- United Kingdom

- /

- Specialty Stores

- /

- LSE:AO.

3 UK Penny Stocks With Market Caps Up To £3B

Reviewed by Simply Wall St

The recent performance of the UK market, particularly the FTSE 100 and FTSE 250 indices, has been impacted by weak trade data from China, highlighting global economic interdependencies. Despite these challenges, investors continue to seek opportunities in various segments of the market. Penny stocks, though often considered a niche area due to their historical connotations, can offer intriguing possibilities for growth when backed by strong financial health and clear business strategies.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.21 | £300.14M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.96 | £445.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ✅ 5 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.45 | £184.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.864 | £1.16B | ✅ 4 ⚠️ 2 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.75 | £63.09M | ✅ 4 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.39 | £423.22M | ✅ 2 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £179.48M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.875 | £12.05M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 411 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

AO World (LSE:AO.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AO World plc, along with its subsidiaries, operates as an online retailer of domestic appliances and ancillary services in the United Kingdom and Germany, with a market cap of £561.36 million.

Operations: The company does not report specific revenue segments.

Market Cap: £561.36M

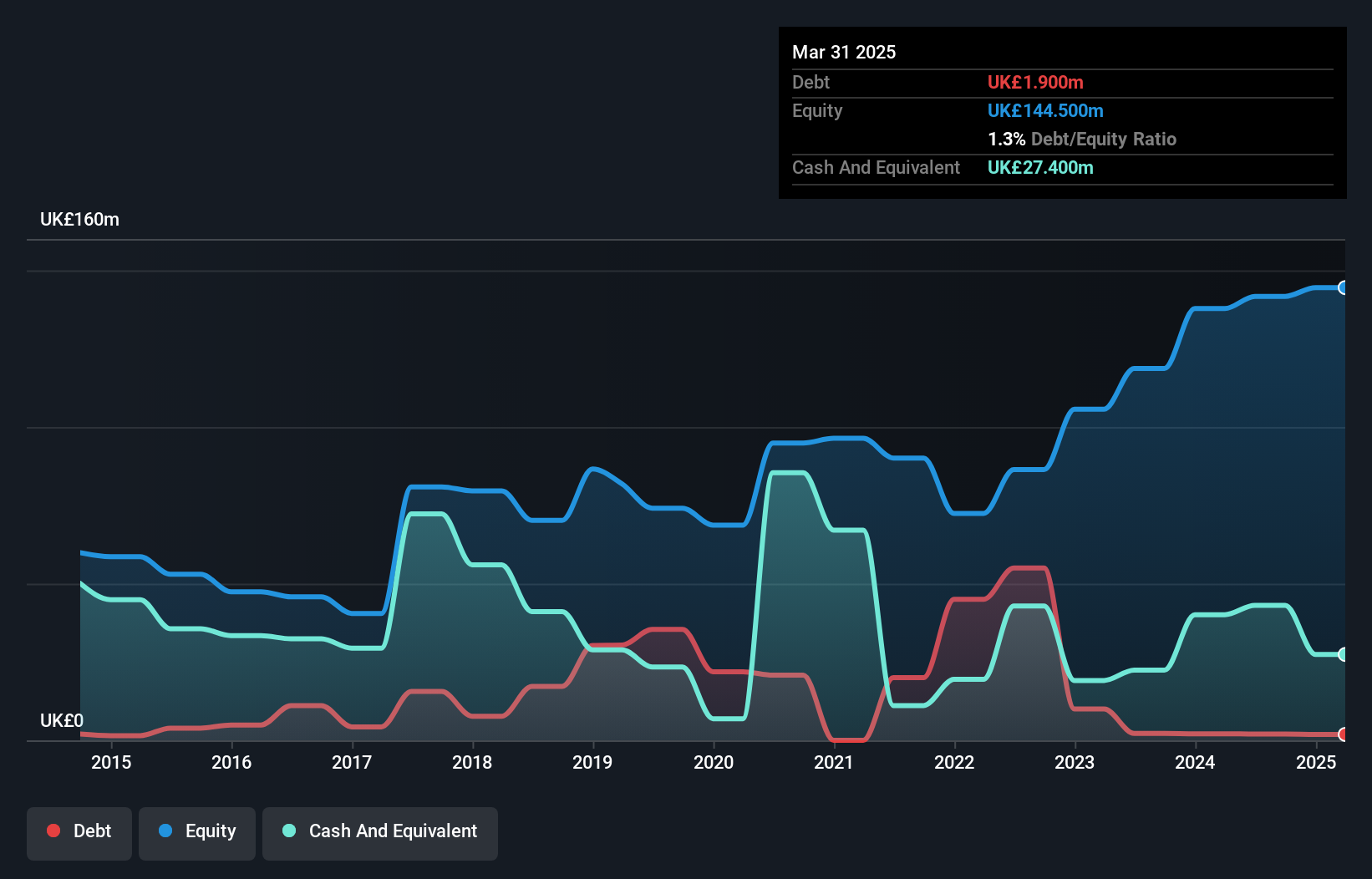

AO World has been trading below its estimated fair value, with analysts predicting a potential price increase of 39.3%. Despite a challenging year with negative earnings growth and reduced profit margins, the company remains profitable over the past five years, supported by strong cash flow that covers debt well. Recent financial results showed sales growth to £1.14 billion but a decline in net income to £10.5 million due to large one-off losses affecting earnings quality. The management team is experienced, and while short-term liabilities exceed assets slightly, long-term liabilities are adequately covered by assets.

- Unlock comprehensive insights into our analysis of AO World stock in this financial health report.

- Evaluate AO World's prospects by accessing our earnings growth report.

Intuitive Investments Group (LSE:IIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intuitive Investments Group Plc focuses on investing in early and later-stage life sciences businesses across the UK, continental Europe, and the US, with a market cap of £247.78 million.

Operations: The revenue segments for Intuitive Investments Group are not classified into specific categories, as indicated by the unclassified services amounting to -£0.43 million.

Market Cap: £247.78M

Intuitive Investments Group Plc, a pre-revenue entity with a market cap of £247.78 million, focuses on life sciences investments but remains unprofitable with increasing losses over the past five years. Despite being debt-free and having short-term assets exceeding liabilities, its cash runway is limited to two months based on recent free cash flow estimates; however, it recently raised £9.58 million through a follow-on equity offering. The board's average tenure is 1.8 years, indicating inexperience. Recent earnings showed an improvement in revenue to £0.34 million and reduced net loss compared to the previous year’s figures.

- Take a closer look at Intuitive Investments Group's potential here in our financial health report.

- Evaluate Intuitive Investments Group's historical performance by accessing our past performance report.

Deliveroo (LSE:ROO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deliveroo plc is a holding company that operates an online food delivery platform across several countries including the United Kingdom, Ireland, and France, with a market cap of £2.55 billion.

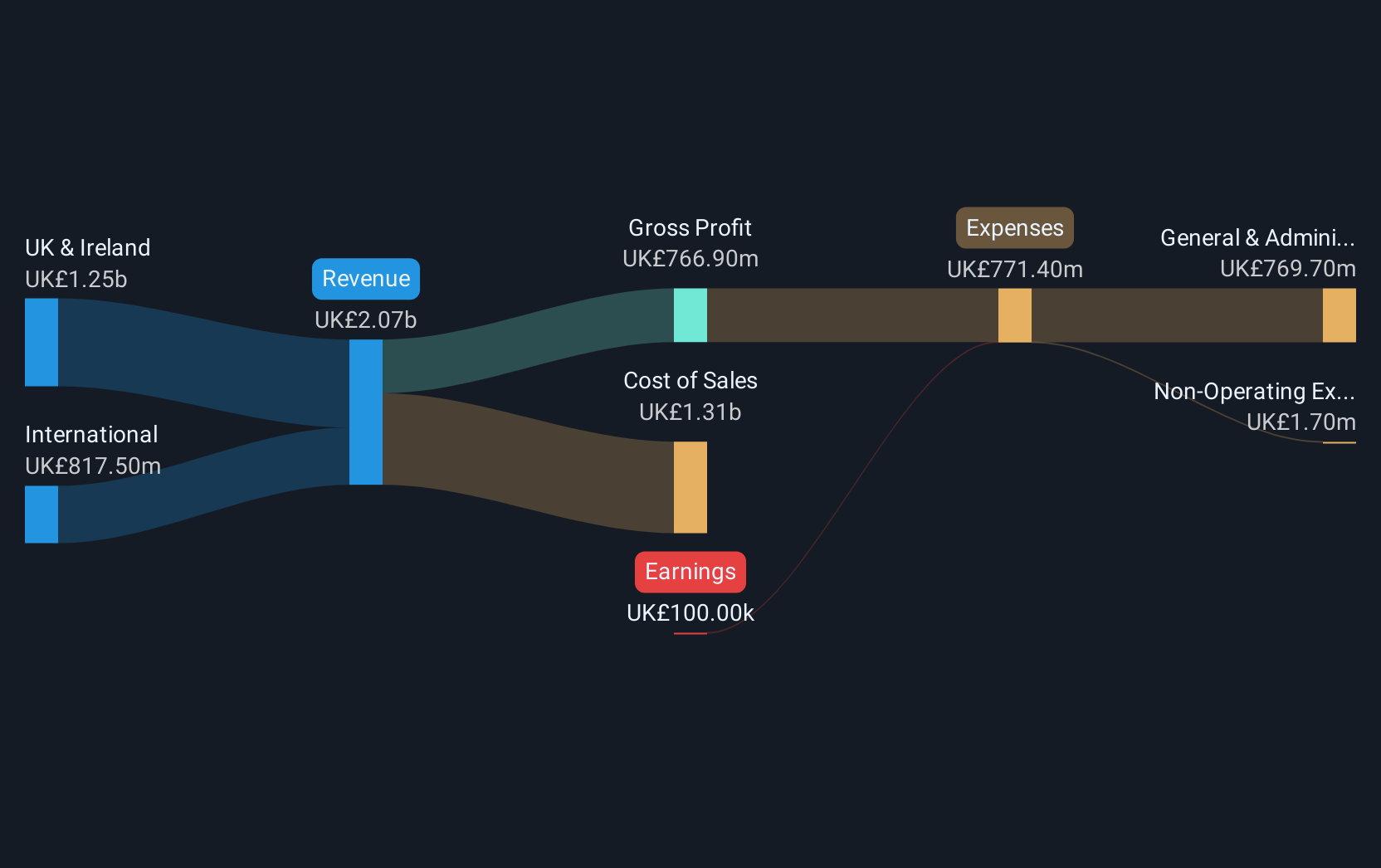

Operations: The company generates £2.07 billion in revenue from its on-demand food delivery platform operations.

Market Cap: £2.55B

Deliveroo plc, with a market cap of £2.55 billion, is currently unprofitable but has been reducing losses by 41.5% annually over the past five years. Despite this, it boasts strong financial health with short-term assets of £790.9 million exceeding both its short-term and long-term liabilities and remains debt-free. The company has a stable cash runway for over three years due to positive free cash flow growth at 22.8% per year. Recent developments include DoorDash's proposed acquisition valued at approximately £2.7 billion, which has received shareholder approval and is expected to complete by late 2025 pending regulatory clearance.

- Dive into the specifics of Deliveroo here with our thorough balance sheet health report.

- Assess Deliveroo's future earnings estimates with our detailed growth reports.

Make It Happen

- Click through to start exploring the rest of the 408 UK Penny Stocks now.

- Searching for a Fresh Perspective? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AO.

AO World

Engages in the online retailing of domestic appliances and ancillary services in the United Kingdom and Germany.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives