- United Kingdom

- /

- Capital Markets

- /

- LSE:LSEG

We Ran A Stock Scan For Earnings Growth And London Stock Exchange Group (LON:LSEG) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like London Stock Exchange Group (LON:LSEG), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for London Stock Exchange Group

How Quickly Is London Stock Exchange Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. London Stock Exchange Group managed to grow EPS by 6.9% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

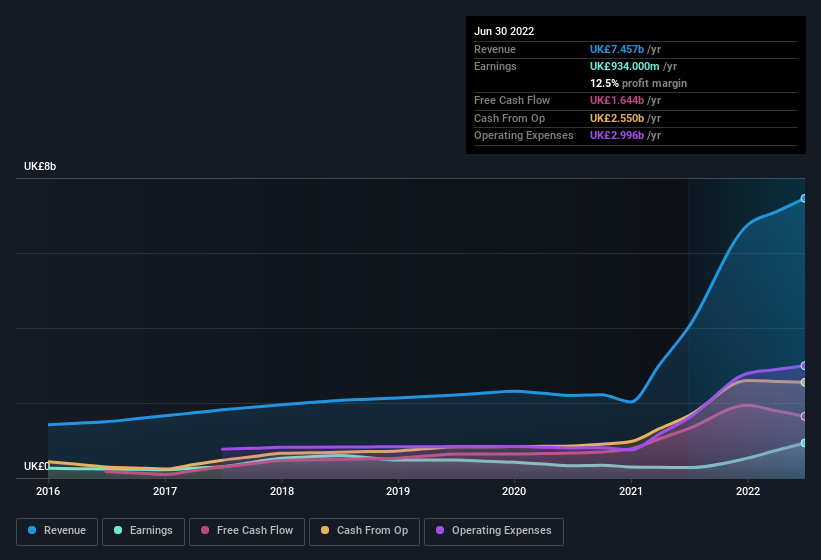

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that London Stock Exchange Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. On the revenue front, London Stock Exchange Group has done well over the past year, growing revenue by 85% to UK£7.5b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of London Stock Exchange Group's forecast profits?

Are London Stock Exchange Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling London Stock Exchange Group shares, in the last year. So it's definitely nice that Independent Non-Executive Director Kathleen DeRose bought UK£34k worth of shares at an average price of around UK£68.10. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in London Stock Exchange Group.

Should You Add London Stock Exchange Group To Your Watchlist?

One important encouraging feature of London Stock Exchange Group is that it is growing profits. Not every business can grow its EPS, but London Stock Exchange Group certainly can. The icing on the cake is that an insider bought shares during the year; a point of interest for people who will want to keep a watchful eye on this stock. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of London Stock Exchange Group. You might benefit from giving it a glance today.

Keen growth investors love to see insider buying. Thankfully, London Stock Exchange Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:LSEG

London Stock Exchange Group

Operates as a financial markets infrastructure and data provider primarily in the United Kingdom and internationally.

Flawless balance sheet with reasonable growth potential.