- United Kingdom

- /

- Capital Markets

- /

- LSE:IGG

I Ran A Stock Scan For Earnings Growth And IG Group Holdings (LON:IGG) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like IG Group Holdings (LON:IGG). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for IG Group Holdings

How Fast Is IG Group Holdings Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years IG Group Holdings grew its EPS by 12% per year. That growth rate is fairly good, assuming the company can keep it up.

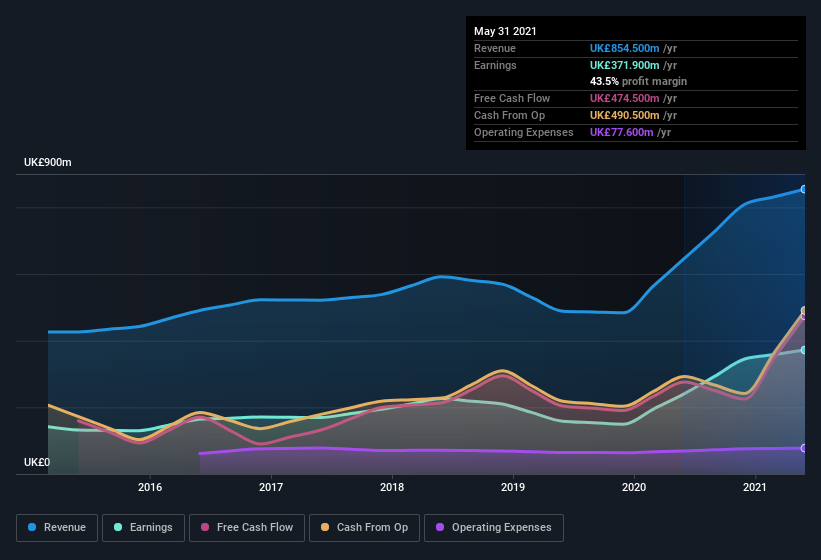

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). IG Group Holdings maintained stable EBIT margins over the last year, all while growing revenue 32% to UK£855m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future IG Group Holdings EPS 100% free.

Are IG Group Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did IG Group Holdings insiders refrain from selling stock during the year, but they also spent UK£107k buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. Zooming in, we can see that the biggest insider purchase was by CEO & Executive Director June Felix for UK£50k worth of shares, at about UK£7.90 per share.

The good news, alongside the insider buying, for IG Group Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enormous stake in the company, worth UK£132m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Should You Add IG Group Holdings To Your Watchlist?

One important encouraging feature of IG Group Holdings is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Even so, be aware that IG Group Holdings is showing 1 warning sign in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of IG Group Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IGG

IG Group Holdings

A fintech company, engages in the online trading business worldwide.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives