- United Kingdom

- /

- Capital Markets

- /

- LSE:CMCX

CMC Markets plc (LON:CMCX) Analysts Are Reducing Their Forecasts For This Year

The analysts covering CMC Markets plc (LON:CMCX) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

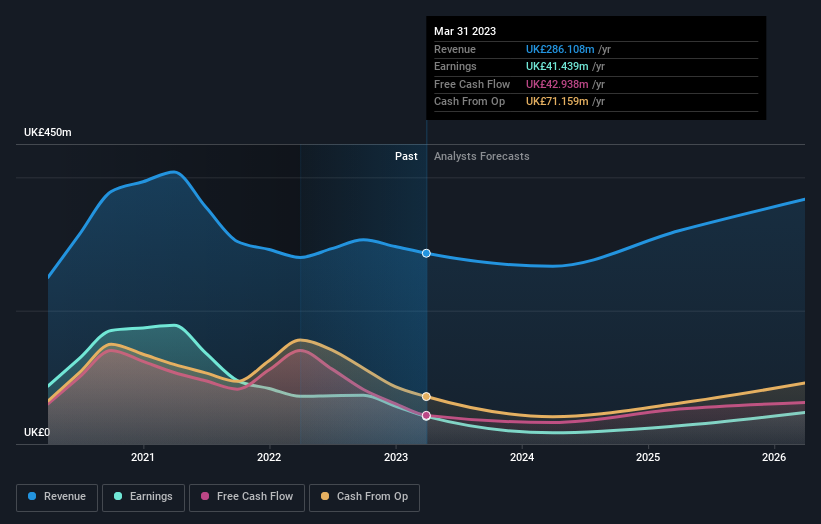

Following the latest downgrade, the four analysts covering CMC Markets provided consensus estimates of UK£267m revenue in 2024, which would reflect a discernible 6.8% decline on its sales over the past 12 months. Statutory earnings per share are anticipated to tumble 60% to UK£0.06 in the same period. Before this latest update, the analysts had been forecasting revenues of UK£338m and earnings per share (EPS) of UK£0.15 in 2024. Indeed, we can see that the analysts are a lot more bearish about CMC Markets' prospects, administering a pretty serious reduction to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for CMC Markets

The consensus price target fell 21% to UK£1.52, with the weaker earnings outlook clearly leading analyst valuation estimates.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 6.8% by the end of 2024. This indicates a significant reduction from annual growth of 14% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 0.2% annually for the foreseeable future. It's pretty clear that CMC Markets' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for CMC Markets. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with CMC Markets' financials, such as its declining profit margins. For more information, you can click here to discover this and the 2 other concerns we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CMCX

CMC Markets

Provides a platform for investing, trading, and brokerage in the United Kingdom, Australia, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.