- United Kingdom

- /

- Diversified Financial

- /

- LSE:MNG

3 UK Stocks Trading Up To 31.5% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, largely influenced by weak trade data from China, which has affected companies with significant exposure to the Chinese market. Amid these challenging conditions, identifying stocks trading below their intrinsic value can offer potential opportunities for investors seeking undervalued assets in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SigmaRoc (AIM:SRC) | £1.164 | £2.31 | 49.5% |

| Pinewood Technologies Group (LSE:PINE) | £4.17 | £7.86 | 46.9% |

| PageGroup (LSE:PAGE) | £2.322 | £4.46 | 47.9% |

| Mitie Group (LSE:MTO) | £1.366 | £2.56 | 46.6% |

| Hollywood Bowl Group (LSE:BOWL) | £2.52 | £4.91 | 48.6% |

| Gym Group (LSE:GYM) | £1.48 | £2.93 | 49.5% |

| Gooch & Housego (AIM:GHH) | £5.86 | £11.25 | 47.9% |

| Gateley (Holdings) (AIM:GTLY) | £1.285 | £2.57 | 49.9% |

| Begbies Traynor Group (AIM:BEG) | £1.17 | £2.22 | 47.3% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.215 | £4.37 | 49.3% |

Here's a peek at a few of the choices from the screener.

CVS Group (AIM:CVSG)

Overview: CVS Group plc operates in veterinary services, pet crematoria, online pharmacy, and retail sectors with a market cap of £982.84 million.

Operations: The company's revenue is derived from its operations in veterinary services, pet crematoria, online pharmacy, and retail sectors.

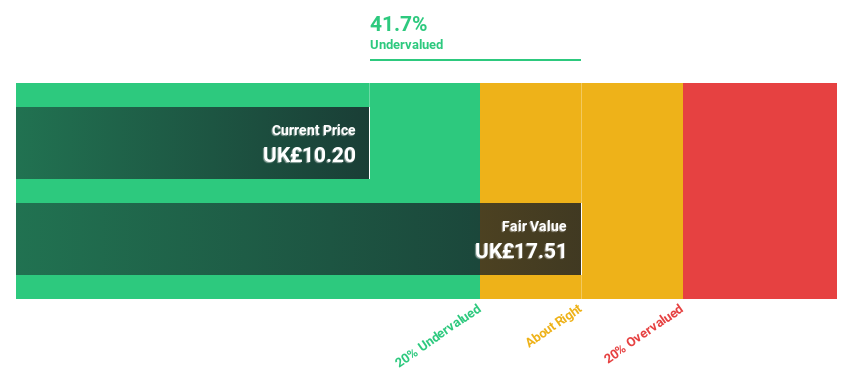

Estimated Discount To Fair Value: 30.5%

CVS Group's recent financial results show a notable increase in net income to £52.8 million from £6.2 million last year, despite a decline in profit margins. The company is trading at approximately 30.5% below its estimated fair value of £19.7 per share, indicating potential undervaluation based on cash flows. While revenue growth is expected to outpace the UK market, interest payments are not well covered by earnings, which could pose financial challenges moving forward.

- In light of our recent growth report, it seems possible that CVS Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in CVS Group's balance sheet health report.

Entain (LSE:ENT)

Overview: Entain Plc is a sports-betting and gaming company with operations in the United Kingdom, Ireland, Italy, the rest of Europe, Australia, New Zealand, and internationally; it has a market cap of £5.19 billion.

Operations: Entain's revenue segments include £500.90 million from CEE, £2.14 billion from UK&I, and £2.55 billion from International markets.

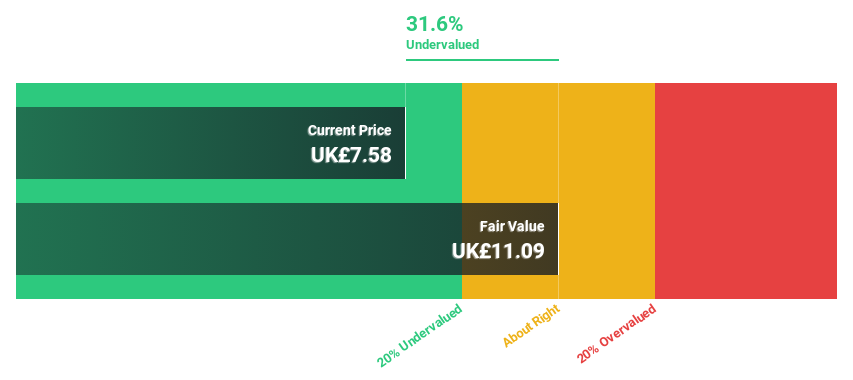

Estimated Discount To Fair Value: 31.5%

Entain is trading at £8.12, significantly below its estimated fair value of £11.85, highlighting potential undervaluation based on cash flows. Despite a net loss of £98.3 million for H1 2025, analysts anticipate a 42% stock price increase and forecast earnings to grow substantially over the next three years. However, the dividend yield remains inadequately covered by earnings, and recent debt repricing efforts could impact financial flexibility moving forward.

