- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:QQ.

3 UK Growth Stocks With High Insider Ownership Expecting 67% Earnings Growth

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns about China's economic recovery and its impact on global trade. In this environment, identifying growth companies with high insider ownership can be advantageous, as such firms often demonstrate strong internal confidence and alignment between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 25.9% | 91.4% |

| Metals Exploration (AIM:MTL) | 10.4% | 85.9% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| LSL Property Services (LSE:LSL) | 10.4% | 21.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 86.7% |

| Energean (LSE:ENOG) | 19% | 48.9% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| ActiveOps (AIM:AOM) | 19.5% | 43.3% |

Let's explore several standout options from the results in the screener.

Faron Pharmaceuticals Oy (AIM:FARN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Faron Pharmaceuticals Oy is a clinical-stage drug discovery and development company with a market cap of £201.18 million.

Operations: Faron Pharmaceuticals Oy does not currently have any revenue segments, as indicated by the absence of reported figures.

Insider Ownership: 21.4%

Earnings Growth Forecast: 62% p.a.

Faron Pharmaceuticals Oy, recently added to the S&P Global BMI Index, is a growth-focused company with high insider ownership. Despite reporting a net loss of €19.42 million for H1 2025 and having less than one year of cash runway, its revenue is forecast to grow significantly faster than the UK market at 64.7% per year. The company received positive FDA feedback on its bexmarilimab trial, which could enhance future growth prospects in cancer immunotherapy.

- Delve into the full analysis future growth report here for a deeper understanding of Faron Pharmaceuticals Oy.

- The analysis detailed in our Faron Pharmaceuticals Oy valuation report hints at an inflated share price compared to its estimated value.

PensionBee Group (LSE:PBEE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PensionBee Group plc offers online retirement saving services in the United Kingdom and the United States, with a market cap of £371.12 million.

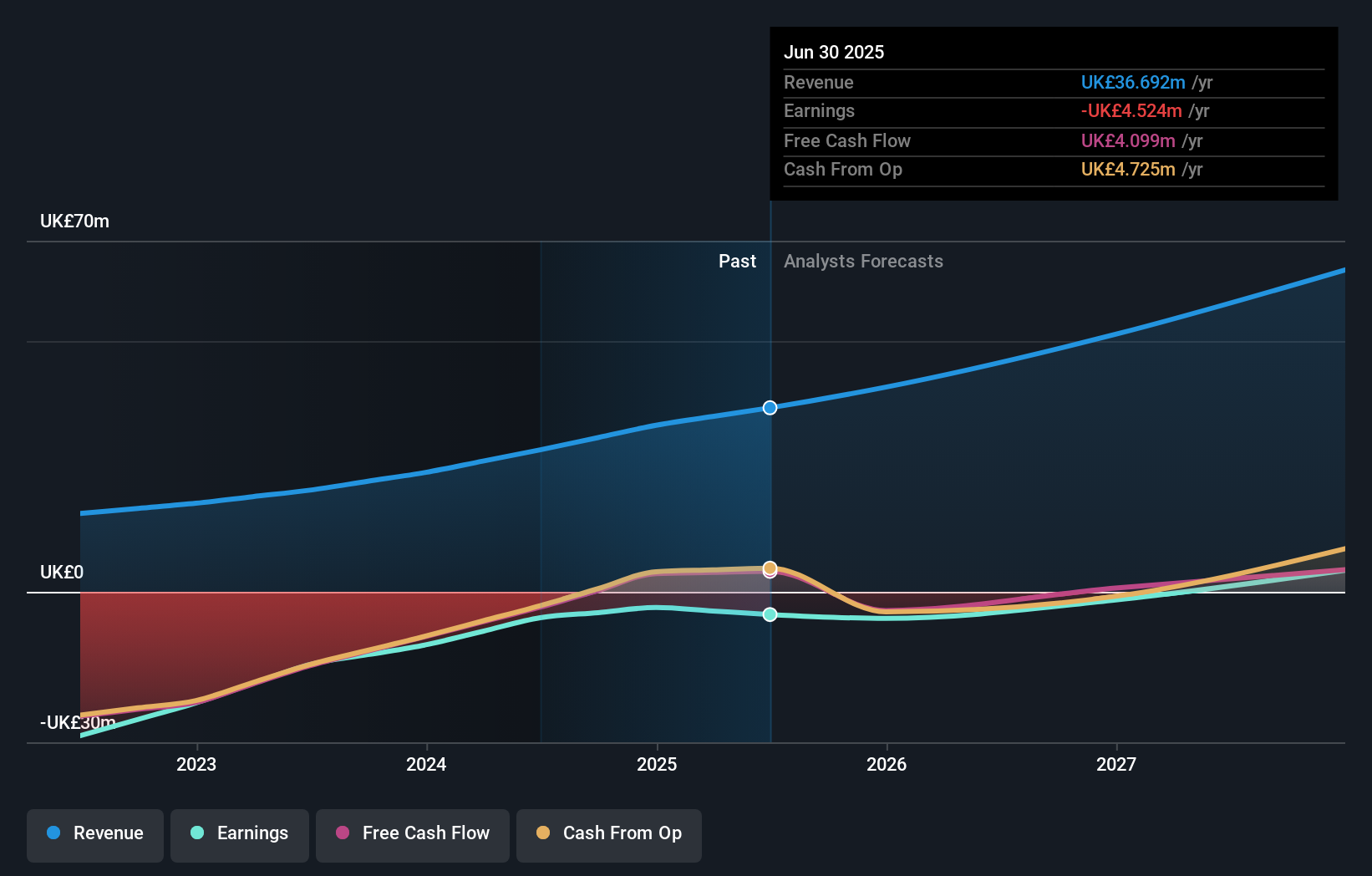

Operations: The company generates revenue of £36.69 million from its Internet Information Providers segment.

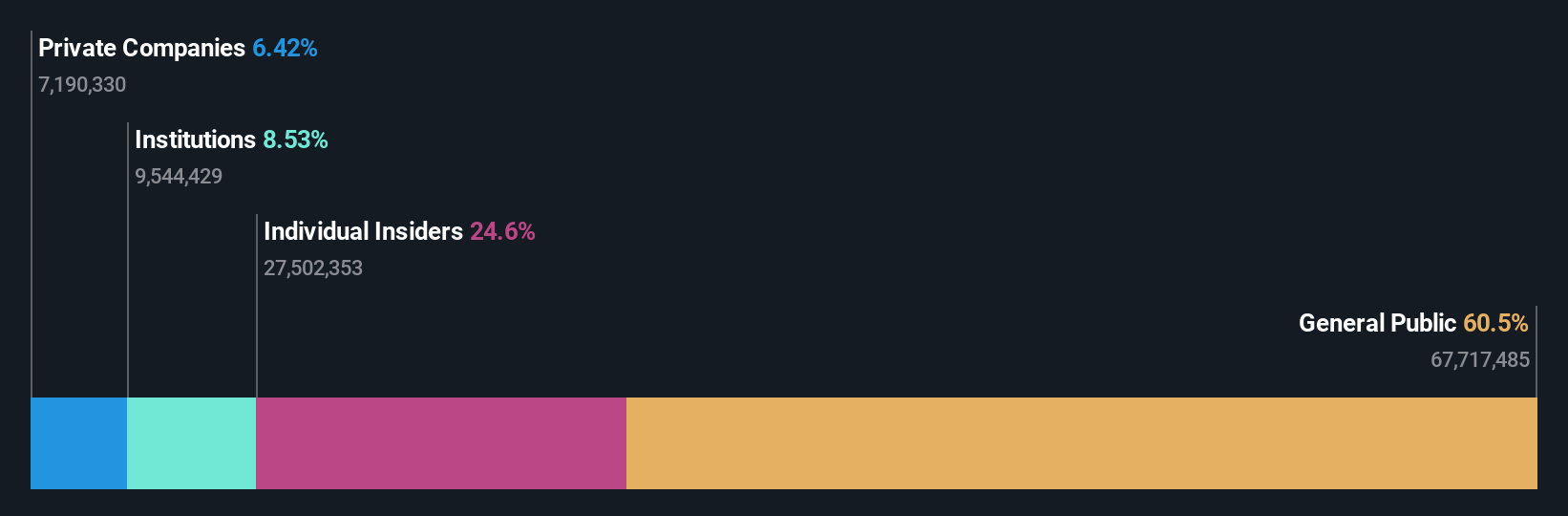

Insider Ownership: 36.8%

Earnings Growth Forecast: 61.4% p.a.

PensionBee Group, with significant insider ownership, is forecast to grow revenue at 18.7% annually, outpacing the UK market's 4.2%. Despite a net loss of £5.06 million for H1 2025 and no substantial insider buying recently, analysts expect its stock price to rise by 26.6%. The company's earnings are projected to grow by 61.39% per year as it aims for profitability within three years, indicating strong growth potential despite recent challenges.

- Click to explore a detailed breakdown of our findings in PensionBee Group's earnings growth report.

- Our comprehensive valuation report raises the possibility that PensionBee Group is priced higher than what may be justified by its financials.

QinetiQ Group (LSE:QQ.)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QinetiQ Group plc offers science and technology solutions for defense, security, and infrastructure sectors across the United Kingdom, the United States, Australia, and internationally with a market cap of approximately £2.65 billion.

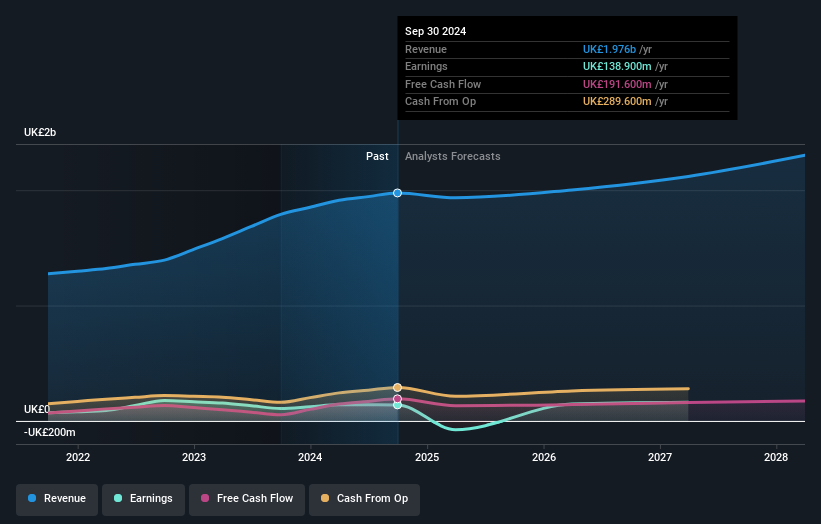

Operations: The company's revenue is primarily derived from two segments: EMEA Services, contributing £1.48 billion, and Global Solutions, which adds £453.90 million.

Insider Ownership: 13.4%

Earnings Growth Forecast: 67.4% p.a.

QinetiQ Group has seen more insider buying than selling over the past three months, although not in significant volumes. The company's revenue is forecast to grow at 4.8% annually, surpassing the UK market average of 4.2%. Earnings are projected to increase by 67.36% per year, with profitability expected within three years. Recent leadership changes include Corry Neale's appointment as Chief Executive for Australia Sector, enhancing its strategic capabilities in defence and technology sectors.

- Navigate through the intricacies of QinetiQ Group with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that QinetiQ Group's share price might be on the cheaper side.

Summing It All Up

- Click here to access our complete index of 61 Fast Growing UK Companies With High Insider Ownership.

- Seeking Other Investments? Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if QinetiQ Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:QQ.

QinetiQ Group

Provides science and technology solution in the defense, security, and infrastructure markets in the United Kingdom, the United States, Australia, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives