- United Kingdom

- /

- Commercial Services

- /

- LSE:MER

Midwich Group And 2 More Top UK Dividend Stocks To Consider

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting the interconnectedness of global economies. In such fluctuating conditions, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate these uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.24% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.24% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.27% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.09% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.30% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.97% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.92% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.55% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.86% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.58% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Midwich Group (AIM:MIDW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Midwich Group plc, along with its subsidiaries, distributes audio visual solutions to trade customers across various regions including the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and North America; it has a market cap of £282.38 million.

Operations: Midwich Group generates revenue of £1.32 billion from its wholesale distribution of computer peripherals.

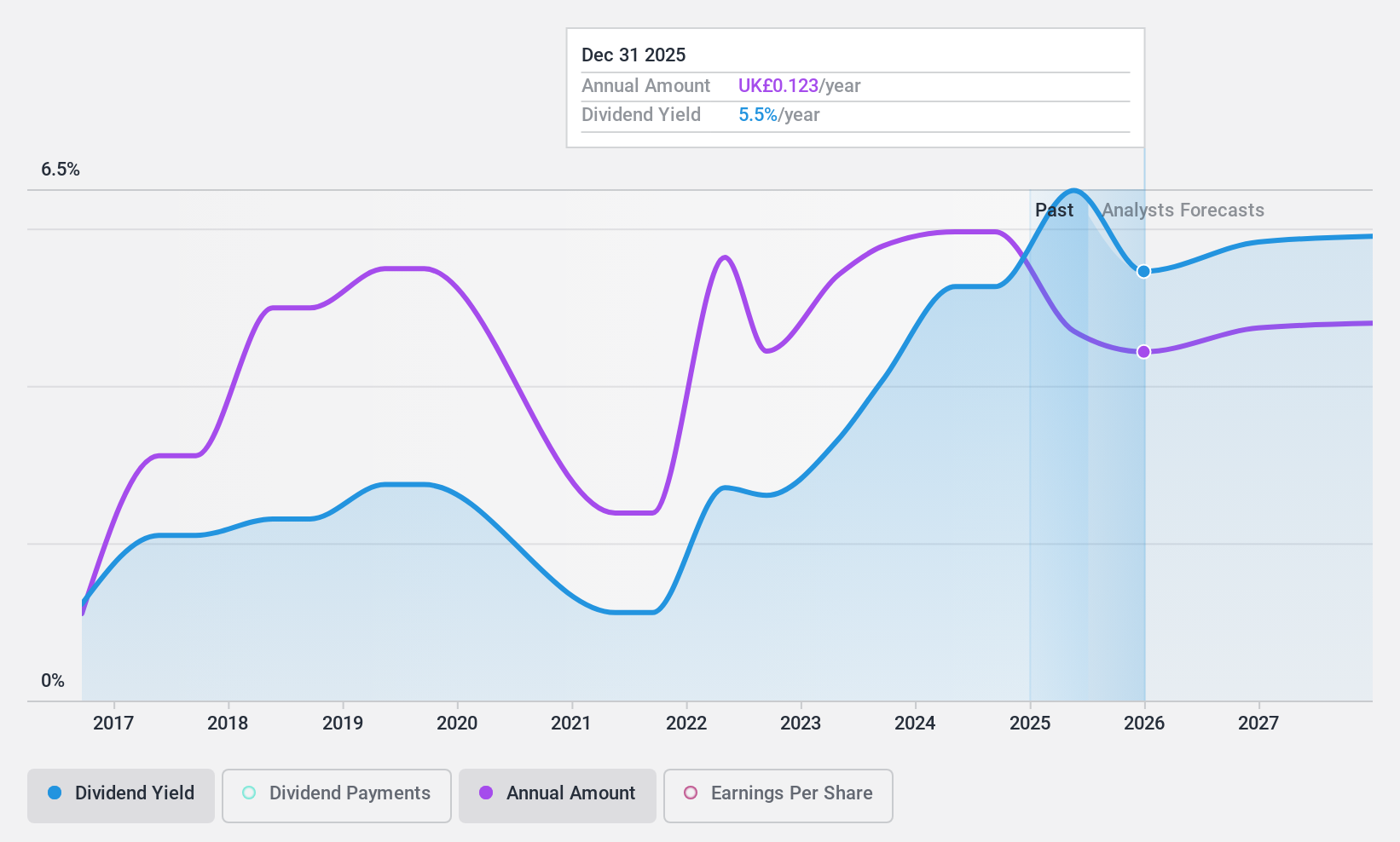

Dividend Yield: 6%

Midwich Group's dividend is covered by earnings and cash flows, with a payout ratio of 74.6% and a cash payout ratio of 36.3%. Despite its top-tier dividend yield of 5.98%, the company's dividends have been volatile over its eight-year history, reflecting an unstable track record. Recent guidance suggests marginal revenue growth amid challenging market conditions, while overhead reductions aim to boost profit margins. H1 2024 earnings showed decreased net income despite increased sales, maintaining interim dividends at prior levels.

- Click here to discover the nuances of Midwich Group with our detailed analytical dividend report.

- Our expertly prepared valuation report Midwich Group implies its share price may be lower than expected.

Foresight Environmental Infrastructure (LSE:FGEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foresight Environmental Infrastructure, listed under ticker LSE:FGEN, operates as a fund managed by John Laing Capital Management Limited with a market cap of £499.99 million.

Operations: Foresight Environmental Infrastructure generates its revenue primarily from investments in environmental infrastructure, amounting to -£6.50 million.

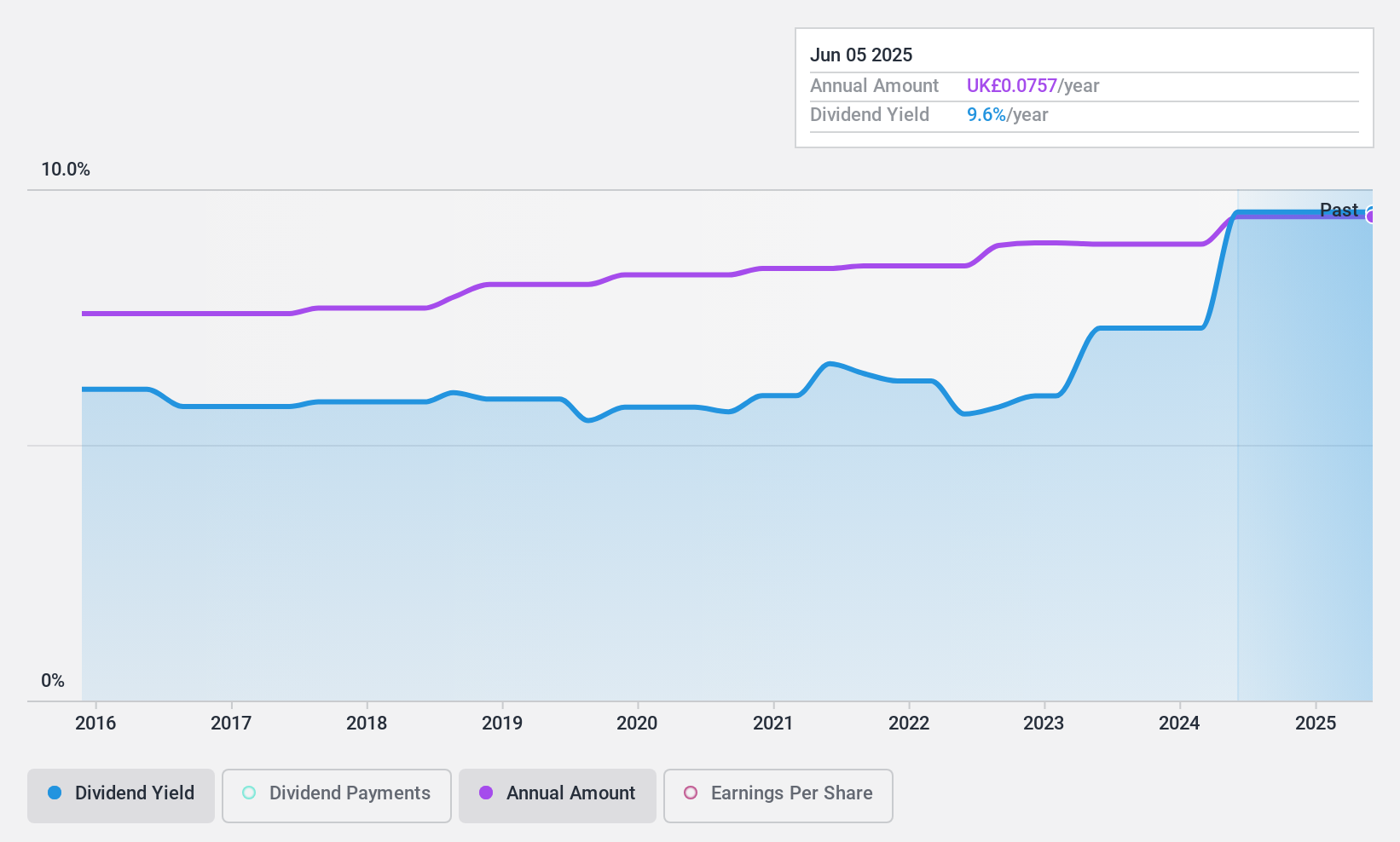

Dividend Yield: 9.9%

Foresight Environmental Infrastructure's dividend yield is among the top 25% in the UK market, yet sustainability concerns arise as dividends are not covered by earnings or cash flows. Despite a stable and growing dividend history over the past decade, recent results showed a net loss of £0.54 million for H1 2024 compared to a previous net income of £1.87 million, raising questions about future payout reliability amid ongoing financial challenges.

- Get an in-depth perspective on Foresight Environmental Infrastructure's performance by reading our dividend report here.

- Our valuation report unveils the possibility Foresight Environmental Infrastructure's shares may be trading at a premium.

Mears Group (LSE:MER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mears Group plc, with a market cap of £339.77 million, provides outsourced services to both the public and private sectors in the United Kingdom through its subsidiaries.

Operations: Mears Group plc generates revenue through its Management segment at £591.63 million and Maintenance segment at £551.73 million in the United Kingdom.

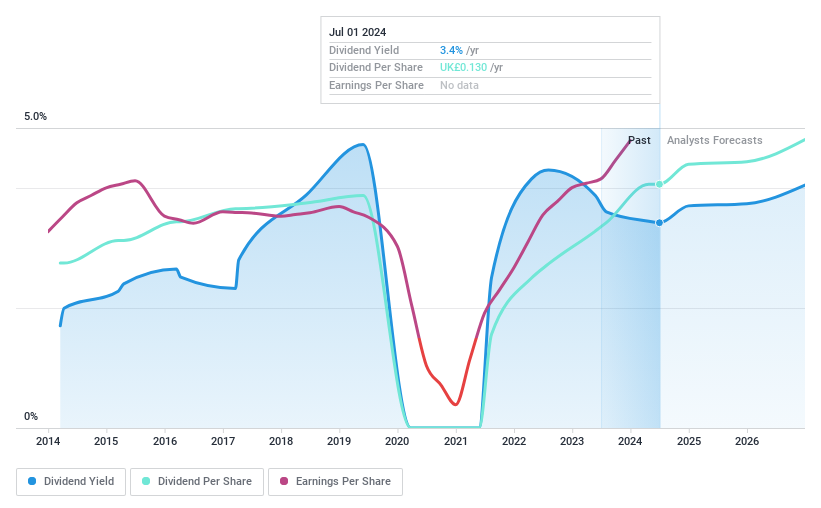

Dividend Yield: 3.9%

Mears Group's dividend payments are well covered by both earnings and cash flows, with a low payout ratio of 33.4% and a cash payout ratio of 10.7%. Despite past volatility in dividends, recent increases highlight growth potential. The stock trades at a favorable Price-To-Earnings ratio of 7.9x, below the UK market average, offering good value to investors. Recent guidance indicates revenues could reach £1.13 billion for 2024, suggesting improved financial performance ahead.

- Unlock comprehensive insights into our analysis of Mears Group stock in this dividend report.

- The analysis detailed in our Mears Group valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Reveal the 62 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MER

Mears Group

Provides various outsourced services to the public and private sectors in the United Kingdom.

Outstanding track record with excellent balance sheet and pays a dividend.