- United Kingdom

- /

- Capital Markets

- /

- LSE:ASHM

UK Penny Stock Highlights: Diaceutics And 2 Compelling Options

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. For investors exploring opportunities beyond established names, penny stocks—typically smaller or newer companies—can offer intriguing prospects despite their somewhat outdated moniker. These stocks may present surprising value and potential stability when backed by solid financial health; in this article, we examine three such penny stocks that could offer compelling investment opportunities.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.215 | £301.38M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.535 | £508.81M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.30 | £347.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.25 | £53.93M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.04 | £313.01M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.245 | £198.48M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.26 | £69.82M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.17 | £819.53M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Diaceutics (AIM:DXRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Diaceutics PLC is a diagnostic commercialization company that offers data, data analytics, and implementation services to pharmaceutical and biotech companies, with a market cap of £108.64 million.

Operations: The company generates revenue from its Medical Labs & Research segment, totaling £32.16 million.

Market Cap: £108.64M

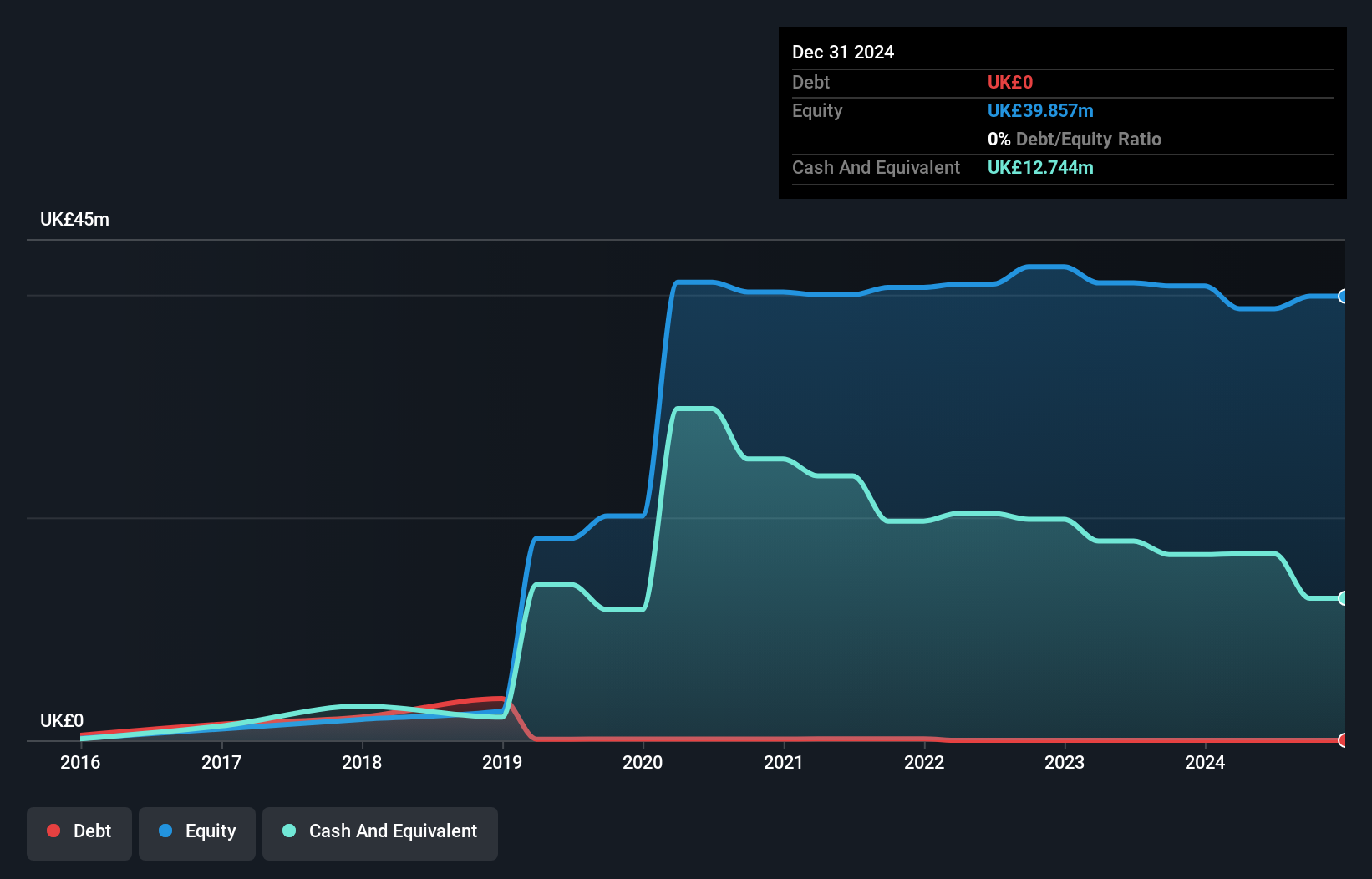

Diaceutics PLC, with a market cap of £108.64 million and revenue of £32.16 million, is navigating the challenges typical for smaller stocks in its sector. Despite being unprofitable, the company maintains a strong cash position with short-term assets exceeding liabilities and no debt burden. However, the board's limited experience and recent insider selling may raise concerns among investors. Analysts anticipate significant stock price appreciation, suggesting potential upside if growth forecasts materialize. The company's stable weekly volatility and absence of shareholder dilution over the past year provide some reassurance amidst its current financial struggles.

- Dive into the specifics of Diaceutics here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Diaceutics' future.

Ashmore Group (LSE:ASHM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ashmore Group plc is a publicly owned investment manager with a market cap of £1.13 billion.

Operations: Ashmore Group does not report specific revenue segments.

Market Cap: £1.13B

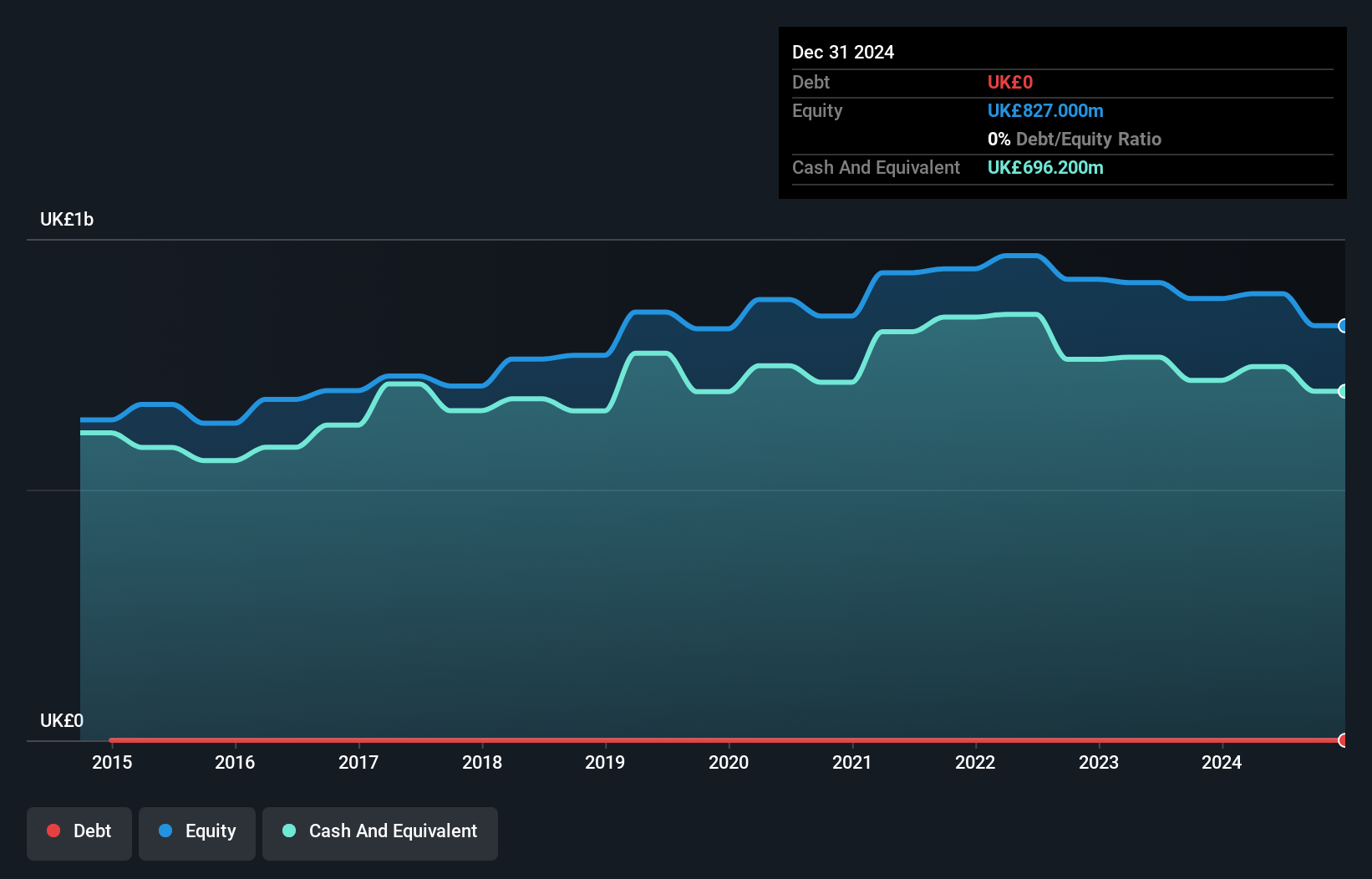

Ashmore Group plc, with a market cap of £1.13 billion, presents a mixed picture for investors interested in penny stocks. Despite being debt-free and having short-term assets significantly exceeding liabilities, the company's earnings have declined by 25.1% annually over the past five years and are forecast to decline further. Recent board changes, including Anna Sweeney's appointment as Chair of the Audit and Risk Committee, may enhance governance but do not offset concerns about negative earnings growth and significant insider selling in recent months. The dividend yield is high at 9.84%, though not well covered by earnings or cash flows.

- Get an in-depth perspective on Ashmore Group's performance by reading our balance sheet health report here.

