- United Kingdom

- /

- Metals and Mining

- /

- LSE:BMV

3 UK Penny Stocks With Market Caps Over £4M

Reviewed by Simply Wall St

The UK market has seen some turbulence recently, with the FTSE 100 index closing lower amid concerns over China's economic recovery and its impact on global trade. In such a climate, investors are often on the lookout for stocks that offer both affordability and potential growth. Although the term "penny stocks" may seem outdated, these smaller or newer companies can still present intriguing opportunities when they demonstrate strong financial health and stability.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £1.01 | £159.32M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.145 | £808.16M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.175 | £100.28M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.95 | £188.38M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.292 | £199.26M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.29 | £426.67M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.442 | $256.95M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.15 | £87.09M | ★★★★★★ |

Click here to see the full list of 466 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cordel Group (AIM:CRDL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cordel Group Plc is a software company operating in Australia, the United Kingdom, New Zealand, and the Americas with a market cap of £14.83 million.

Operations: The company generates revenue of £4.44 million from its data integration and analytic services.

Market Cap: £14.83M

Cordel Group Plc, with a market cap of £14.83 million and revenue of £4.44 million, remains unprofitable but has reduced losses over the past five years. The company has secured significant contracts with Aurizon Holdings Ltd and Southeastern, enhancing its footprint in the rail industry through AI-enhanced data services. Despite a volatile share price and shareholder dilution by 7.7%, Cordel is debt-free with sufficient cash runway for over three years at current free cash flow levels. Recent certifications from Network Rail bolster its strategic position in rail infrastructure monitoring, highlighting potential growth avenues despite management's short tenure.

- Navigate through the intricacies of Cordel Group with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Cordel Group's track record.

Bluebird Mining Ventures (LSE:BMV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bluebird Mining Ventures Ltd, along with its subsidiaries, is involved in the mining and development of mineral properties and has a market capitalization of approximately £4.60 million.

Operations: No revenue segments have been reported.

Market Cap: £4.6M

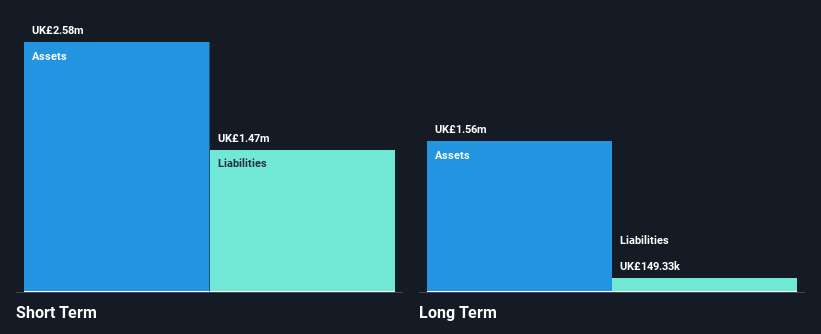

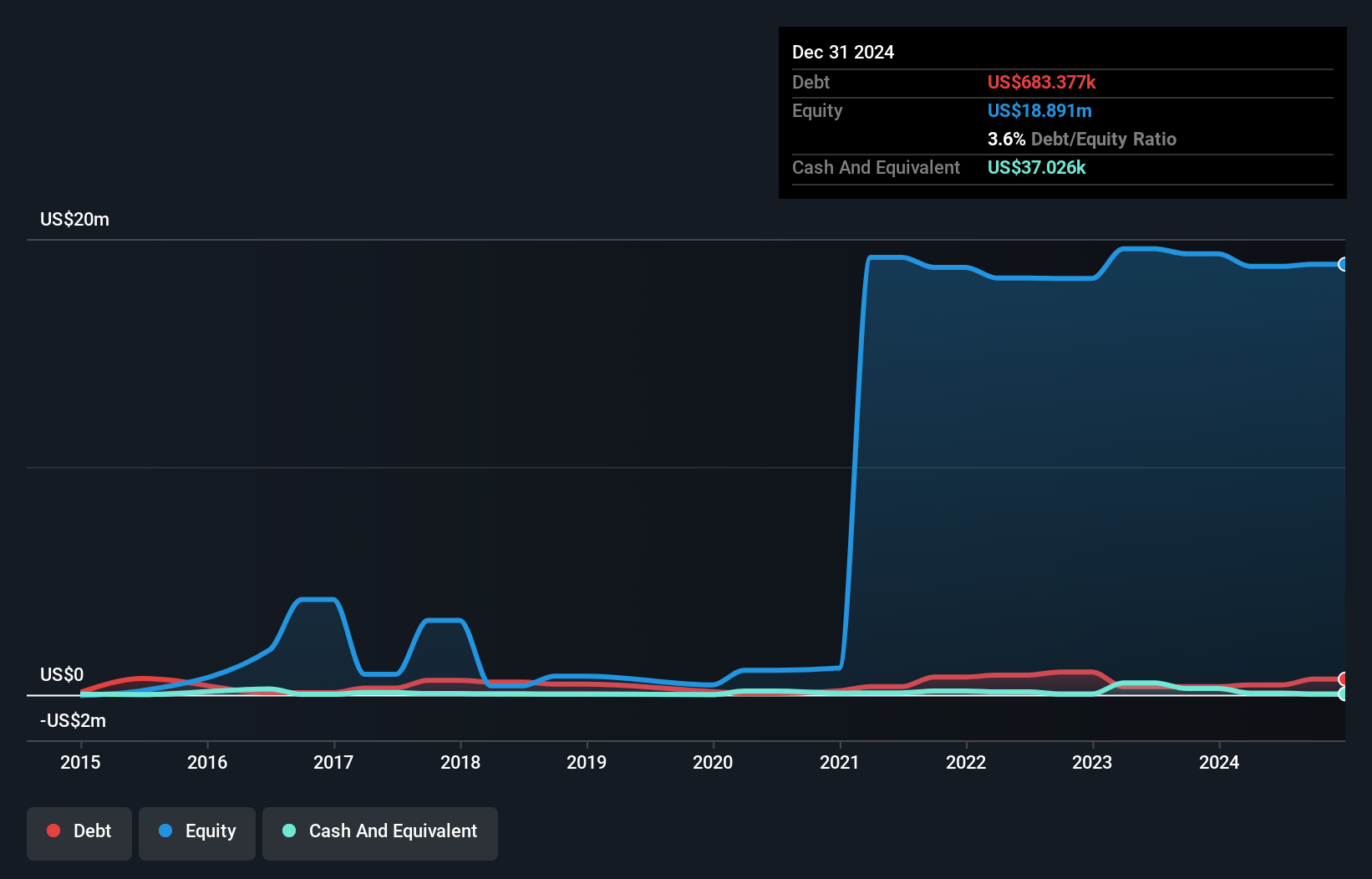

Bluebird Mining Ventures Ltd, with a market cap of £4.60 million, operates as a pre-revenue entity in the mining sector. The company has experienced shareholder dilution, increasing shares by 7.6% over the past year while maintaining a satisfactory net debt to equity ratio of 1.9%. Despite its seasoned board and management team, Bluebird remains unprofitable with losses escalating at 17.3% annually over five years and recent half-year losses reaching US$0.9217 million. A recent follow-on equity offering raised £0.062 million but short-term liabilities still exceed assets significantly, indicating financial challenges ahead despite reduced volatility in stock price movements.

- Click here to discover the nuances of Bluebird Mining Ventures with our detailed analytical financial health report.

- Understand Bluebird Mining Ventures' track record by examining our performance history report.

LMS Capital (LSE:LMS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LMS Capital plc is a private equity firm focusing on direct and fund of funds investments across various stages including mid ventures, late ventures, emerging growth, middle market, later stage, growth and development capital, buyout and recapitalization with a market cap of £14.21 million.

Operations: LMS Capital plc has not reported any specific revenue segments.

Market Cap: £14.21M

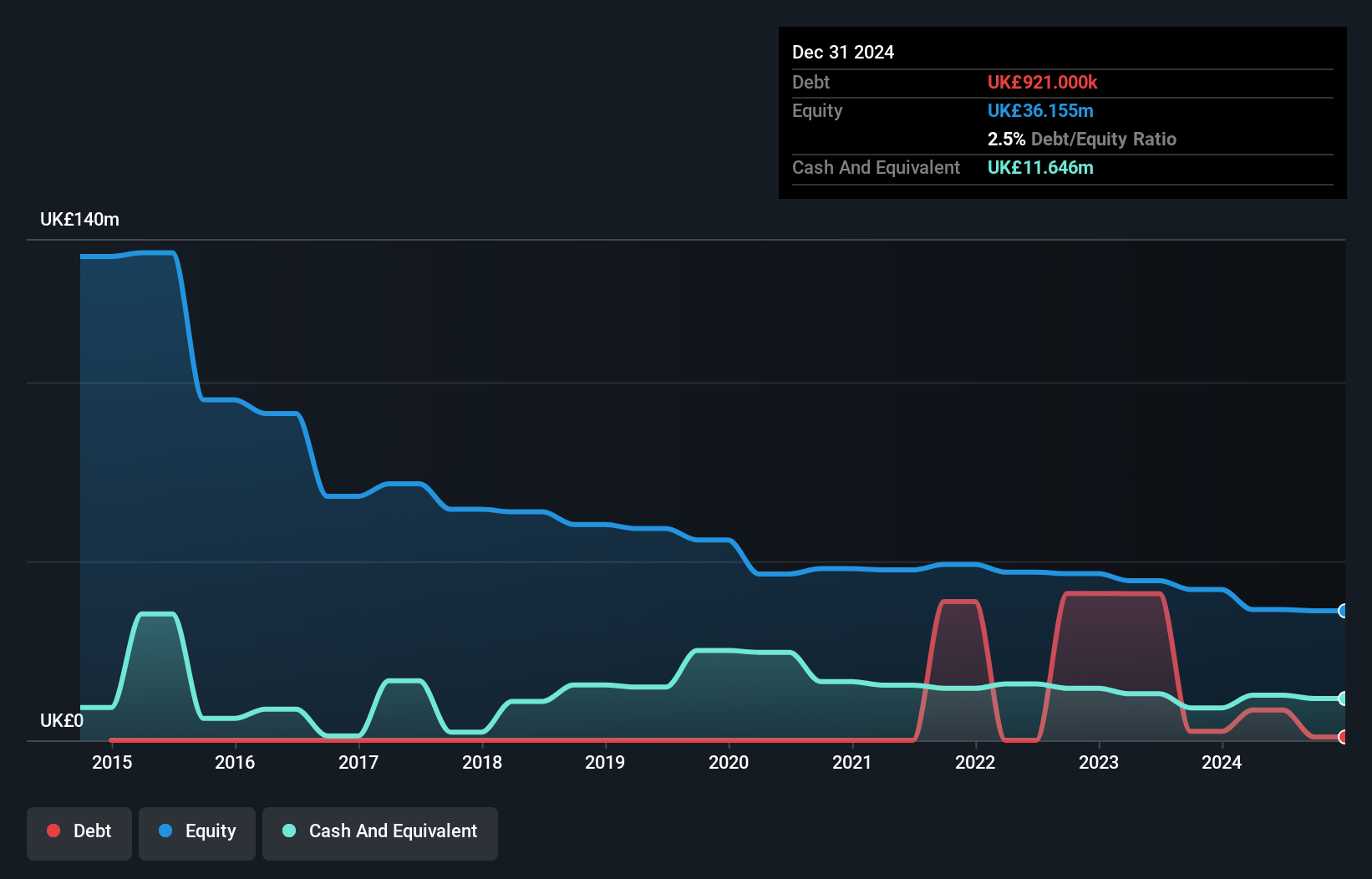

LMS Capital plc, with a market cap of £14.21 million, is a pre-revenue private equity firm currently unprofitable but has managed to reduce losses by 11.3% annually over five years. Its financial position is relatively stable with short-term assets of £12.8 million exceeding liabilities of £8.8 million and no long-term liabilities on the books. The company maintains more cash than its total debt and has a sufficient cash runway for over three years if current free cash flow trends persist. However, its dividend yield of 5.26% is not well covered by earnings or free cash flows, and share price volatility remains high despite stable weekly movements compared to most UK stocks.

- Click to explore a detailed breakdown of our findings in LMS Capital's financial health report.

- Examine LMS Capital's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Unlock more gems! Our UK Penny Stocks screener has unearthed 463 more companies for you to explore.Click here to unveil our expertly curated list of 466 UK Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bluebird Mining Ventures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BMV

Bluebird Mining Ventures

Engages in mining and developing of mineral properties.

Excellent balance sheet slight.