- United Kingdom

- /

- Diversified Financial

- /

- LSE:PAG

Here's Why We Think Paragon Banking Group (LON:PAG) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Paragon Banking Group (LON:PAG). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Paragon Banking Group

Paragon Banking Group's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Paragon Banking Group has managed to grow EPS by 36% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

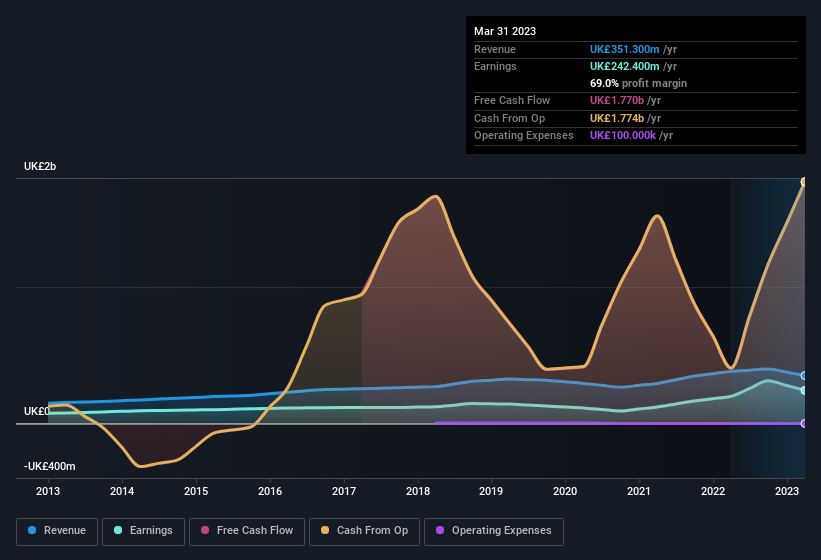

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Paragon Banking Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While Paragon Banking Group may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Paragon Banking Group's future EPS 100% free.

Are Paragon Banking Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Paragon Banking Group shareholders can gain quiet confidence from the fact that insiders shelled out UK£204k to buy stock, over the last year. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. We also note that it was the Independent Non-Executive Director, Hugo Tudor, who made the biggest single acquisition, paying UK£41k for shares at about UK£5.87 each.

Along with the insider buying, another encouraging sign for Paragon Banking Group is that insiders, as a group, have a considerable shareholding. To be specific, they have UK£9.8m worth of shares. This considerable investment should help drive long-term value in the business. Even though that's only about 0.9% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Paragon Banking Group To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Paragon Banking Group's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for Paragon Banking Group (of which 1 shouldn't be ignored!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Paragon Banking Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:PAG

Paragon Banking Group

Provides financial products and services in the United Kingdom.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives