- United Kingdom

- /

- Medical Equipment

- /

- LSE:SN.

3 UK Stocks Trading At Up To 41% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting concerns over global economic recovery. Amid these conditions, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer potential value despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ASA International Group (LSE:ASAI) | £0.7775 | £1.51 | 48.4% |

| GlobalData (AIM:DATA) | £1.89 | £3.76 | 49.7% |

| Zotefoams (LSE:ZTF) | £2.94 | £5.72 | 48.6% |

| Hercules Site Services (AIM:HERC) | £0.445 | £0.88 | 49.5% |

| Duke Capital (AIM:DUKE) | £0.306 | £0.58 | 47.5% |

| Vp (LSE:VP.) | £5.50 | £9.93 | 44.6% |

| Loungers (AIM:LGRS) | £3.08 | £5.43 | 43.3% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.8% |

| Watches of Switzerland Group (LSE:WOSG) | £4.848 | £9.05 | 46.4% |

| Quartix Technologies (AIM:QTX) | £1.675 | £3.08 | 45.7% |

Let's uncover some gems from our specialized screener.

Smith & Nephew (LSE:SN.)

Overview: Smith & Nephew plc, with a market cap of £8.58 billion, develops, manufactures, markets, and sells medical devices and services both in the United Kingdom and internationally.

Operations: The company's revenue is derived from three primary segments: Orthopaedics ($2.26 billion), Sports Medicine & ENT ($1.77 billion), and Advanced Wound Management (AWM) ($1.61 billion).

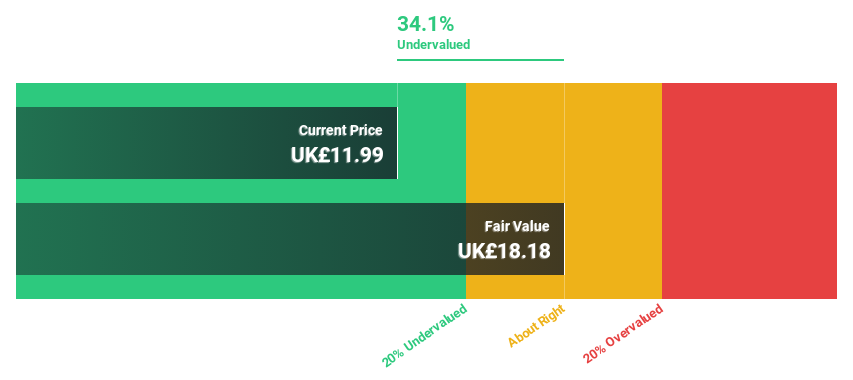

Estimated Discount To Fair Value: 41%

Smith & Nephew is trading significantly below its estimated fair value, presenting an opportunity for investors focused on cash flow valuation. Despite a high debt level and low forecasted return on equity, the company expects robust earnings growth of over 20% annually. Recent developments include FDA clearance for innovative surgical planning software and strategic board appointments, which may enhance corporate governance. However, challenges like slower revenue growth due to China headwinds persist.

- Upon reviewing our latest growth report, Smith & Nephew's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Smith & Nephew.

Senior (LSE:SNR)

Overview: Senior plc is a company that designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy sectors globally, with a market cap of approximately £653.32 million.

Operations: The company generates revenue from its Aerospace segment, which contributes £651.10 million, and its Flexonics segment, which adds £333 million.

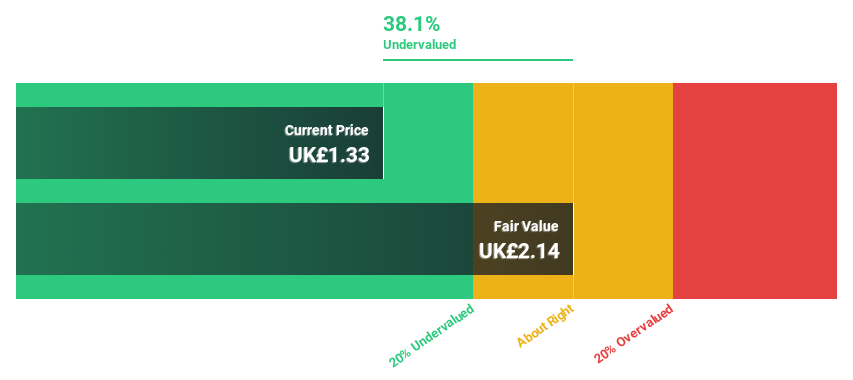

Estimated Discount To Fair Value: 23.9%

Senior is trading 23.9% below its estimated fair value of £2.1, with significant earnings growth forecast at 31.5% annually, outpacing the UK market's average. Revenue growth is projected at 5.7% per year, surpassing the broader market but not reaching high-growth benchmarks. Recent executive changes include Alpna Amar joining as CFO in May 2025, potentially strengthening financial oversight amid a transition period with Susan Brennan's retirement from the board in April 2025.

- The analysis detailed in our Senior growth report hints at robust future financial performance.

- Click here to discover the nuances of Senior with our detailed financial health report.

TP ICAP Group (LSE:TCAP)

Overview: TP ICAP Group PLC operates as an intermediary offering trade execution, pre-trade and settlement services, contextual insights, and data-led solutions across Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of approximately £1.94 billion.

Operations: The company's revenue segments are comprised of Liquidnet (£323 million), Global Broking (£1.24 billion), Parameta Solutions (£195 million), and Energy & Commodities (£471 million).

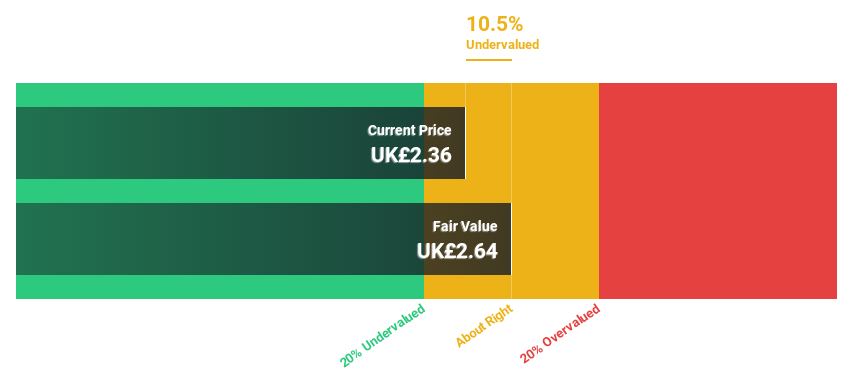

Estimated Discount To Fair Value: 11.9%

TP ICAP Group is trading at £2.59, below its estimated fair value of £2.93, reflecting a modest undervaluation based on cash flow analysis. Earnings are forecast to grow significantly at 21.4% annually, outpacing the UK market's average growth rate of 14.6%. However, revenue growth is slower at 4.1% per year and the dividend yield of 5.73% lacks earnings coverage, presenting a potential risk for income-focused investors despite high earnings growth expectations over the next three years.

- In light of our recent growth report, it seems possible that TP ICAP Group's financial performance will exceed current levels.

- Get an in-depth perspective on TP ICAP Group's balance sheet by reading our health report here.

Seize The Opportunity

- Access the full spectrum of 54 Undervalued UK Stocks Based On Cash Flows by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SN.

Smith & Nephew

Develops, manufactures, markets, and sells medical devices and services in the United Kingdom and internationally.

Good value with reasonable growth potential.