- United Kingdom

- /

- Specialty Stores

- /

- LSE:AO.

December 2024's Promising Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. In such a climate, investors might find it worthwhile to look beyond established blue-chip stocks and consider penny stocks, which often represent smaller or newer companies. Although the term "penny stock" may seem outdated, these investments can still offer intriguing opportunities for growth when backed by solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.35 | £171.93M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4395 | $255.49M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.12 | £472M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.45 | £313.05M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

AO World (LSE:AO.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AO World plc, along with its subsidiaries, operates as an online retailer of domestic appliances and ancillary services in the United Kingdom and Germany, with a market cap of £614.44 million.

Operations: The company generates revenue of £1.07 billion from its online retailing of domestic appliances and ancillary services.

Market Cap: £614.44M

AO World plc, with a market cap of £614.44 million, has shown financial stability and growth potential despite its short-term liabilities (£264.6M) exceeding short-term assets (£251.4M). The company has reduced its debt-to-equity ratio significantly over the past five years to 1.4%, and its debt is well covered by operating cash flow (very large coverage). AO's earnings are forecasted to grow by 20.24% annually, though recent profit growth has been negative (-1.1%). Recent announcements indicate revenue guidance for 2024 between £1.09 billion to £1.13 billion with significant B2C Retail growth anticipated over 10%.

- Click to explore a detailed breakdown of our findings in AO World's financial health report.

- Gain insights into AO World's future direction by reviewing our growth report.

Funding Circle Holdings (LSE:FCH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Funding Circle Holdings plc operates online lending platforms in the United Kingdom, the United States, and internationally, with a market cap of £435.43 million.

Operations: The company generates revenue primarily from its United Kingdom operations, with £10.8 million from FlexiPay and £138.6 million from Term Loans.

Market Cap: £435.43M

Funding Circle Holdings plc, with a market cap of £435.43 million, is navigating the penny stock landscape with mixed financial signals. The company is unprofitable but has shown progress by reducing its debt-to-equity ratio from 38.9% to 31.6% over five years and maintaining more cash than total debt, indicating financial prudence. Recent strategic moves include a £25 million share buyback program aimed at enhancing balance sheet efficiency and the appointment of Ken Stannard as Chair Designate, bringing extensive industry experience to the board. Analysts are optimistic about future growth prospects despite current profitability challenges.

- Navigate through the intricacies of Funding Circle Holdings with our comprehensive balance sheet health report here.

- Evaluate Funding Circle Holdings' prospects by accessing our earnings growth report.

QinetiQ Group (LSE:QQ.)

Simply Wall St Financial Health Rating: ★★★★★☆

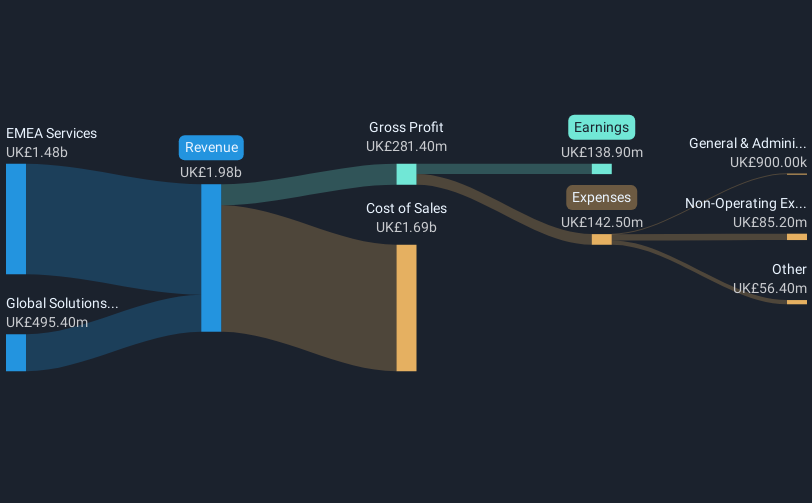

Overview: QinetiQ Group plc is a science and engineering company serving the defense, security, and infrastructure markets in the UK, US, Australia, and internationally with a market cap of £2.32 billion.

Operations: The company's revenue is primarily derived from EMEA Services, contributing £1.48 billion, and Global Solutions, which adds £495.4 million.

Market Cap: £2.32B

QinetiQ Group plc, with a market cap of £2.32 billion, shows solid financial health in the penny stock arena. Recent earnings reveal stable performance with sales reaching £946.8 million for the half year ended September 2024. The company has increased its equity buyback plan by £50 million to a total of £150 million, signaling confidence in its valuation. QinetiQ's short-term assets exceed both short and long-term liabilities, ensuring liquidity stability. Despite a modest return on equity at 15%, the company's debt is well covered by operating cash flow and interest payments are secure with EBIT coverage at 14.4x.

- Click here and access our complete financial health analysis report to understand the dynamics of QinetiQ Group.

- Learn about QinetiQ Group's future growth trajectory here.

Next Steps

- Investigate our full lineup of 472 UK Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AO.

AO World

Engages in the online retailing of domestic appliances and ancillary services in the United Kingdom and Germany.

Excellent balance sheet with reasonable growth potential.