- United Kingdom

- /

- Software

- /

- AIM:WNWD

December 2024's Most Promising Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting companies tied to global commodity markets. Despite these broader market fluctuations, investors often turn their attention to penny stocks for potential opportunities. While the term "penny stocks" might seem outdated, these smaller or newer companies can offer affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.88 | £385.89M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.00 | £458.26M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.155 | £98.68M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.43 | £310.49M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.435 | $252.88M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Midwich Group (AIM:MIDW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Midwich Group plc, along with its subsidiaries, distributes audio visual solutions to trade customers across various regions including the United Kingdom, Ireland, Europe, the Middle East, Africa, Asia Pacific, and North America; it has a market cap of £302.84 million.

Operations: The company generates revenue of £1.32 billion from its wholesale distribution of computer peripherals.

Market Cap: £302.84M

Midwich Group plc, with a market cap of £302.84 million and revenue of £1.32 billion, demonstrates financial resilience among UK penny stocks. Its short-term assets comfortably cover both short and long-term liabilities, while its debt to equity ratio has improved significantly over five years. Despite high net debt levels, operating cash flow adequately covers debt obligations. The company has experienced management and board teams with stable weekly volatility in stock performance. Recent guidance indicates marginal revenue growth amid challenging market conditions, supported by cost reductions aimed at enhancing profit margins in the latter half of the year.

- Navigate through the intricacies of Midwich Group with our comprehensive balance sheet health report here.

- Gain insights into Midwich Group's outlook and expected performance with our report on the company's earnings estimates.

Windward (AIM:WNWD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Windward Ltd. is a predictive intelligence company operating in Israel and internationally, with a market cap of £184.23 million.

Operations: The company generates revenue of $33.09 million from its Software & Programming segment.

Market Cap: £184.23M

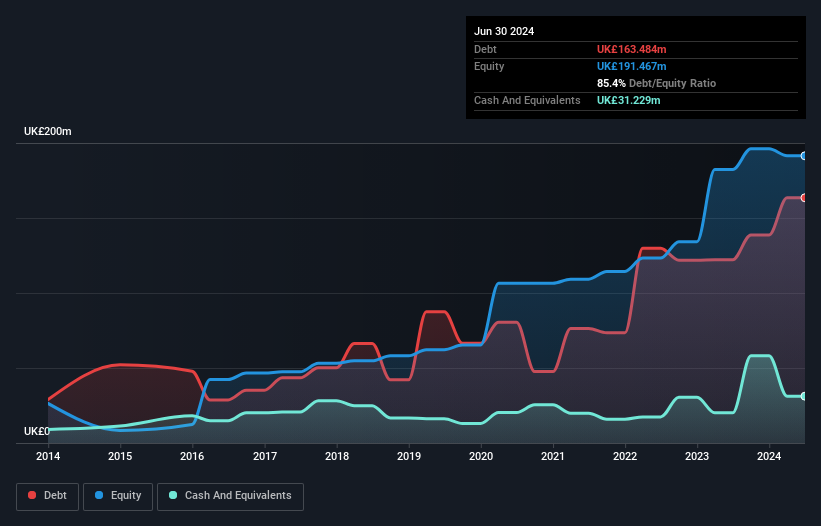

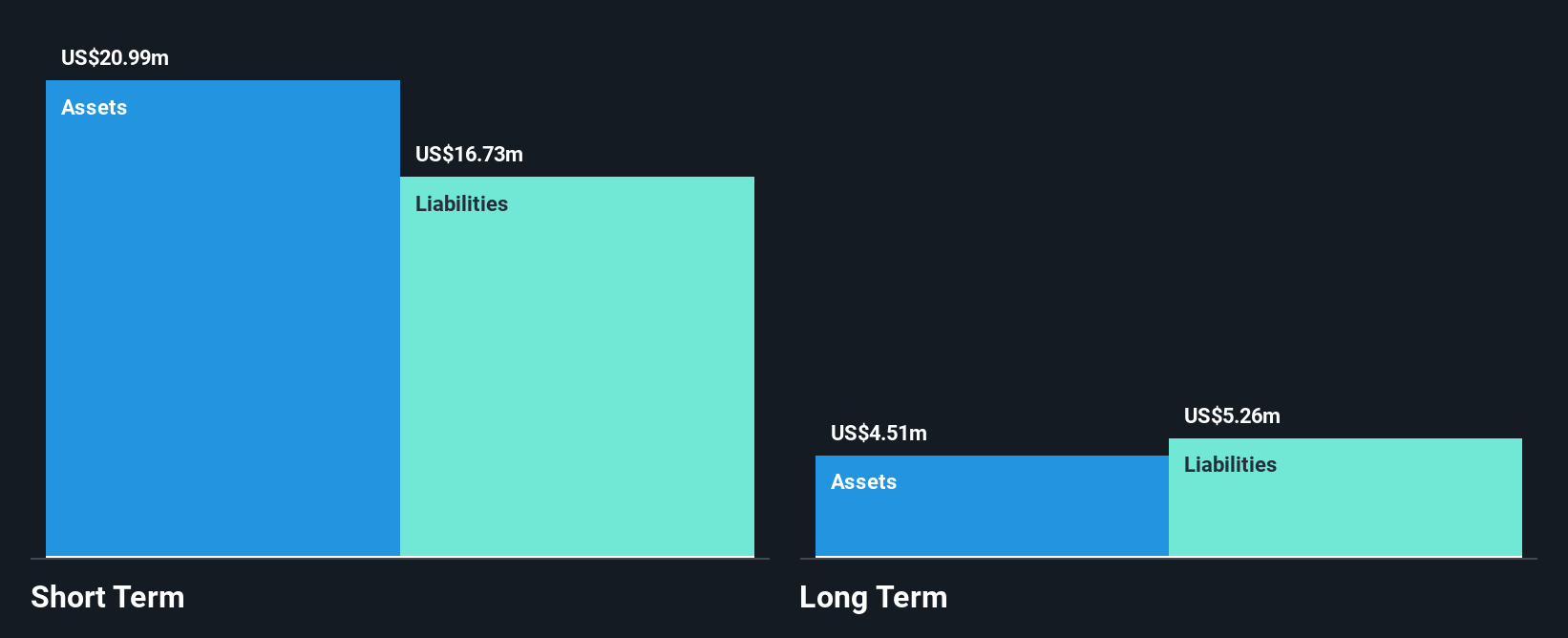

Windward Ltd., with a market cap of £184.23 million and revenue of US$33.09 million, is navigating through significant changes in the penny stock landscape. The company recently announced an acquisition by FTV Management Company, L.P., valued at approximately £210 million, signaling potential strategic shifts. Despite being unprofitable with increasing losses over the past five years, Windward maintains a debt-free status and has a cash runway exceeding three years based on current free cash flow. Recent product launches like Advanced Intelligence and Early Detection highlight its focus on leveraging AI for maritime intelligence solutions, aiming to enhance operational efficiency and decision-making capabilities for clients globally.

- Get an in-depth perspective on Windward's performance by reading our balance sheet health report here.

- Gain insights into Windward's future direction by reviewing our growth report.

Ashmore Group (LSE:ASHM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ashmore Group plc is a publicly owned investment manager with a market cap of £1.06 billion.

Operations: The company generates £186.8 million from its investment management services segment.

Market Cap: £1.06B

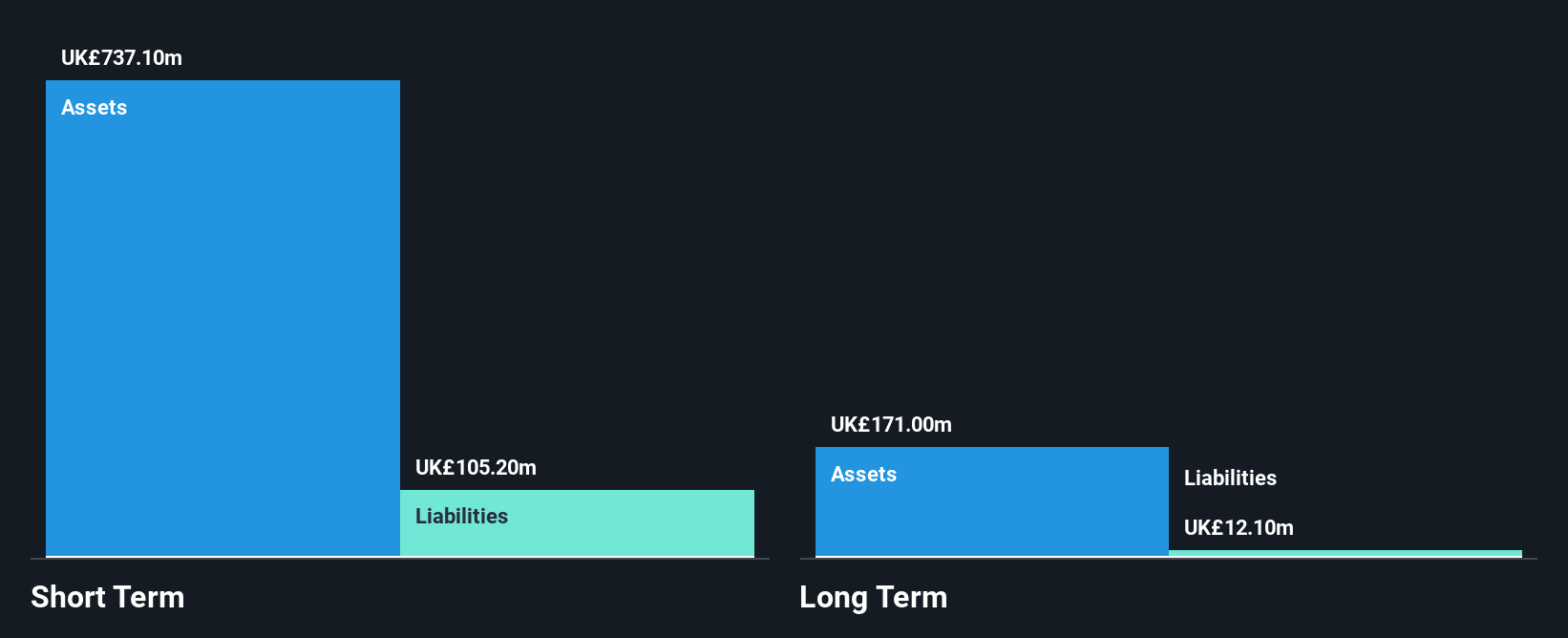

Ashmore Group plc, with a market cap of £1.06 billion and revenue of £186.8 million, presents a mixed picture in the penny stock arena. Despite its earnings declining by 21.8% annually over five years, recent growth of 12.5% indicates potential recovery momentum. The company is debt-free and boasts strong liquidity with short-term assets (£806 million) far exceeding liabilities (£88.9 million). However, its dividend yield of 10.62% is not well covered by earnings or cash flow, raising sustainability concerns despite recent affirmations at the AGM for a final dividend declaration of 12.1 pence per share for fiscal year ended June 2024.

- Click here and access our complete financial health analysis report to understand the dynamics of Ashmore Group.

- Understand Ashmore Group's earnings outlook by examining our growth report.

Key Takeaways

- Dive into all 472 of the UK Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Windward might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:WNWD

Windward

Operates as a predictive intelligence company in Israel and internationally.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives