- United Kingdom

- /

- Capital Markets

- /

- LSE:OCI

Here's Why We Think Oakley Capital Investments (LON:OCI) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Oakley Capital Investments (LON:OCI). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Oakley Capital Investments

Oakley Capital Investments' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Oakley Capital Investments has achieved impressive annual EPS growth of 52%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Oakley Capital Investments' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that Oakley Capital Investments is growing revenues, and EBIT margins improved by 7.4 percentage points to 99%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

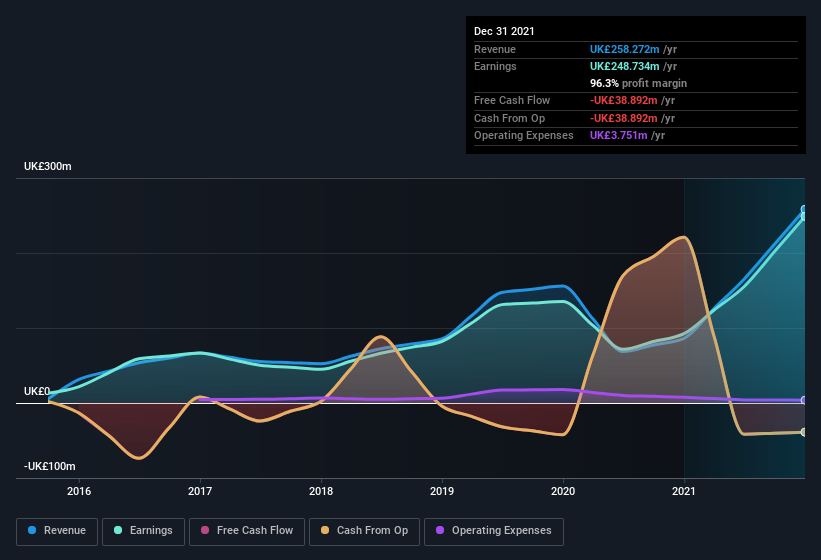

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Oakley Capital Investments' balance sheet strength, before getting too excited.

Are Oakley Capital Investments Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in Oakley Capital Investments will be more than happy to see insiders committing themselves to the company, spending UK£522k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. It is also worth noting that it was Senior Partner & Co-Founder David Till who made the biggest single purchase, worth UK£200k, paying UK£4.01 per share.

The good news, alongside the insider buying, for Oakley Capital Investments bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at UK£83m, they have plenty of motivation to push the business to succeed. Amounting to 11% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

Should You Add Oakley Capital Investments To Your Watchlist?

Oakley Capital Investments' earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Oakley Capital Investments belongs near the top of your watchlist. It is worth noting though that we have found 1 warning sign for Oakley Capital Investments that you need to take into consideration.

Keen growth investors love to see insider buying. Thankfully, Oakley Capital Investments isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Oakley Capital Investments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:OCI

Oakley Capital Investments

Oakley Capital Investments Limited is private equity and venture capital firm specializing in investments in early, series B, growth, late stage, small and mid markets, corporate carve-outs, buyouts, restructuring, management buy-outs, management buy-ins, public to privates, re-financings, secondary purchases, growth capital, turnarounds, industry consolidation, business roll-outs and buy-and-build investments as well as investments in other funds.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives