- United Kingdom

- /

- Oil and Gas

- /

- AIM:NWF

UK's Top 3 Dividend Stocks To Consider

Reviewed by Simply Wall St

As the FTSE 100 index experiences fluctuations due to weak trade data from China, investors in the UK market are navigating a landscape marked by global economic uncertainties. In such an environment, dividend stocks can offer a measure of stability and potential income, making them an attractive consideration for those looking to weather market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 6.24% | ★★★★★★ |

| Man Group (LSE:EMG) | 6.32% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.29% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.17% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.77% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.30% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.80% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.93% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.67% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.66% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

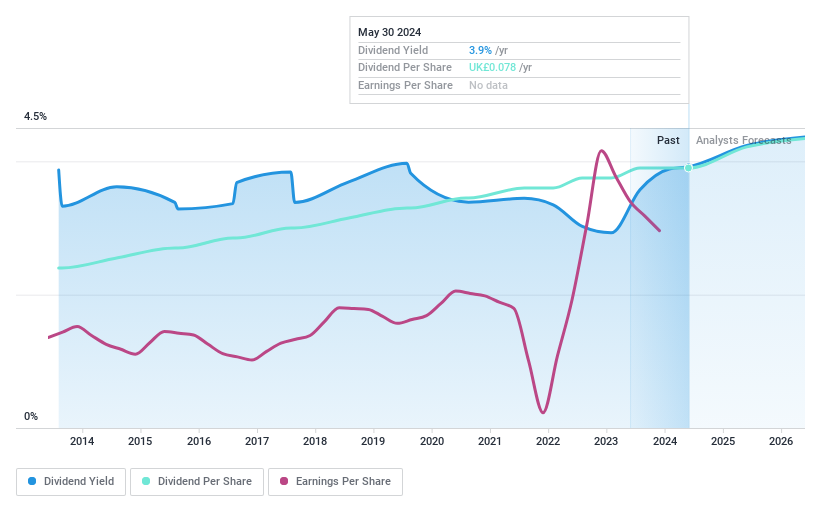

NWF Group (AIM:NWF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NWF Group plc, with a market cap of £85.80 million, primarily engages in the sale and distribution of fuel oils in the United Kingdom through its subsidiaries.

Operations: NWF Group plc's revenue segments comprise £82.30 million from Food, £204.10 million from Feeds, and £653.10 million from Fuels.

Dividend Yield: 4.7%

NWF Group's dividend strategy appears robust, with stable and reliable payments over the past decade. Despite a lower-than-top-tier yield of 4.67% compared to the UK market's top 25%, dividends are well-covered by earnings (50.1% payout ratio) and cash flows (32.3% cash payout ratio). Recent announcements affirm an unchanged interim dividend, aligning with their strategic focus on sustainable profitability and growth through potential M&A activities, despite a slight decline in recent earnings performance.

- Unlock comprehensive insights into our analysis of NWF Group stock in this dividend report.

- The analysis detailed in our NWF Group valuation report hints at an deflated share price compared to its estimated value.

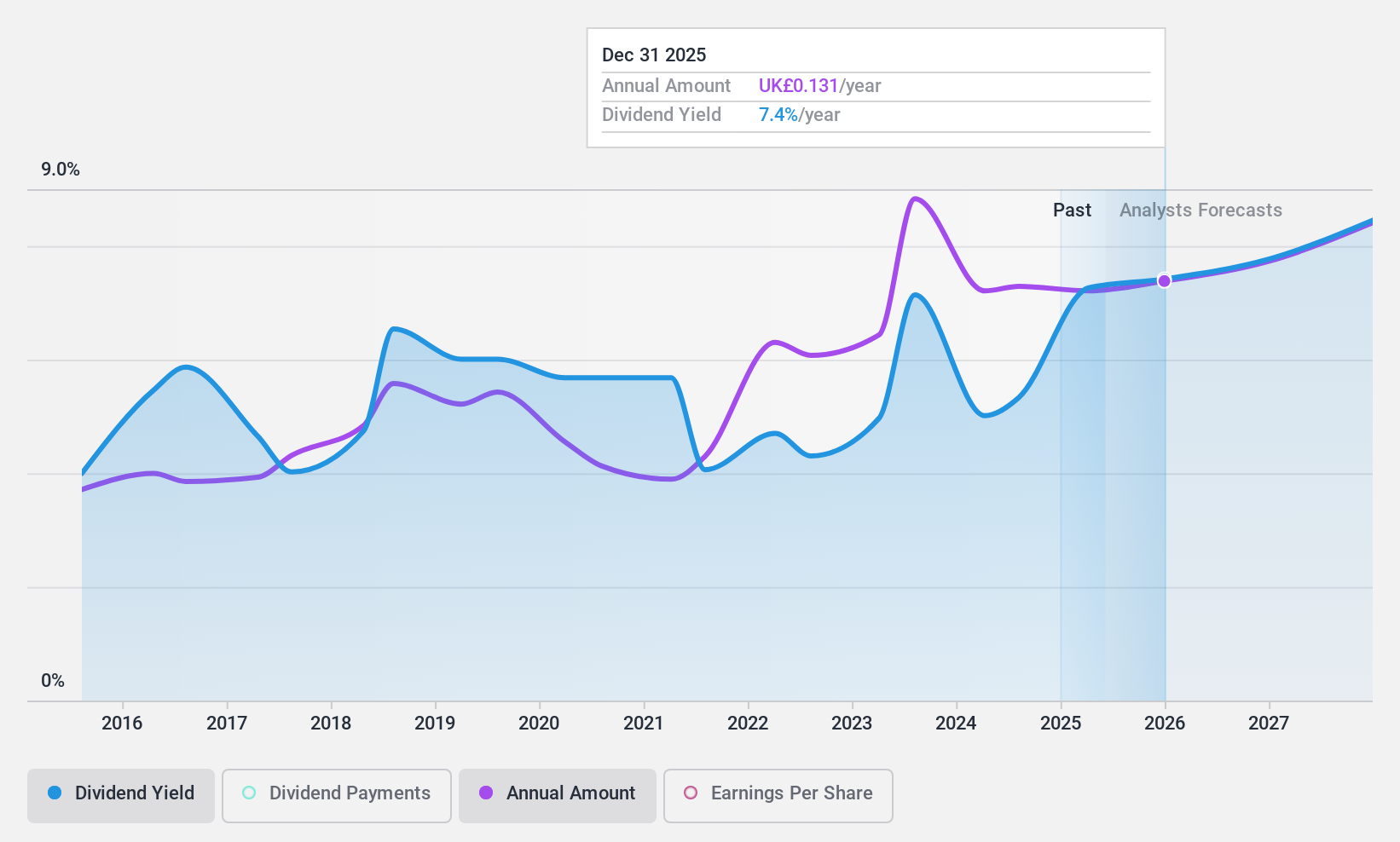

Man Group (LSE:EMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Man Group Limited is a publicly owned investment manager with a market cap of £2.42 billion.

Operations: Man Group Limited generates revenue primarily from its Investment Management Business, which amounts to $1.43 billion.

Dividend Yield: 6.3%

Man Group's dividend payments are well-supported by earnings (67% payout ratio) and cash flows (32.7% cash payout ratio), with a recent increase to 17.2 cents for 2024. However, the dividend history has been volatile over the past decade, impacting reliability perceptions despite being in the top 25% of UK payers at 6.32%. The company's $100 million share buyback program and disciplined M&A strategy aim to enhance shareholder value alongside progressive dividend growth aligned with earnings expansion.

- Take a closer look at Man Group's potential here in our dividend report.

- Our expertly prepared valuation report Man Group implies its share price may be lower than expected.

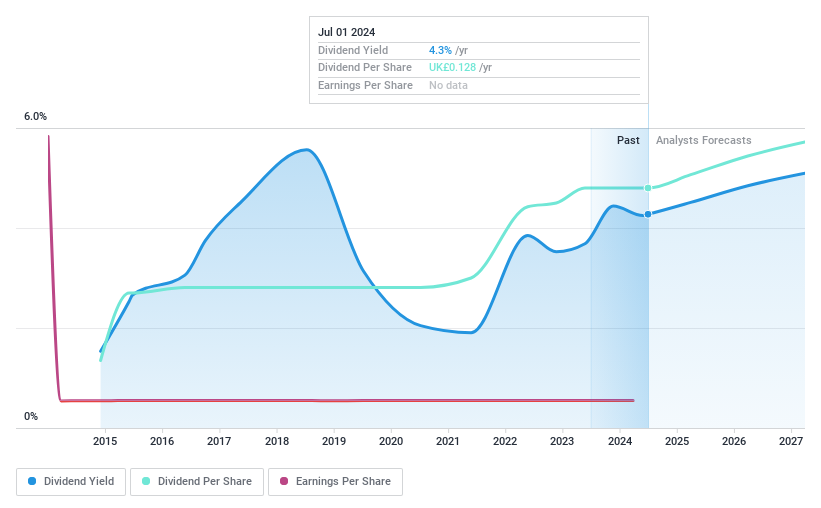

Pets at Home Group (LSE:PETS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pets at Home Group Plc operates as a specialist omnichannel retailer offering pet food, related products, and accessories across the United Kingdom with a market cap of £1.07 billion.

Operations: Pets at Home Group's revenue is derived from two main segments: Retail, which generates £1.33 billion, and Vet Group, contributing £161.10 million.

Dividend Yield: 5.5%

Pets at Home Group maintains a stable dividend history with payments reliably growing over the past decade. Its 5.45% yield, though below the top UK payers, is supported by a sustainable payout ratio of 67.3% and strong cash flow coverage at 35.8%. Trading below estimated fair value and analyst targets suggests potential for capital appreciation alongside dividend income. Recent board changes may influence governance but do not directly impact dividend prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Pets at Home Group.

- Our comprehensive valuation report raises the possibility that Pets at Home Group is priced lower than what may be justified by its financials.

Key Takeaways

- Discover the full array of 61 Top UK Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NWF Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NWF

NWF Group

Primarily engages in the sale and distribution of fuel oils in the United Kingdom.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives