- United Kingdom

- /

- Capital Markets

- /

- LSE:LSEG

Here's Why We Think London Stock Exchange Group (LON:LSEG) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like London Stock Exchange Group (LON:LSEG). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for London Stock Exchange Group

How Fast Is London Stock Exchange Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. We can see that in the last three years London Stock Exchange Group grew its EPS by 6.2% per year. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

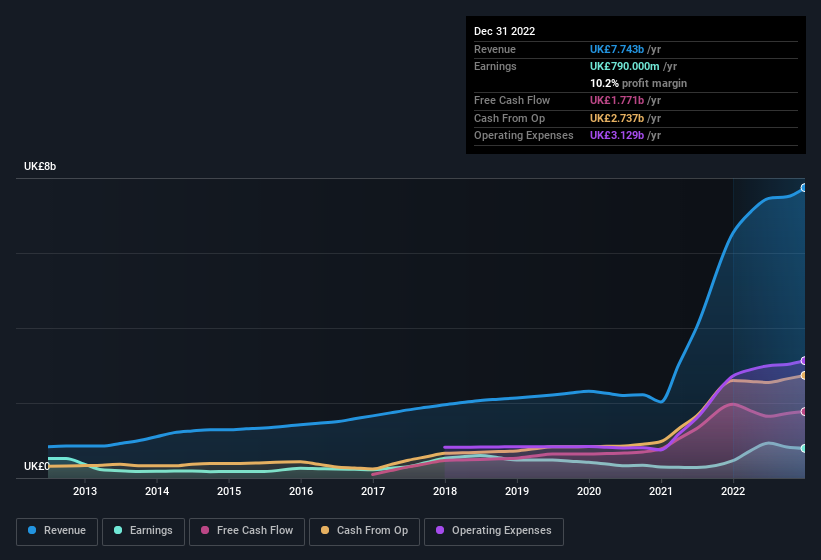

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that London Stock Exchange Group's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for London Stock Exchange Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 18% to UK£7.7b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for London Stock Exchange Group?

Are London Stock Exchange Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the Independent Non-Executive Director, Dominic Blakemore, paid UK£50k to buy shares at an average price of UK£73.18. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

Is London Stock Exchange Group Worth Keeping An Eye On?

One positive for London Stock Exchange Group is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, London Stock Exchange Group seems free from that morose affliction. The icing on the cake is that an insider bought shares during the year; a point of interest for people who will want to keep a watchful eye on this stock. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how London Stock Exchange Group shapes up to industry peers, when it comes to ROE.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of London Stock Exchange Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:LSEG

London Stock Exchange Group

Operates as a financial markets infrastructure and data provider primarily in the United Kingdom and internationally.

Flawless balance sheet with reasonable growth potential.