- United Kingdom

- /

- Consumer Finance

- /

- LSE:KSPI

Here's Why We Think Kaspi.kz (LON:KSPI) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Kaspi.kz (LON:KSPI), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Kaspi.kz

How Quickly Is Kaspi.kz Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Kaspi.kz's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 48%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

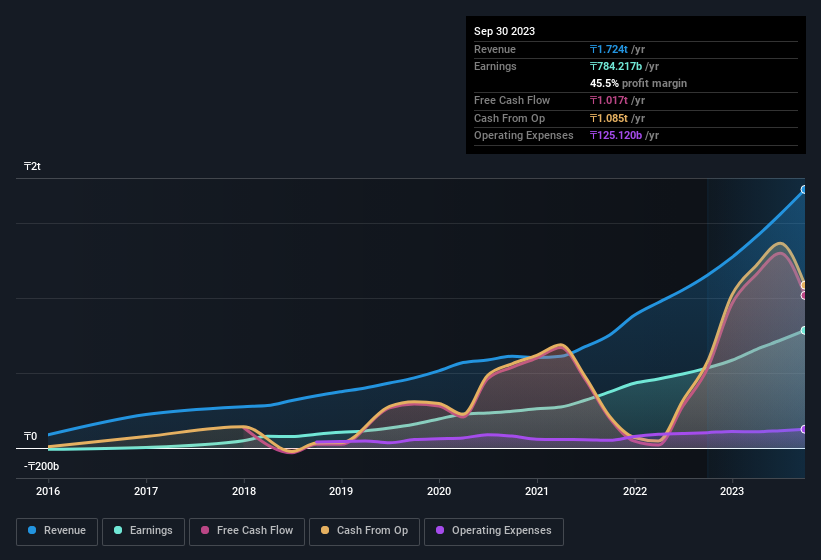

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Kaspi.kz's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Kaspi.kz maintained stable EBIT margins over the last year, all while growing revenue 50% to ₸1.7t. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Kaspi.kz?

Are Kaspi.kz Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Kaspi.kz will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Actually, with 44% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. at the current share price. That level of investment from insiders is nothing to sneeze at.

Is Kaspi.kz Worth Keeping An Eye On?

Kaspi.kz's earnings per share have been soaring, with growth rates sky high. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, Kaspi.kz is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. What about risks? Every company has them, and we've spotted 1 warning sign for Kaspi.kz you should know about.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in GB with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kaspi.kz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:KSPI

Kaspi.kz

Provides payments, marketplace, and fintech solutions for consumers and merchants in the Republic of Kazakhstan.

Flawless balance sheet with solid track record and pays a dividend.