net income growth, we found that Caspian Sunrise's growth is quite high when compared to the industry average growth of 21% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Caspian Sunrise's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Caspian Sunrise Making Efficient Use Of Its Profits?

Caspian Sunrise's ' three-year median payout ratio is on the lower side at 24% implying that it is retaining a higher percentage (76%) of its profits. So it seems like the management is reinvesting profits heavily to grow its business and this reflects in its earnings growth number.

Along with seeing a growth in earnings, Caspian Sunrise only recently started paying dividends. Its quite possible that the company was looking to impress its shareholders.

Conclusion

On the whole, we feel that Caspian Sunrise's performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. You can see the 2 risks we have identified for Caspian Sunrise by visiting our risks dashboard for free on our platform here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CASP

Slight with mediocre balance sheet.