- United Kingdom

- /

- Metals and Mining

- /

- AIM:BOD

3 UK Penny Stocks With Market Caps Larger Than £1M

Reviewed by Simply Wall St

The UK stock market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market fluctuations, investors can still find potential opportunities by exploring smaller companies that may offer growth prospects at more accessible price points. Penny stocks, though an outdated term, continue to represent this segment of the market where discerning investors might uncover valuable opportunities among less-established firms with solid fundamentals and promising outlooks.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.065 | £778.12M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £147.58M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £422.96M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.415 | £180.2M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.43 | £341.13M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.60 | £87.73M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.065 | £90.69M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.95 | £188.38M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.418 | £218.7M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Bradda Head Lithium (AIM:BHL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bradda Head Lithium Limited, along with its subsidiaries, focuses on the exploration and development of lithium deposits in the United States and has a market cap of £4.59 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £4.59M

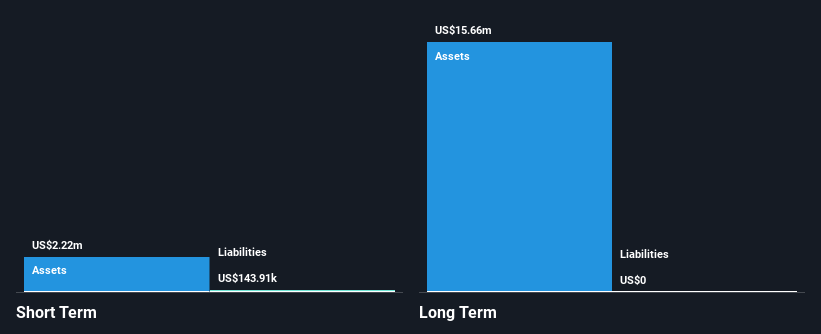

Bradda Head Lithium, with a market cap of £4.59 million, is pre-revenue and focuses on lithium exploration in the U.S. Recent developments include the approval of a drilling permit for its Dragon Target at San Domingo, indicating potential resource expansion. Despite being debt-free and having improved net profit margins recently due to a significant one-off gain, the company's management team lacks extensive experience with an average tenure of 1.9 years. Its board is more seasoned, averaging 5.8 years in tenure. The stock trades significantly below estimated fair value but remains volatile with stable weekly fluctuations at 6%.

- Unlock comprehensive insights into our analysis of Bradda Head Lithium stock in this financial health report.

- Explore historical data to track Bradda Head Lithium's performance over time in our past results report.

Botswana Diamonds (AIM:BOD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Botswana Diamonds plc focuses on the exploration and development of diamond resources in Botswana, South Africa, and Zimbabwe with a market cap of £1.96 million.

Operations: The company generates revenue from its Metals & Mining segment, specifically Gold & Other Precious Metals, amounting to £0.02 million.

Market Cap: £1.96M

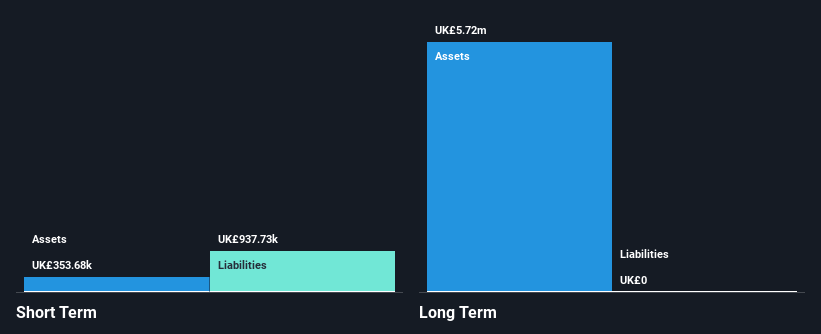

Botswana Diamonds, with a market cap of £1.96 million, is pre-revenue and focuses on diamond exploration in Africa. Recent AI-driven analysis has identified promising kimberlite anomalies near its KX36 discovery, potentially enhancing its resource base if diamonds are confirmed. The company remains debt-free but faces financial uncertainty with auditors expressing going concern doubts due to limited cash runway despite recent capital raises. Renewed prospecting licenses and environmental authorizations for drilling could support future growth prospects; however, short-term liabilities exceed assets, adding risk. Volatile share prices reflect these uncertainties amidst ongoing exploration efforts and strategic developments.

- Click here and access our complete financial health analysis report to understand the dynamics of Botswana Diamonds.

- Learn about Botswana Diamonds' historical performance here.

Braveheart Investment Group (AIM:BRH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Braveheart Investment Group plc is a private equity and venture capital firm that focuses on various stages of investment including loan, mezzanine, seed/startup, early venture, late stage, emerging growth, turnaround situations, distress situations, and buyouts in growth capital companies with a market cap of £3.19 million.

Operations: The company's revenue segment is primarily from the United Kingdom, with a reported figure of -£4.78 million.

Market Cap: £3.19M

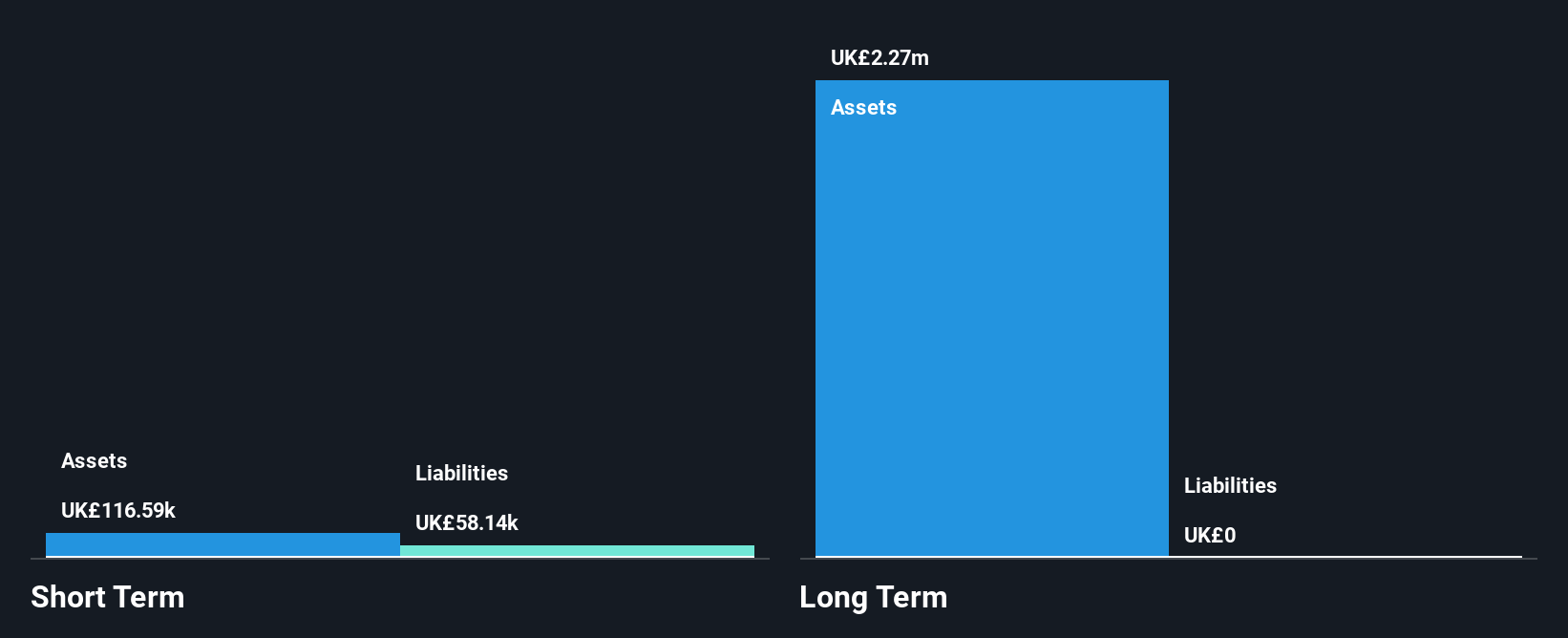

Braveheart Investment Group, with a market cap of £3.19 million, is pre-revenue and focuses on various investment stages across growth capital companies. The firm has no debt and its short-term assets of £1.2 million comfortably cover its short-term liabilities of £43.6K, indicating solid liquidity management despite unprofitability and declining earnings over the past five years at a rate of 42.4% per year. Recent changes in auditors with MAH Chartered Accountants taking over suggest potential shifts in financial oversight as the company navigates high share price volatility, trading below estimated fair value by 22.6%.

- Click here to discover the nuances of Braveheart Investment Group with our detailed analytical financial health report.

- Assess Braveheart Investment Group's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Reveal the 445 hidden gems among our UK Penny Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Botswana Diamonds might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BOD

Botswana Diamonds

Engages in the exploration and development of diamonds in Botswana, South Africa, and Zimbabwe.

Excellent balance sheet slight.