- Examine Ashmore Group's earnings growth report to understand how analysts expect it to perform.

Watches of Switzerland Group (LSE:WOSG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry across the United Kingdom, Europe, and the United States, with a market cap of £863.05 million.

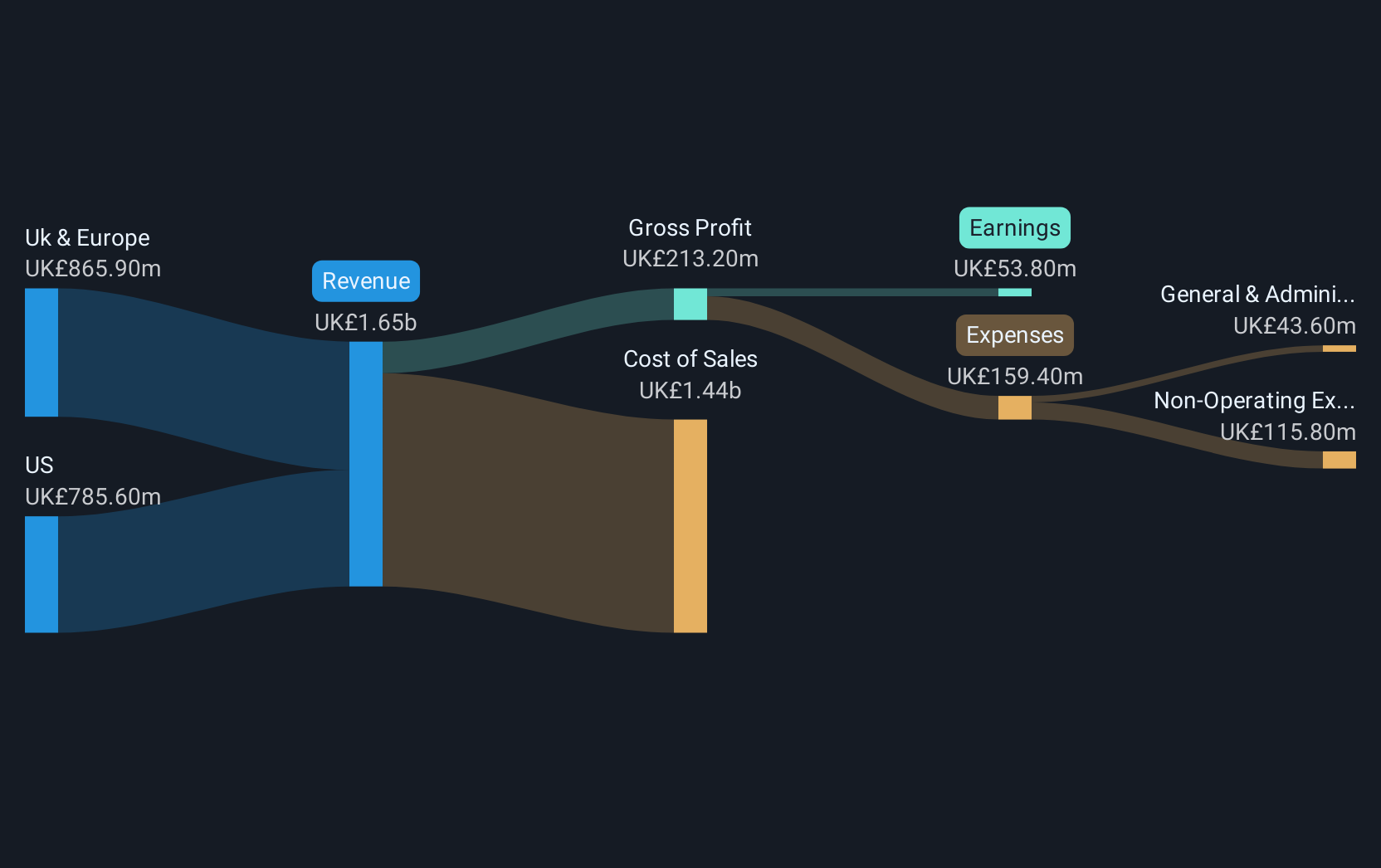

Operations: The company's revenue is derived from two main geographical segments: £785.60 million from the US and £865.90 million from the UK & Europe.

Market Cap: £863.05M

Watches of Switzerland Group, with a market cap of £863.05 million, offers potential for penny stock investors despite some challenges. The company reported full-year sales of £1.65 billion but experienced a decline in net income to £53.8 million due to a significant one-off loss of £57.9 million. While earnings growth was negative last year, the company has demonstrated consistent profit growth over five years and forecasts suggest earnings could grow by 20.94% annually moving forward. Its debt levels are well managed, with operating cash flow covering 95.3% of its debt, though short-term assets fall slightly short in covering long-term liabilities.

- Navigate through the intricacies of Watches of Switzerland Group with our comprehensive balance sheet health report here.

- Evaluate Watches of Switzerland Group's prospects by accessing our earnings growth report.

Seize The Opportunity

- Jump into our full catalog of 296 UK Penny Stocks here.

- Seeking Other Investments? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ASHM

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives