- United Kingdom

- /

- Capital Markets

- /

- LSE:IKIV

3 Promising UK Penny Stocks With Market Caps Under £30M

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index slipping due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, certain investment opportunities remain attractive for those willing to explore beyond the major indices. Penny stocks, often representing smaller or newer companies, continue to offer potential value and growth when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £153.96M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.83 | £465.6M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.60 | £412.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.89 | £712.18M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.39 | £177.02M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.18 | £181.99M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.34 | £332.18M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £4.00 | £190.77M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £1.98 | £141.26M | ★★★★★☆ |

Click here to see the full list of 442 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Ikigai Ventures (LSE:IKIV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ikigai Ventures Limited, with a market cap of £9.62 million, currently does not have significant operations.

Operations: Ikigai Ventures Limited does not report any revenue segments as it currently lacks significant operations.

Market Cap: £9.62M

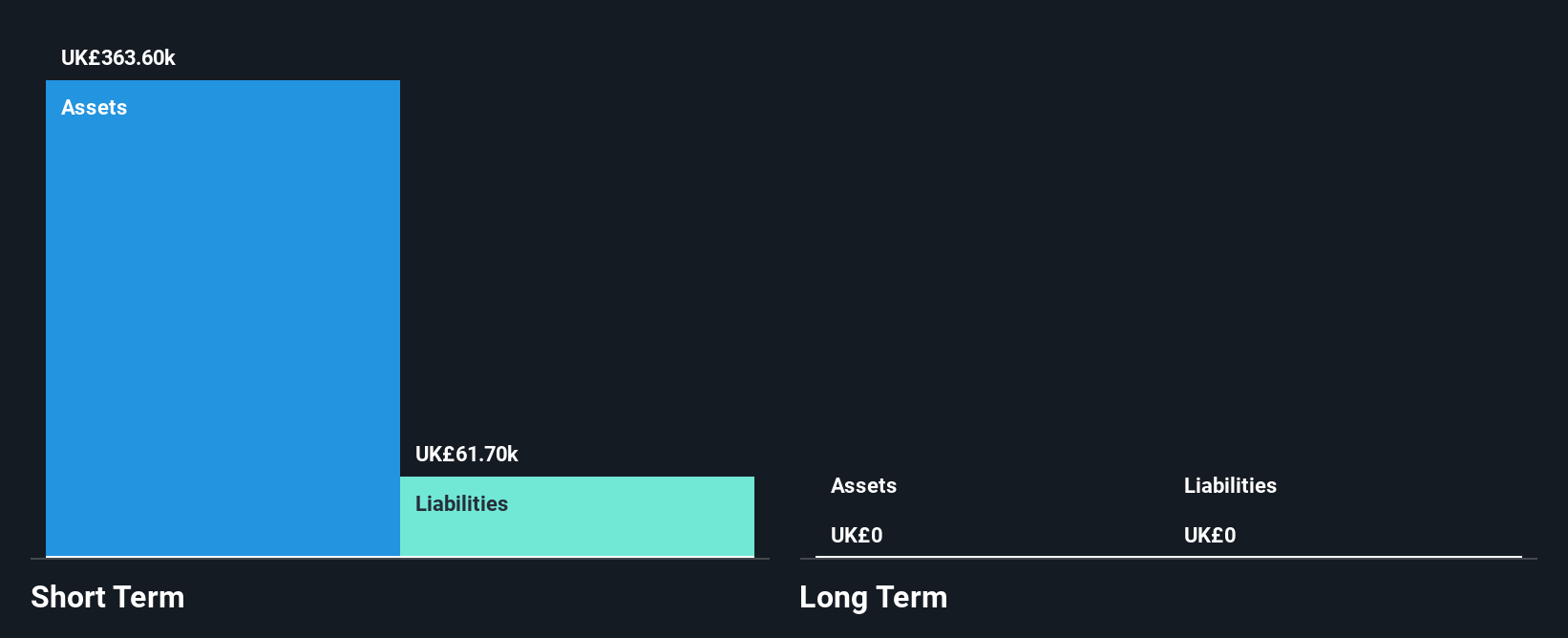

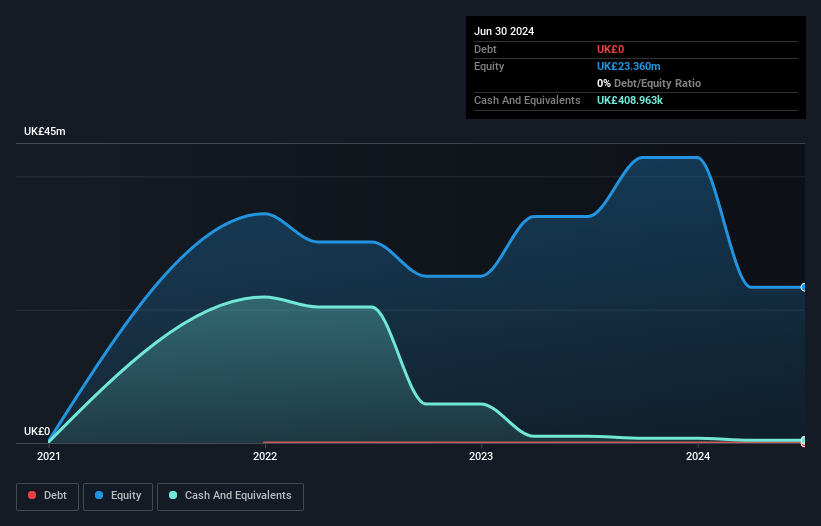

Ikigai Ventures Limited, with a market cap of £9.62 million, is currently pre-revenue and lacks significant operations. The company is debt-free and has no long-term liabilities, which provides some financial stability despite its unprofitability. Its short-term assets of £742.6K comfortably cover short-term liabilities of £70.6K, offering a buffer against immediate financial pressures. The board's average tenure of 3.3 years suggests experienced oversight, while shareholders have not faced meaningful dilution recently. Ikigai reported a reduced net loss for the year ending June 30, 2024 (£0.48 million), indicating efforts towards cost management amidst operational challenges.

- Jump into the full analysis health report here for a deeper understanding of Ikigai Ventures.

- Gain insights into Ikigai Ventures' past trends and performance with our report on the company's historical track record.

Seed Capital Solutions (LSE:SCSP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Seed Capital Solutions Plc currently does not have significant operations and has a market capitalization of approximately £1.39 million.

Operations: Currently, there are no reported revenue segments for Seed Capital Solutions Plc.

Market Cap: £1.39M

Seed Capital Solutions Plc, with a market capitalization of £1.39 million, is currently pre-revenue and lacks significant operations. The company is debt-free and has no long-term liabilities, offering some financial stability despite its unprofitability. Short-term assets of £529K exceed short-term liabilities of £69K, providing a buffer against immediate financial pressures. The board's average tenure of 1.6 years suggests less experienced oversight compared to industry norms. Shareholders have not faced meaningful dilution recently, but the company reported an increased net loss for the year ending June 30, 2024 (£0.26 million), highlighting ongoing operational challenges.

- Take a closer look at Seed Capital Solutions' potential here in our financial health report.

- Examine Seed Capital Solutions' past performance report to understand how it has performed in prior years.

Phoenix Digital Assets (OFEX:PNIX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Phoenix Digital Assets Plc manages a portfolio of digital assets and investments in the United Kingdom, with a market cap of £28.21 million.

Operations: Phoenix Digital Assets Plc has not reported any specific revenue segments.

Market Cap: £28.21M

Phoenix Digital Assets Plc, with a market cap of £28.21 million, is pre-revenue and operates without debt or long-term liabilities, which provides some financial stability. The company's earnings have grown significantly by 535.4% over the past year, surpassing both its historical growth rate and industry averages. Its outstanding Return on Equity of 95.7% and low Price-To-Earnings ratio of 1.3x suggest potential value compared to the broader UK market average of 15.8x. However, short-term assets (£420.4K) fall short of covering short-term liabilities (£8.1M), indicating liquidity challenges despite high-quality earnings growth.

- Dive into the specifics of Phoenix Digital Assets here with our thorough balance sheet health report.

- Understand Phoenix Digital Assets' track record by examining our performance history report.

Summing It All Up

- Unlock our comprehensive list of 442 UK Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IKIV

Flawless balance sheet very low.

Market Insights

Community Narratives