- United Kingdom

- /

- Oil and Gas

- /

- AIM:HSP

3 UK Dividend Stocks To Consider With Up To 7.3% Yield

Reviewed by Simply Wall St

In the current climate, the UK market is experiencing volatility as evidenced by the recent declines in both the FTSE 100 and FTSE 250 indices, driven by weak trade data from China that has impacted global sentiment. Amid such uncertainty, dividend stocks can offer a measure of stability and potential income, making them an attractive option for investors looking to navigate these challenging times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.39% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.49% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.87% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.91% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.32% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.23% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 5.11% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.93% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.00% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.90% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

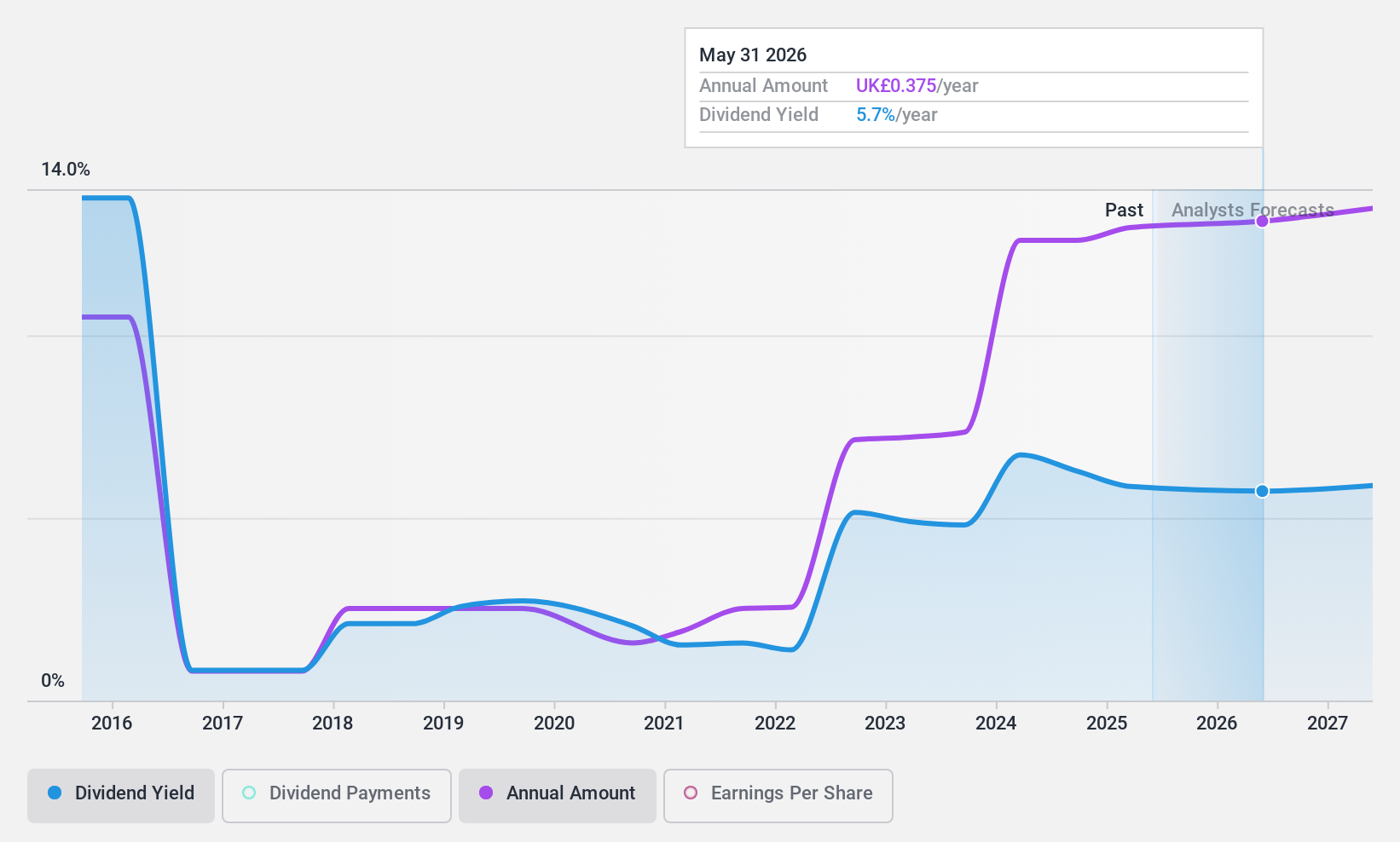

Hargreaves Services (AIM:HSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hargreaves Services Plc offers environmental and industrial services across the United Kingdom, Europe, Hong Kong, and internationally with a market cap of £195.13 million.

Operations: Hargreaves Services Plc generates revenue primarily from its Services segment (£206.86 million) and Hargreaves Land (£7.04 million).

Dividend Yield: 6.1%

Hargreaves Services offers a high dividend yield of 6.08%, placing it in the top 25% of UK dividend payers, though its dividends have been volatile over the past decade. The payout ratio is high at 94.8%, indicating dividends are not well covered by earnings, although they are supported by cash flows with a cash payout ratio of 58.3%. Recent executive changes may impact strategic goals, but internal leadership transitions aim to maintain stability.

- Navigate through the intricacies of Hargreaves Services with our comprehensive dividend report here.

- Our valuation report unveils the possibility Hargreaves Services' shares may be trading at a premium.

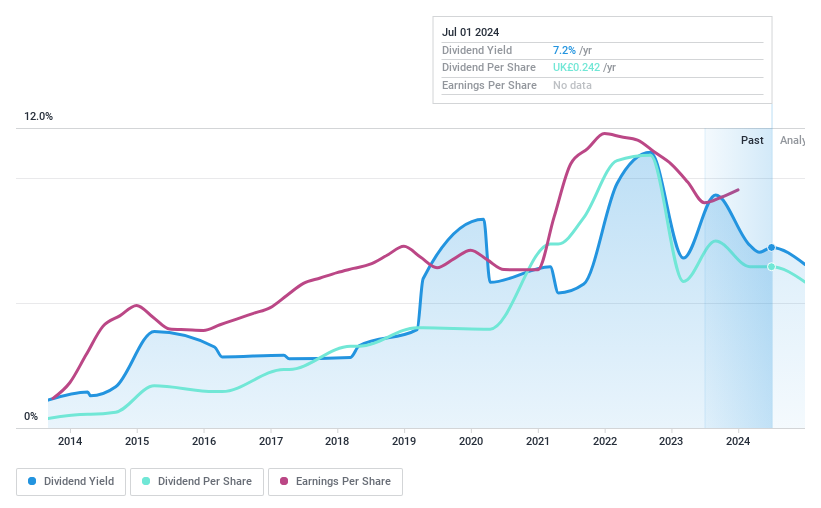

Somero Enterprises (AIM:SOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Somero Enterprises, Inc. designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment in the United States and internationally with a market cap of £175.71 million.

Operations: Somero Enterprises, Inc. generates revenue of $113.69 million from its construction machinery and equipment segment.

Dividend Yield: 7.3%

Somero Enterprises offers a dividend yield of 7.35%, ranking it among the top UK dividend payers, though its dividends have been volatile over the past decade. While the payout ratio is moderate at 49.6%, suggesting coverage by earnings, the high cash payout ratio of 97.4% indicates inadequate coverage by cash flows. Recent executive changes, including CEO retirement and internal promotions, could influence future strategic direction but aim to ensure continuity in leadership transition.

- Unlock comprehensive insights into our analysis of Somero Enterprises stock in this dividend report.

- Upon reviewing our latest valuation report, Somero Enterprises' share price might be too optimistic.

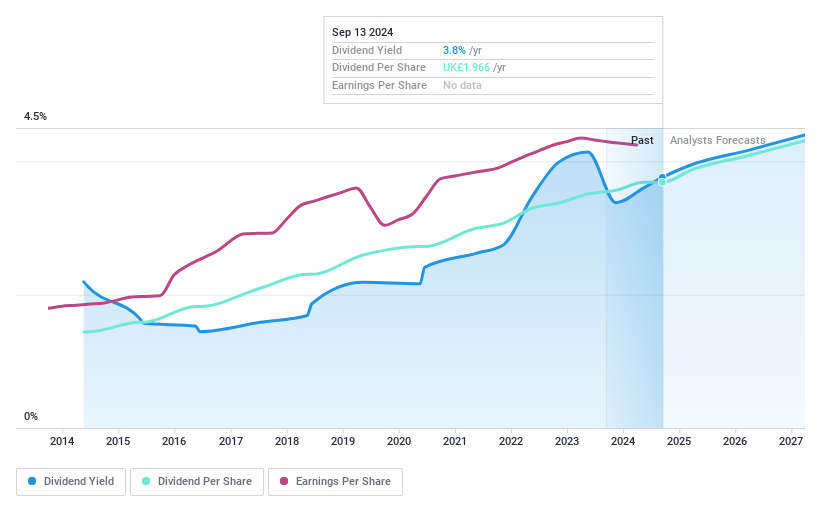

DCC (LSE:DCC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DCC plc is involved in the sales, marketing, and distribution of carbon energy solutions globally with a market cap of £5.03 billion.

Operations: DCC plc generates revenue through its primary segments: DCC Energy (£13.91 billion), DCC Healthcare (£853.99 million), and DCC Technology (£4.80 billion).

Dividend Yield: 3.9%

DCC's dividend yield of 3.93% is lower than the top UK payers, but its dividends are well-covered by both earnings and cash flows, with payout ratios of 59.9% and 49.5%, respectively. The company has consistently increased dividends over the past decade, recently announcing a 5% interim increase. Strategic shifts include divesting its healthcare division to focus on energy, potentially enhancing profitability and growth opportunities in this sector while maintaining disciplined capital allocation for shareholder benefit.

- Get an in-depth perspective on DCC's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that DCC is priced lower than what may be justified by its financials.

Taking Advantage

- Embark on your investment journey to our 63 Top UK Dividend Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hargreaves Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:HSP

Hargreaves Services

Provides environmental and industrial services in the United Kingdom, Europe, Hong Kong, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives