- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:WINE

Promising UK Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

The UK market has been experiencing volatility, with the FTSE 100 index recently faltering due to weak trade data from China, highlighting global economic uncertainties. Despite these challenges, investors often look for opportunities in less conventional areas of the market. Penny stocks, while sometimes considered an outdated term, continue to offer potential growth opportunities by focusing on smaller or newer companies with strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.35 | £171.93M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4395 | $255.49M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.12 | £472M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.45 | £313.05M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Argentex Group (AIM:AGFX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Argentex Group PLC offers tailored currency risk management and payment solutions in the United Kingdom, with a market cap of £36.13 million.

Operations: The company's revenue is derived entirely from its foreign currency dealing business, which generated £48.8 million.

Market Cap: £36.13M

Argentex Group PLC, with a market cap of £36.13 million, operates in the foreign currency dealing sector and has generated £48.8 million in revenue. Despite being debt-free and trading at a good value compared to peers, the company faces challenges such as low return on equity (0.5%) and declining profit margins (currently 0.4% from 15.6% last year). The management team is relatively inexperienced with an average tenure of 0.9 years, and shareholders experienced dilution over the past year with shares outstanding increasing by 6.4%. However, Argentex's short-term assets significantly exceed its liabilities, providing financial stability amidst negative earnings growth trends.

- Jump into the full analysis health report here for a deeper understanding of Argentex Group.

- Understand Argentex Group's earnings outlook by examining our growth report.

CT Automotive Group (AIM:CTA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CT Automotive Group plc designs, develops, manufactures, and supplies automotive interior components and kinematic assemblies for automotive brands in the UK and internationally, with a market cap of £29.44 million.

Operations: The company's revenue is divided into two segments: Tooling, which generated $13.12 million, and Production, with $122.20 million in revenue.

Market Cap: £29.44M

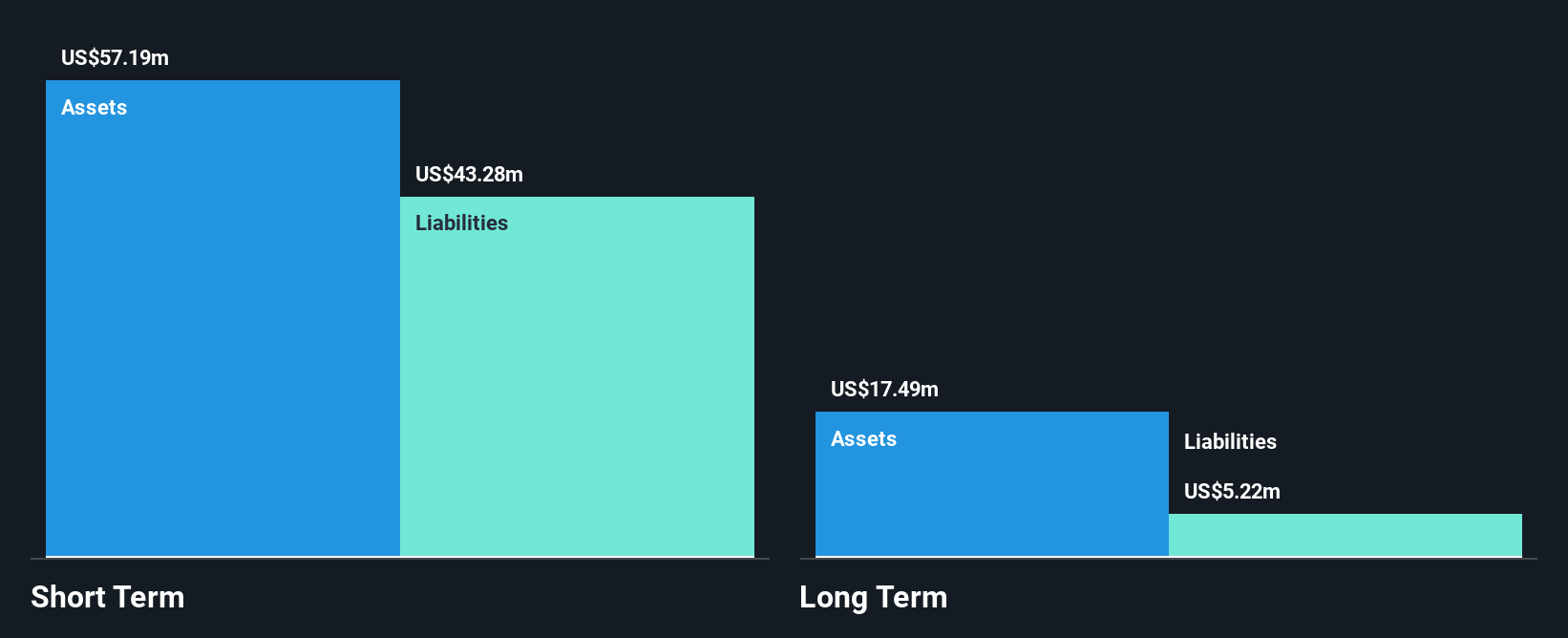

CT Automotive Group plc, with a market cap of £29.44 million, has shown significant financial improvement by becoming profitable over the past year, achieving a net income of US$3.67 million for the half-year ended June 2024. The company benefits from strong interest coverage and a satisfactory net debt to equity ratio of 27%. Recent strategic moves include securing a new US$20 million asset-backed facility to support growth initiatives in Mexico. However, both its board and management team are relatively inexperienced with average tenures below industry norms. Despite these challenges, CT Automotive's return on equity is outstanding at 41.9%, indicating robust profitability potential amidst operational transitions like recent executive changes.

- Navigate through the intricacies of CT Automotive Group with our comprehensive balance sheet health report here.

- Explore CT Automotive Group's analyst forecasts in our growth report.

Naked Wines (AIM:WINE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Naked Wines plc operates as a direct-to-consumer wine retailer in Australia, the United Kingdom, and the United States, with a market capitalization of £36.48 million.

Operations: The company's revenue is derived from three main geographical segments: £119.55 million from the UK, £118.03 million from the USA, and £32.79 million from Australia.

Market Cap: £36.48M

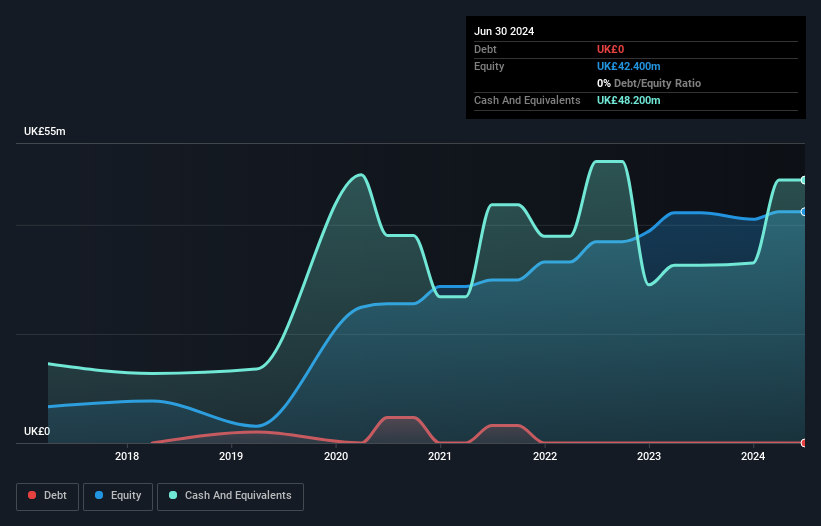

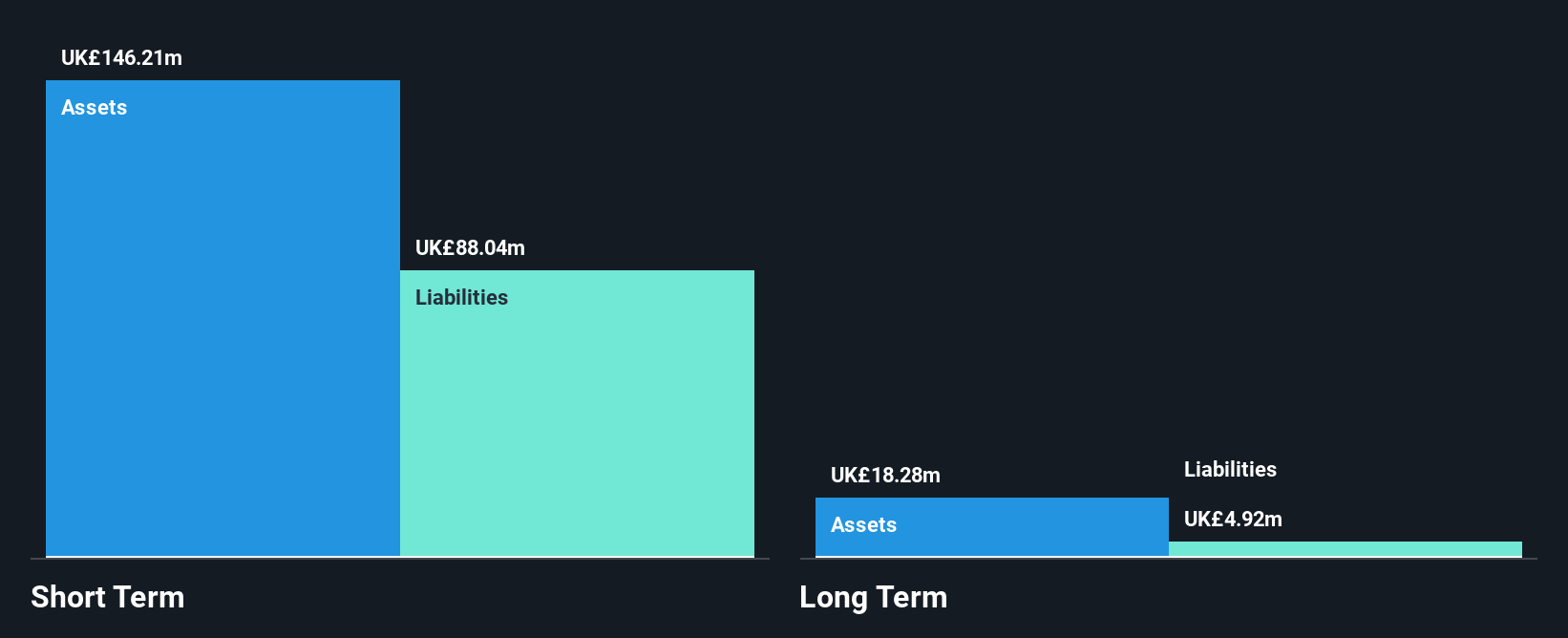

Naked Wines plc, with a market cap of £36.48 million, faces challenges as it remains unprofitable, reporting a net loss of £6.53 million for the half-year ended September 2024. Despite this, the company maintains financial stability with short-term assets of £178.8 million exceeding both its short-term and long-term liabilities significantly. The debt to equity ratio has improved over five years from 30.7% to 9.4%, indicating effective debt management and more cash than total debt enhances its financial flexibility. However, the management and board's inexperience could impact strategic decision-making as they navigate profitability issues amidst declining sales.

- Unlock comprehensive insights into our analysis of Naked Wines stock in this financial health report.

- Evaluate Naked Wines' prospects by accessing our earnings growth report.

Seize The Opportunity

- Get an in-depth perspective on all 472 UK Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Naked Wines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:WINE

Naked Wines

Engages in the direct-to-consumer retailing of wines in Australia, the United Kingdom, and the United States.

Flawless balance sheet and good value.