- United Kingdom

- /

- Diversified Financial

- /

- LSE:CABP

3 Promising UK Penny Stocks With Under £2B Market Cap

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines following weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market fluctuations, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities for investors seeking growth at lower price points. By focusing on those with strong financials and potential for growth, investors can uncover hidden gems in this segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £149.22M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.08 | £783.67M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.155 | £98.68M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.39 | £177.02M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.20 | £417.71M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.445 | $258.69M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.39 | £305.38M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Serabi Gold (AIM:SRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Serabi Gold plc focuses on the evaluation, exploration, and development of gold and other metals mining projects in Brazil, with a market cap of £93.15 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: £93.15M

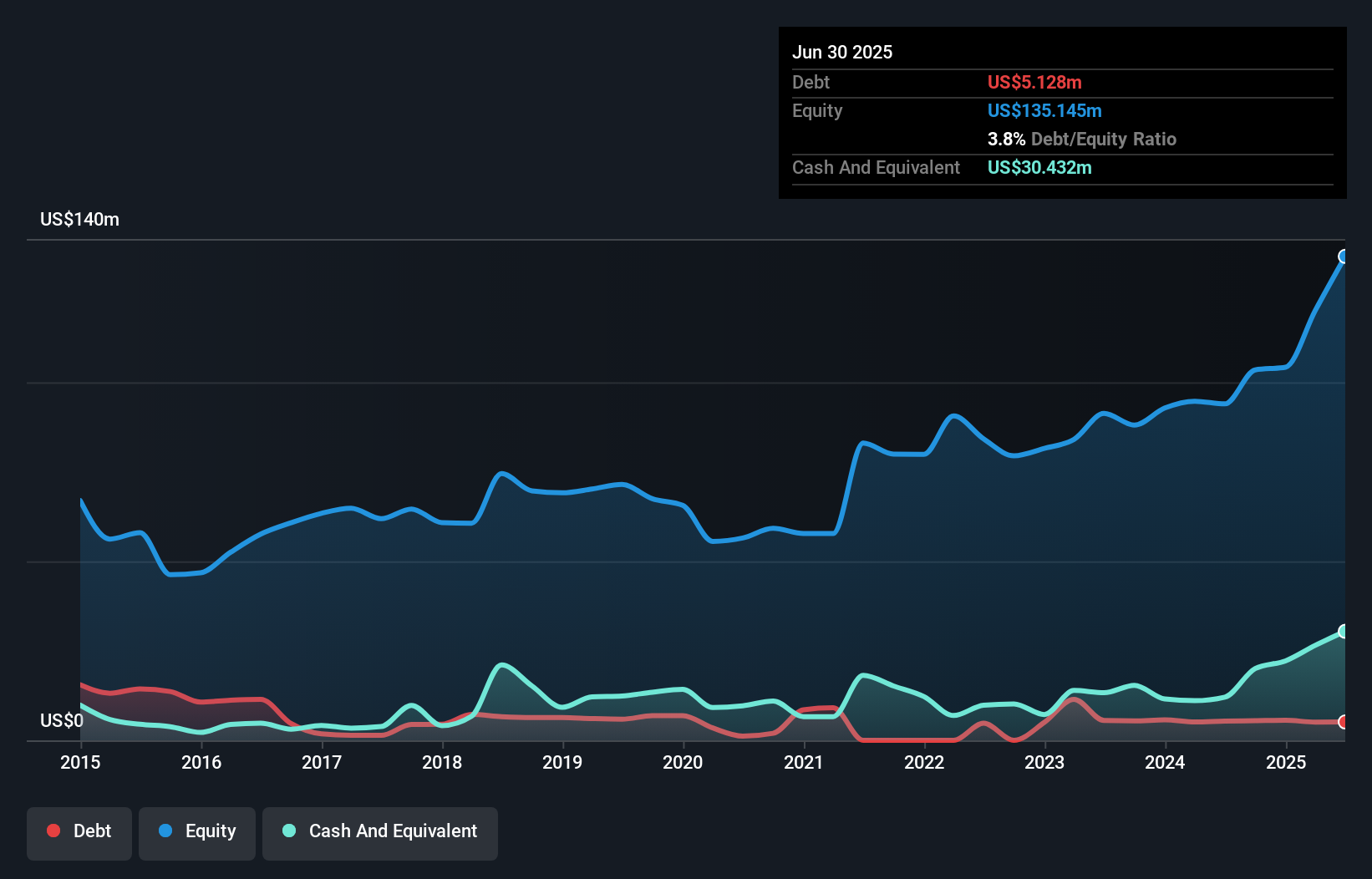

Serabi Gold has demonstrated significant financial improvement, with earnings growing by a very large 339% over the past year, surpassing its five-year average growth. The company reported third-quarter sales of US$27.63 million, up from US$17.37 million the previous year, and achieved a net income of US$8.62 million compared to a net loss previously. Its short-term assets exceed both short- and long-term liabilities, indicating strong liquidity management. Serabi's recent technical report for its Coringa Gold Project suggests potential future growth opportunities in Brazil’s Tapajós region while maintaining stable production levels and reducing debt over time.

- Dive into the specifics of Serabi Gold here with our thorough balance sheet health report.

- Assess Serabi Gold's future earnings estimates with our detailed growth reports.

CAB Payments Holdings (LSE:CABP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CAB Payments Holdings Limited, with a market cap of £176.38 million, operates through its subsidiaries to offer foreign exchange and cross-border payment services to banks, fintech companies, development organizations, and governments both in the United Kingdom and internationally.

Operations: No revenue segments have been reported for CAB Payments Holdings.

Market Cap: £176.38M

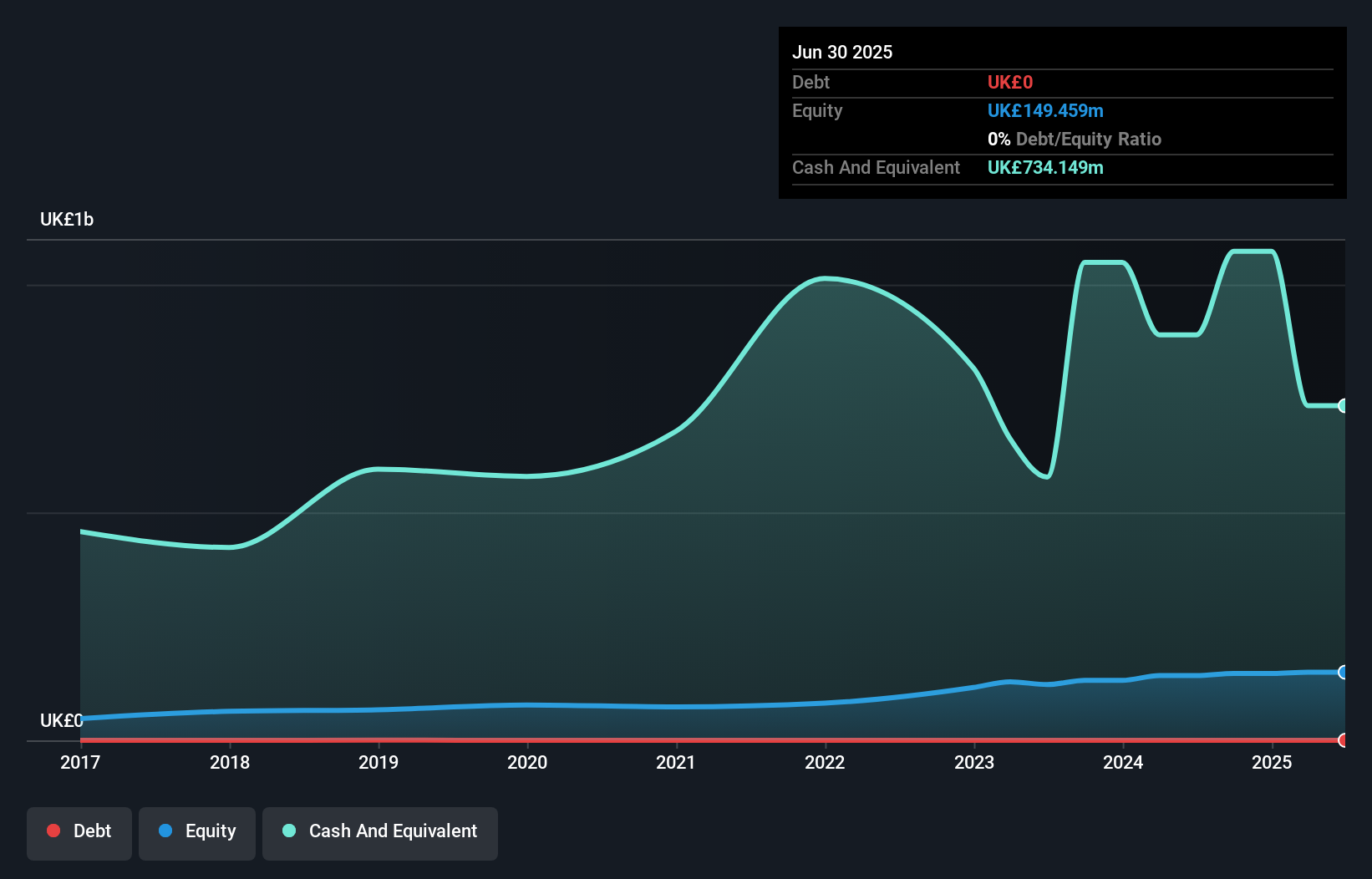

CAB Payments Holdings, with a market cap of £176.38 million, has experienced significant volatility in its share price and faces challenges such as negative earnings growth and insufficient interest coverage by EBIT. Despite trading at a good value compared to peers, short-term liabilities exceed short-term assets (£1.4 billion vs. £858 million). The company has reduced its debt-to-equity ratio over five years but reported a large one-off loss impacting recent financial results. Recent M&A activity saw StoneX Group propose acquisitions valuing CAB Payments up to £370 million, though these proposals were ultimately withdrawn or not pursued further by StoneX.

- Take a closer look at CAB Payments Holdings' potential here in our financial health report.

- Understand CAB Payments Holdings' earnings outlook by examining our growth report.

Currys (LSE:CURY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Currys plc is an omnichannel retailer of technology products and services across the UK, Ireland, and several Nordic countries with a market cap of £1.02 billion.

Operations: Currys generates its revenue through the sale of technology products and services in the UK, Ireland, and several Nordic countries.

Market Cap: £1.02B

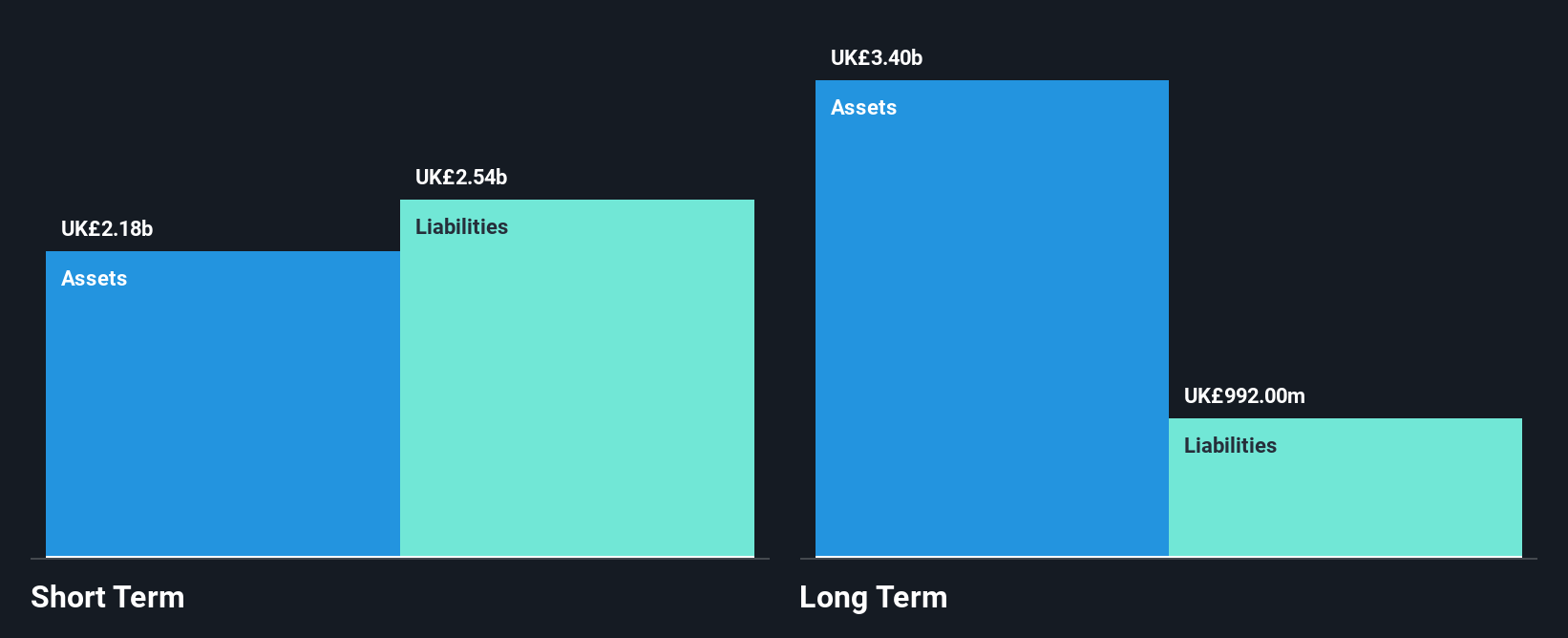

Currys plc, with a market cap of £1.02 billion, has shown notable financial resilience despite challenges. The company has achieved profitability over the past five years and forecasts suggest earnings growth of 20.95% annually. Its short-term assets (£2.2 billion) exceed long-term liabilities (£992 million), though they fall short of covering short-term liabilities (£2.5 billion). Recent results show reduced net loss from £39 million to £8 million year-over-year, indicating operational improvements despite a significant one-off loss impacting earnings. Currys' strategic partnerships and product expansions, like the MANSCAPED launch, enhance its retail offerings and market presence in the UK.

- Click here and access our complete financial health analysis report to understand the dynamics of Currys.

- Learn about Currys' future growth trajectory here.

Where To Now?

- Dive into all 465 of the UK Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CABP

CAB Payments Holdings

Through its subsidiaries, provides foreign exchange (FX) and cross-border payments services to banks, fintech companies, development organizations, and governments in the United Kingdom and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives