- United Kingdom

- /

- Capital Markets

- /

- LSE:BOOK

Discover European Undervalued Small Caps With Insider Activity In July 2025

Reviewed by Simply Wall St

As the European markets navigate a period of mixed performance, with the pan-European STOXX Europe 600 Index remaining roughly flat amid ongoing U.S. and European trade discussions, attention has turned to small-cap stocks that may offer unique opportunities in this environment. With industrial production in the euro area showing signs of recovery and investor sentiment in Germany reaching its highest level in three years, identifying small-cap companies with strong fundamentals and insider activity could be particularly rewarding for investors seeking potential value plays.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Kitwave Group | 12.9x | 0.3x | 45.71% | ★★★★★☆ |

| Stelrad Group | 13.3x | 0.8x | 37.09% | ★★★★★☆ |

| Foxtons Group | 13.5x | 1.1x | 37.34% | ★★★★★☆ |

| Hoist Finance | 8.9x | 1.8x | 17.85% | ★★★★☆☆ |

| CVS Group | 44.3x | 1.3x | 40.07% | ★★★★☆☆ |

| Seeing Machines | NA | 2.8x | 45.78% | ★★★★☆☆ |

| A.G. BARR | 19.9x | 1.9x | 45.02% | ★★★☆☆☆ |

| Yubico | 33.1x | 4.7x | -12.93% | ★★★☆☆☆ |

| Lords Group Trading | NA | 0.2x | -3.58% | ★★★☆☆☆ |

| WithSecure Oyj | NA | 1.4x | -0.31% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

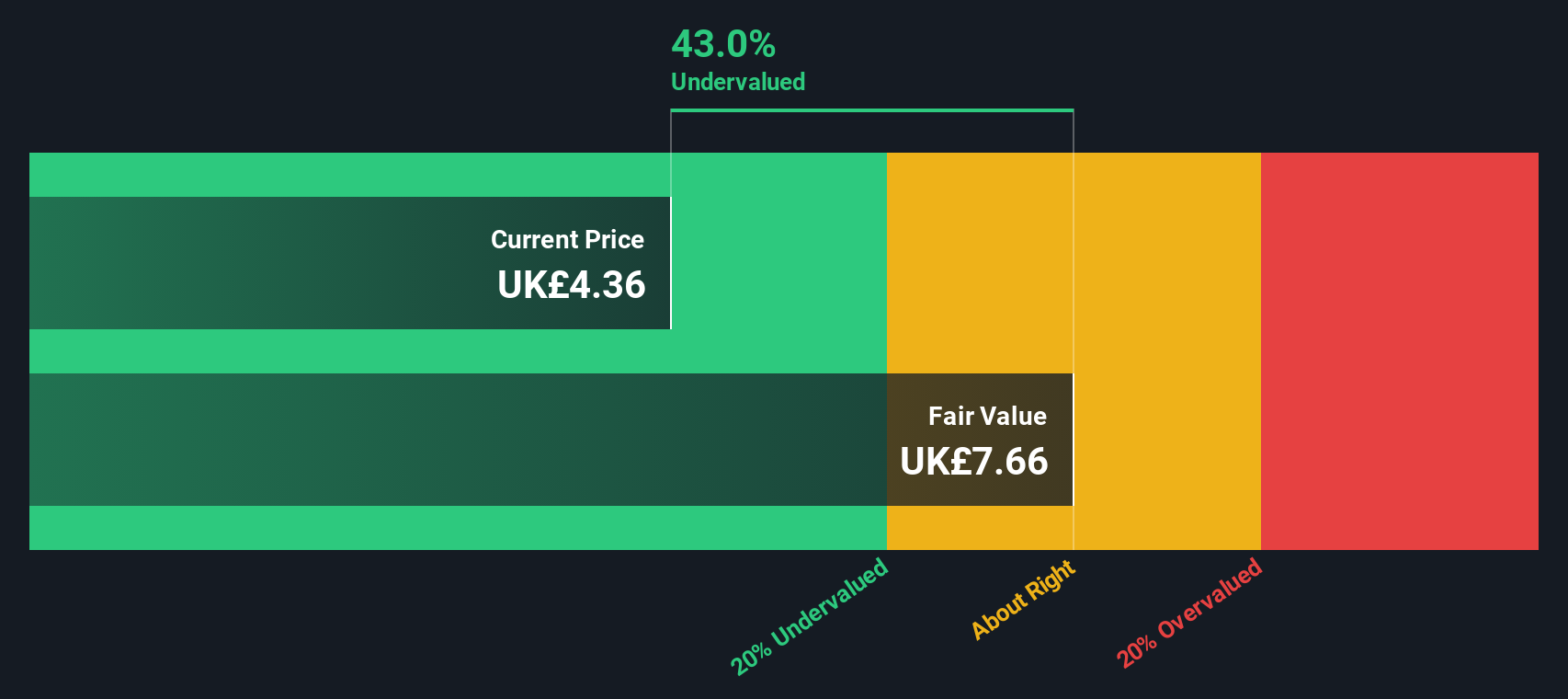

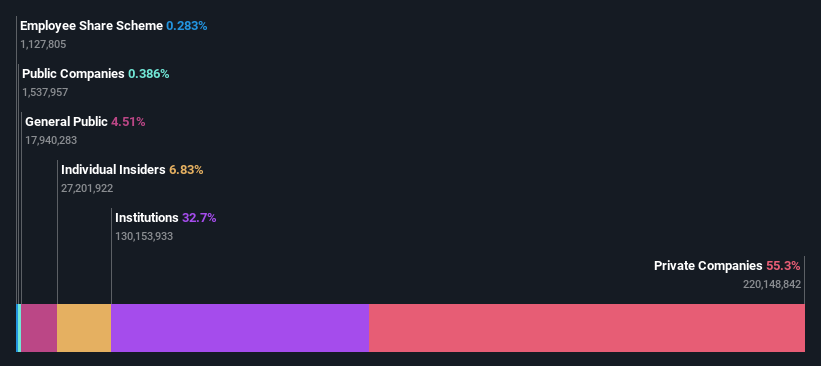

Literacy Capital (LSE:BOOK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Literacy Capital is a closed-end investment company focused on investing in private UK businesses, with a market cap of £0.38 billion.

Operations: The company primarily generates revenue from financial services, specifically through closed-end funds. Over the years, its net income margin has shown variability, with a peak of 93.51% in March 2022 and a decline to -106.88% by December 2024. Operating expenses have remained relatively stable, with general and administrative expenses being a significant component.

PE: -62.0x

Literacy Capital, a smaller player in the European market, has caught attention due to its perceived value potential. Despite a 10.8% annual decline in earnings over the past five years, insider confidence is evident with Christopher Sellers purchasing 50,000 shares for £191K between January and March 2025. The company relies entirely on external borrowing for funding, which carries higher risk compared to customer deposits. Investors may find interest in its growth prospects amid these dynamics.

- Delve into the full analysis valuation report here for a deeper understanding of Literacy Capital.

Examine Literacy Capital's past performance report to understand how it has performed in the past.

CLS Holdings (LSE:CLI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: CLS Holdings is a property investment company focusing on commercial real estate in the United Kingdom, Germany, and France, with operations generating revenue primarily from its investment properties and a market capitalization of £0.94 billion.

Operations: The company generates revenue primarily from investment properties in the United Kingdom, Germany, and France. Over time, its gross profit margin has shown a decreasing trend from 84.13% to 75.05%. Operating expenses are consistently significant, with general and administrative expenses being a notable component of these costs.

PE: -2.8x

CLS Holdings, a small-cap player in Europe, is navigating challenges with its reliance on higher-risk external borrowing. Despite this, earnings are projected to surge by 96% annually. Insider confidence is evident as key insiders have been purchasing shares over recent months. However, the financial strain is visible with interest payments not fully covered by earnings and a reduced dividend announced in May 2025. The CFO's upcoming departure adds uncertainty but also potential for fresh strategic direction.

- Dive into the specifics of CLS Holdings here with our thorough valuation report.

Gain insights into CLS Holdings' historical performance by reviewing our past performance report.

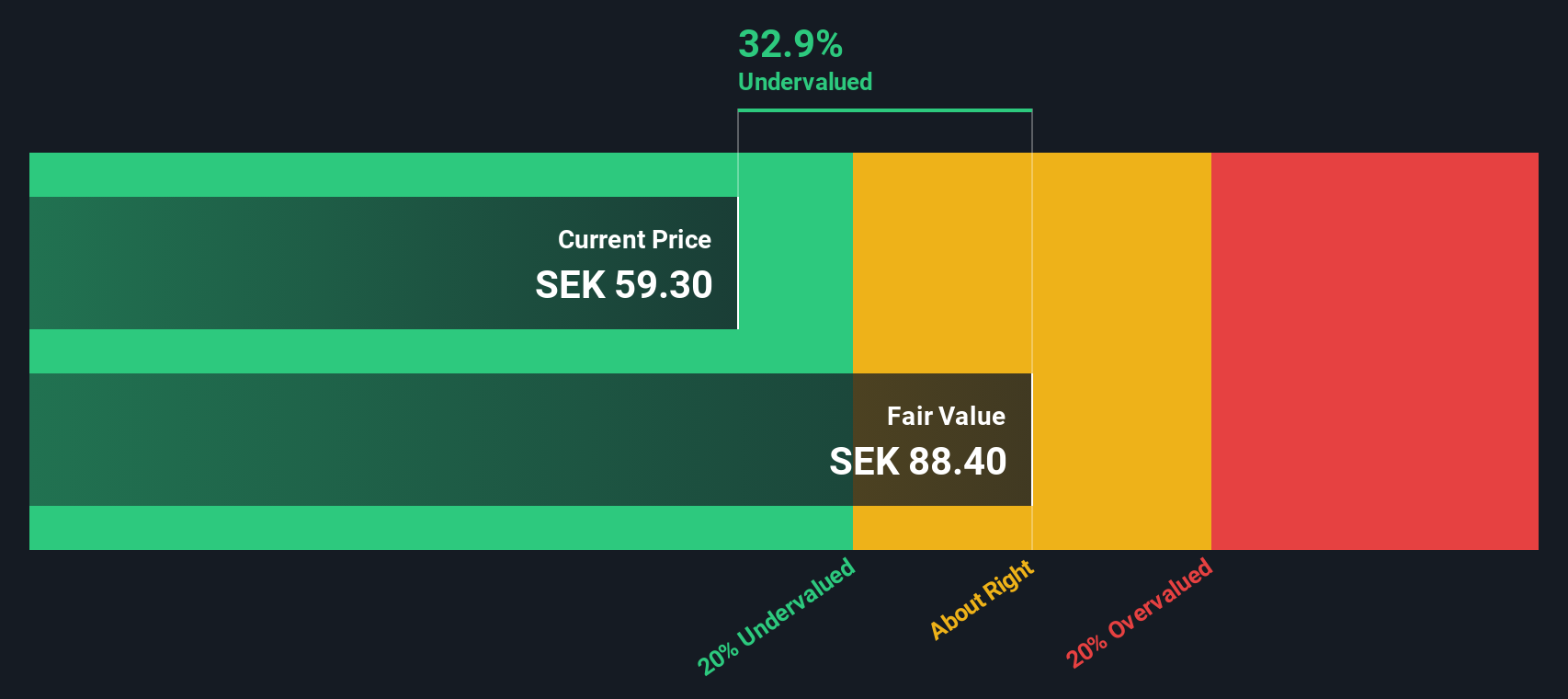

Nolato (OM:NOLA B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nolato is a Swedish company that develops and manufactures polymer product systems for customers in medical technology, pharmaceuticals, consumer electronics, telecom, automotive, and other industrial sectors with a market capitalization of approximately SEK 14.06 billion.

Operations: Nolato's revenue streams are primarily driven by its core operations, with recent figures showing a revenue of SEK 9.63 billion and net income of SEK 738 million as of June 2025. The company's cost structure is heavily influenced by its cost of goods sold (COGS), which was SEK 7.94 billion in the same period. Notably, the gross profit margin has shown an upward trend, reaching 17.60% in June 2025, indicating an improvement in profitability from earlier periods such as December 2023 when it was at 13.99%. Operating expenses include significant allocations towards general and administrative expenses and sales & marketing efforts, reflecting strategic investments to support business growth and market presence.

PE: 21.5x

Nolato, a smaller European company, shows potential in its recent financial performance. Despite a slight dip in sales for the second quarter of 2025 to SEK 2,395 million from SEK 2,439 million last year, net income rose significantly to SEK 212 million from SEK 169 million. This improvement in earnings per share reflects growing profitability amid challenging funding conditions reliant on external borrowing. Insider confidence is evident with recent purchases within the past six months, suggesting optimism about future growth prospects.

- Take a closer look at Nolato's potential here in our valuation report.

Gain insights into Nolato's past trends and performance with our Past report.

Taking Advantage

- Investigate our full lineup of 55 Undervalued European Small Caps With Insider Buying right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BOOK

Literacy Capital

A venture capital and private equity firm specializing in early stage investments, direct private equity investments, buyout, growth capital, MBIs, M&A, mature, family owned, fund investments and co investments with private equity managers.

Good value with worrying balance sheet.

Market Insights

Community Narratives