- United Kingdom

- /

- Software

- /

- AIM:QTX

Michelmersh Brick Holdings And 2 Other Promising UK Penny Stocks

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China and its impact on global demand. In such uncertain times, investors often look for stocks that offer a blend of affordability and growth potential. Penny stocks, though sometimes considered a relic of past trading eras, still hold promise when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.84 | £293.08M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.89 | £439.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.075 | £392.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.686 | £1.05B | ✅ 4 ⚠️ 2 View Analysis > |

| Character Group (AIM:CCT) | £2.44 | £44.6M | ✅ 2 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.92M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.158 | £2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.36 | £38.95M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 392 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Michelmersh Brick Holdings (AIM:MBH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Michelmersh Brick Holdings plc, along with its subsidiaries, manufactures and sells bricks and brick prefabricated products in the United Kingdom and Europe, with a market cap of £98.43 million.

Operations: Michelmersh Brick Holdings generates revenue of £70.11 million from its Building Products segment.

Market Cap: £98.43M

Michelmersh Brick Holdings, with a market cap of £98.43 million, has shown resilience despite challenges. The company remains debt-free and its short-term assets comfortably cover liabilities. However, recent earnings have declined with net income dropping to £6.1 million from £9.66 million the previous year, and profit margins have decreased to 8.7%. Despite these setbacks, Michelmersh is executing a share buyback program worth up to £2 million to enhance shareholder value and has maintained its dividend payout with a slight increase from last year. Analysts forecast earnings growth of 14.78% annually moving forward.

- Click to explore a detailed breakdown of our findings in Michelmersh Brick Holdings' financial health report.

- Evaluate Michelmersh Brick Holdings' prospects by accessing our earnings growth report.

Quartix Technologies (AIM:QTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quartix Technologies plc designs, develops, markets, and delivers vehicle telematics services across the United Kingdom, France, the United States, and other European territories with a market cap of £109.45 million.

Operations: Quartix Technologies generates its revenue primarily from Telematics Services (£30.01 million), followed by Customer Acquisition (£2.36 million) and Konetik (£0.034 million).

Market Cap: £109.45M

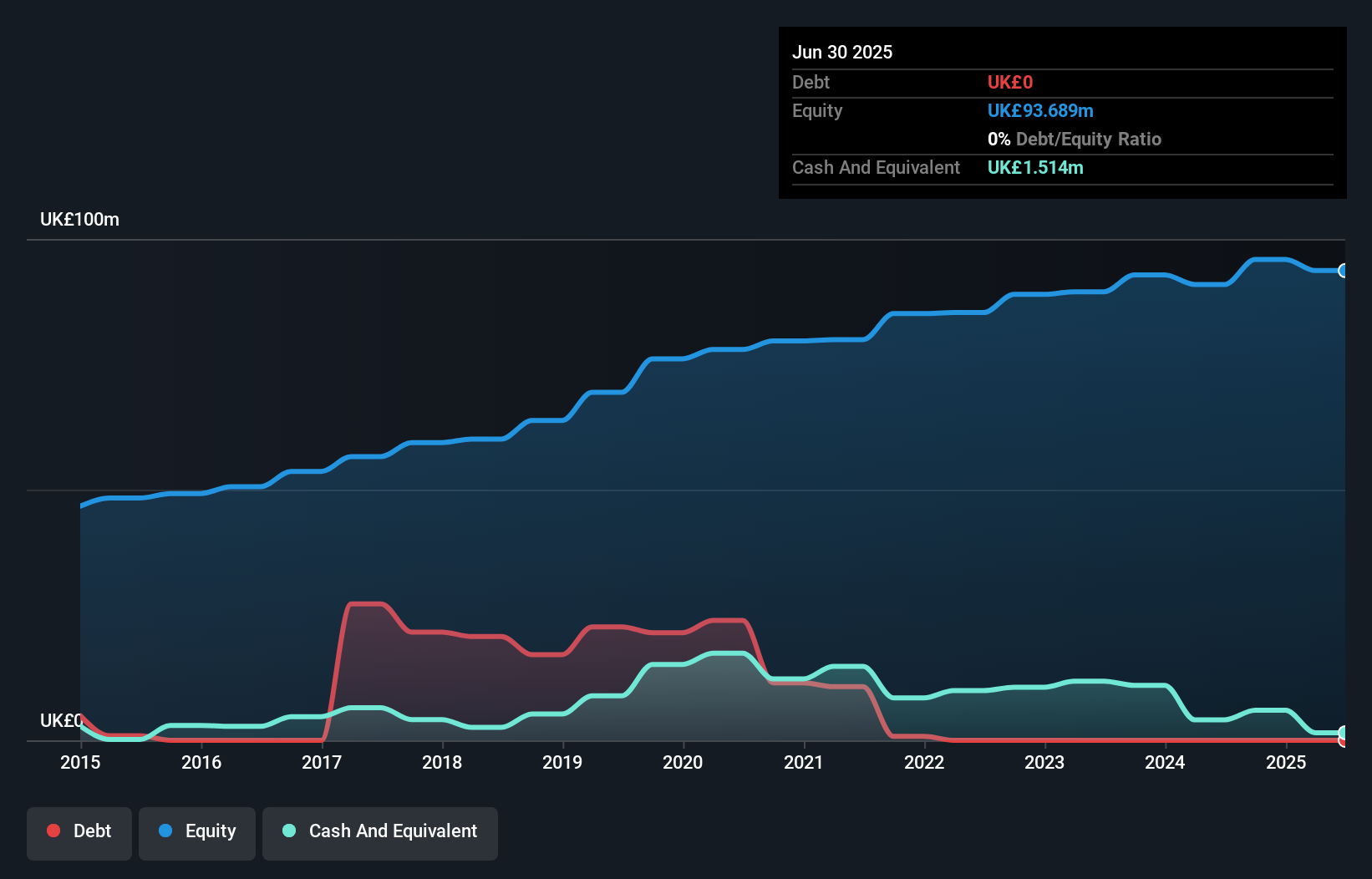

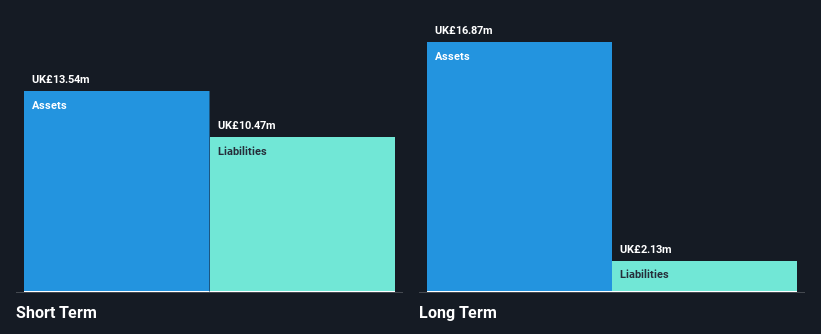

Quartix Technologies, with a market cap of £109.45 million, has demonstrated financial stability by remaining debt-free and achieving profitability. The company's revenue rose to £32.4 million from £29.88 million the previous year, with net income reaching £4.77 million compared to a prior net loss of £0.908 million. Despite having an inexperienced board and management team, Quartix's high return on equity (24.3%) and strong asset coverage for liabilities highlight its robust financial health. While volatility remains higher than most UK stocks, it trades at a favorable price-to-earnings ratio relative to industry peers, suggesting good value potential among penny stocks.

- Navigate through the intricacies of Quartix Technologies with our comprehensive balance sheet health report here.

- Assess Quartix Technologies' future earnings estimates with our detailed growth reports.

Record (LSE:REC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Record plc offers currency and derivative management services across the United Kingdom, North America, Continental Europe, Australia, and internationally with a market cap of £105.99 million.

Operations: The company's revenue of £45.02 million is generated from its currency and derivatives management services.

Market Cap: £105.99M

Record plc, with a market cap of £105.99 million, operates without debt and has robust short-term asset coverage for liabilities. Despite a dip in net profit margins to 21.1% from 22.3%, the company maintains high-quality earnings and a strong return on equity at 31.7%. Earnings growth has been negative recently, but the firm is trading at a significant discount to its estimated fair value, indicating potential value among penny stocks. Recent strategic leadership changes include appointing Andreas Dänzer as Group CIO, bringing extensive investment management experience that could enhance operational capabilities across its international client base.

- Jump into the full analysis health report here for a deeper understanding of Record.

- Gain insights into Record's future direction by reviewing our growth report.

Summing It All Up

- Discover the full array of 392 UK Penny Stocks right here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quartix Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:QTX

Quartix Technologies

Engages in the design, development, marketing, and delivery of vehicle telematics services in the United Kingdom, France, the United States, and other European Territories.

Flawless balance sheet and fair value.

Market Insights

Community Narratives