- The analysis detailed in our Entain growth report hints at robust future financial performance.

- Click here to discover the nuances of Entain with our detailed financial health report.

M&G (LSE:MNG)

Overview: M&G plc operates savings and investment businesses in the UK and internationally, with a market cap of £6.06 billion.

Operations: The company generates revenue through its Asset Management segment, which contributes £1.07 billion, and its Life (Including Wealth) segment, which brings in £7.57 billion.

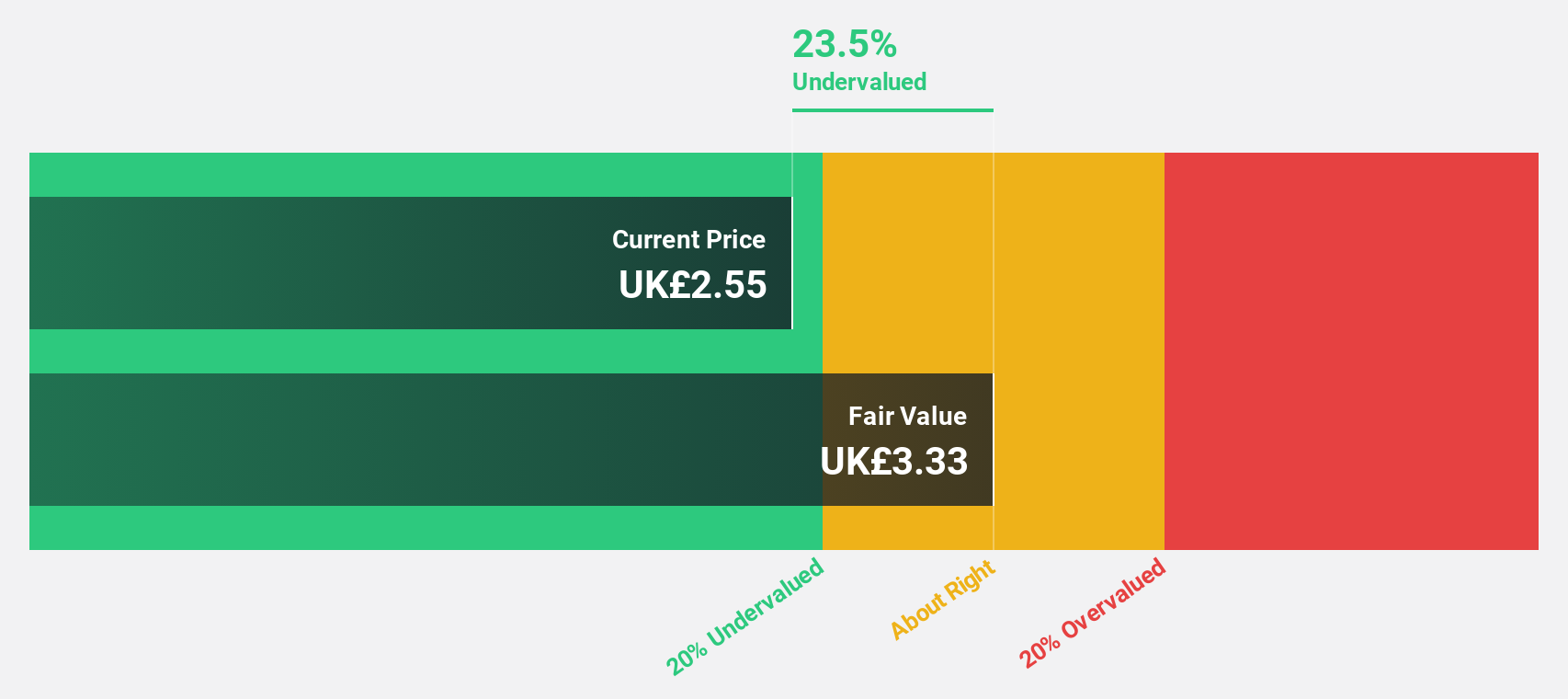

Estimated Discount To Fair Value: 23%

M&G is trading at £2.56, 23% below its estimated fair value of £3.32, suggesting undervaluation based on cash flows. Recent earnings results show a net income of £243 million for H1 2025, reversing a previous loss and improving basic earnings per share to £0.101 from a loss per share last year. Despite this progress, the dividend yield remains unsustainable by current earnings, and revenue is forecast to decline significantly over the next three years.

- Our earnings growth report unveils the potential for significant increases in M&G's future results.

- Dive into the specifics of M&G here with our thorough financial health report.

Key Takeaways

- Dive into all 53 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MNG

M&G

Through its subsidiaries, engages in savings and investment businesses in the United Kingdom and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives