- United Kingdom

- /

- Transportation

- /

- LSE:FGP

3 Undervalued Small Caps In UK With Recent Insider Buying Activity

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines, partly due to weak trade data from China impacting global sentiment. As economic uncertainties persist, particularly in sectors tied to international trade like mining, investors may find opportunities in small-cap stocks that demonstrate resilience through insider buying activity. Identifying such stocks requires careful consideration of their potential for growth and stability amidst broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Headlam Group | NA | 0.2x | 25.47% | ★★★★★☆ |

| Sabre Insurance Group | 11.2x | 1.5x | 13.39% | ★★★★☆☆ |

| iomart Group | 29.1x | 0.8x | 23.65% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 49.16% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 38.44% | ★★★★☆☆ |

| Gooch & Housego | 37.6x | 0.9x | 37.25% | ★★★☆☆☆ |

| Renew Holdings | 18.3x | 0.8x | 38.53% | ★★★☆☆☆ |

| Reach | 6.8x | 0.5x | -134.42% | ★★★☆☆☆ |

| Genus | 144.5x | 1.7x | 24.31% | ★★★☆☆☆ |

| THG | NA | 0.4x | -1027.30% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Alpha Group International is a financial services company that provides payment and risk management solutions across various segments, with a market capitalization of £1.2 billion.

Operations: Alpha Group International generates revenue primarily from Alpha Pay, Institutional, Corporate Toronto, Corporate Amsterdam, and Corporate London segments. The company's gross profit margin has shown a notable upward trend, reaching 85.66% by June 2024. Operating expenses have been a significant cost component, with general and administrative expenses consistently forming a substantial portion of these costs over the periods analyzed.

PE: 10.3x

Alpha Group International, a small company in the UK, is drawing attention with its anticipated 6.31% annual earnings growth and recent inclusion in the S&P Global BMI Index. The company's reliance on external borrowing for funding poses higher risks, yet it maintains high-quality earnings. Demonstrating insider confidence, Clive Kahn purchased 50,000 shares valued at £1.04 million in September 2024. As CEO from January 2025 following Morgan Tillbrook's departure, Kahn brings extensive experience to potentially drive future growth and value creation.

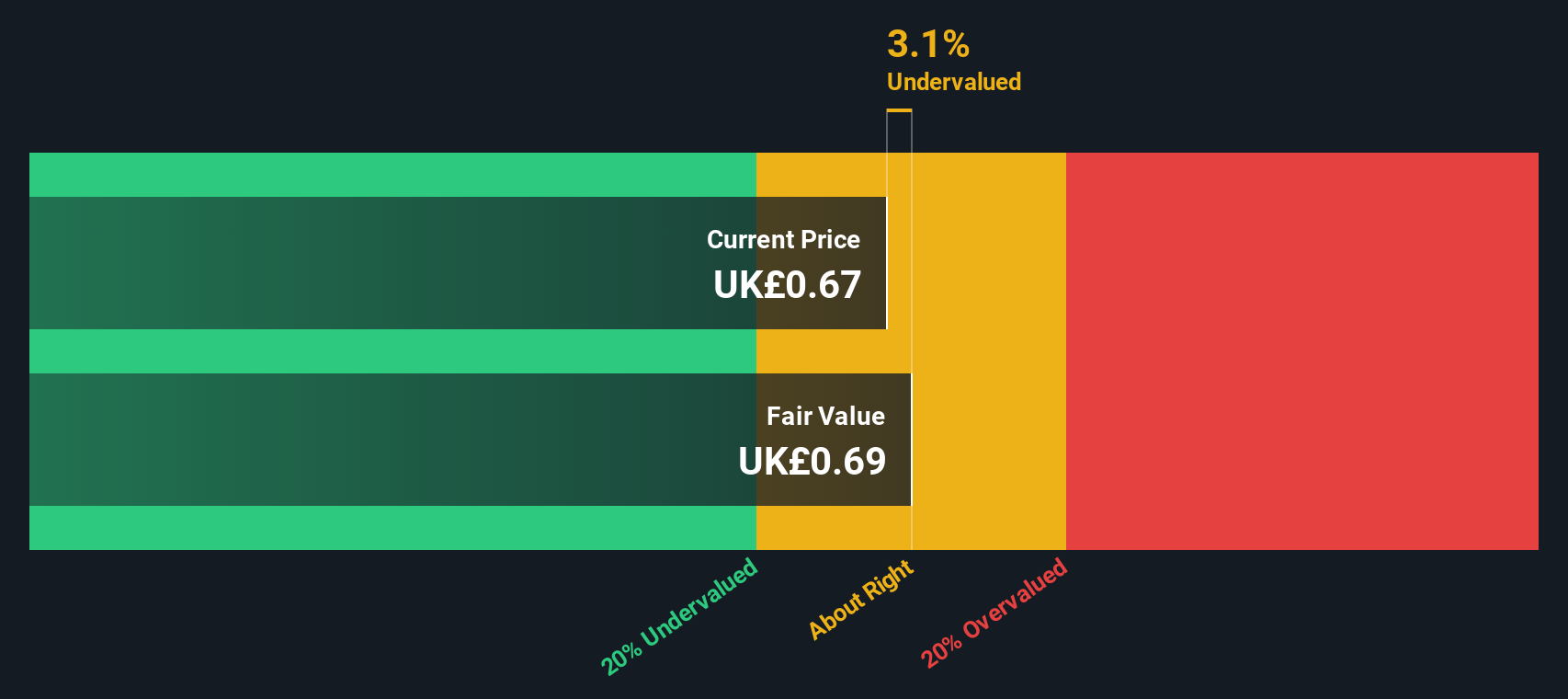

FirstGroup (LSE:FGP)

Simply Wall St Value Rating: ★★★★☆☆

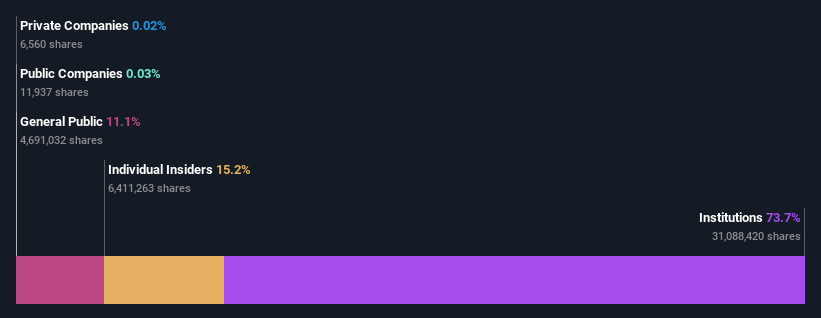

Overview: FirstGroup is a leading UK-based transport operator with operations primarily in bus and rail services, holding a market capitalization of approximately £1.02 billion.

Operations: FirstGroup's primary revenue streams are derived from its First Bus and First Rail segments, with the latter contributing significantly more to overall revenue. The company has experienced fluctuations in its net income margin, which showed negative values at various points but reached 0.0196% by late 2024. Gross profit margins have demonstrated a generally increasing trend, peaking at 63.18% in September 2023 before slightly decreasing to 59.31% by December 2024.

PE: 9.7x

FirstGroup, a company with a market presence in the UK, recently announced a share repurchase program worth £50 million to reduce its issued share capital. This move indicates management's confidence in the company's value. For the half-year ending September 28, 2024, FirstGroup reported sales of £2.34 billion and net income of £55.8 million, reversing last year's loss of £55.1 million. Additionally, they declared an interim dividend of 1.7 pence per share to be paid on December 31, 2024. The firm is actively exploring mergers and acquisitions to diversify earnings beyond train operations into bus and rail sectors for growth potential.

Hays (LSE:HAS)

Simply Wall St Value Rating: ★★★★★☆

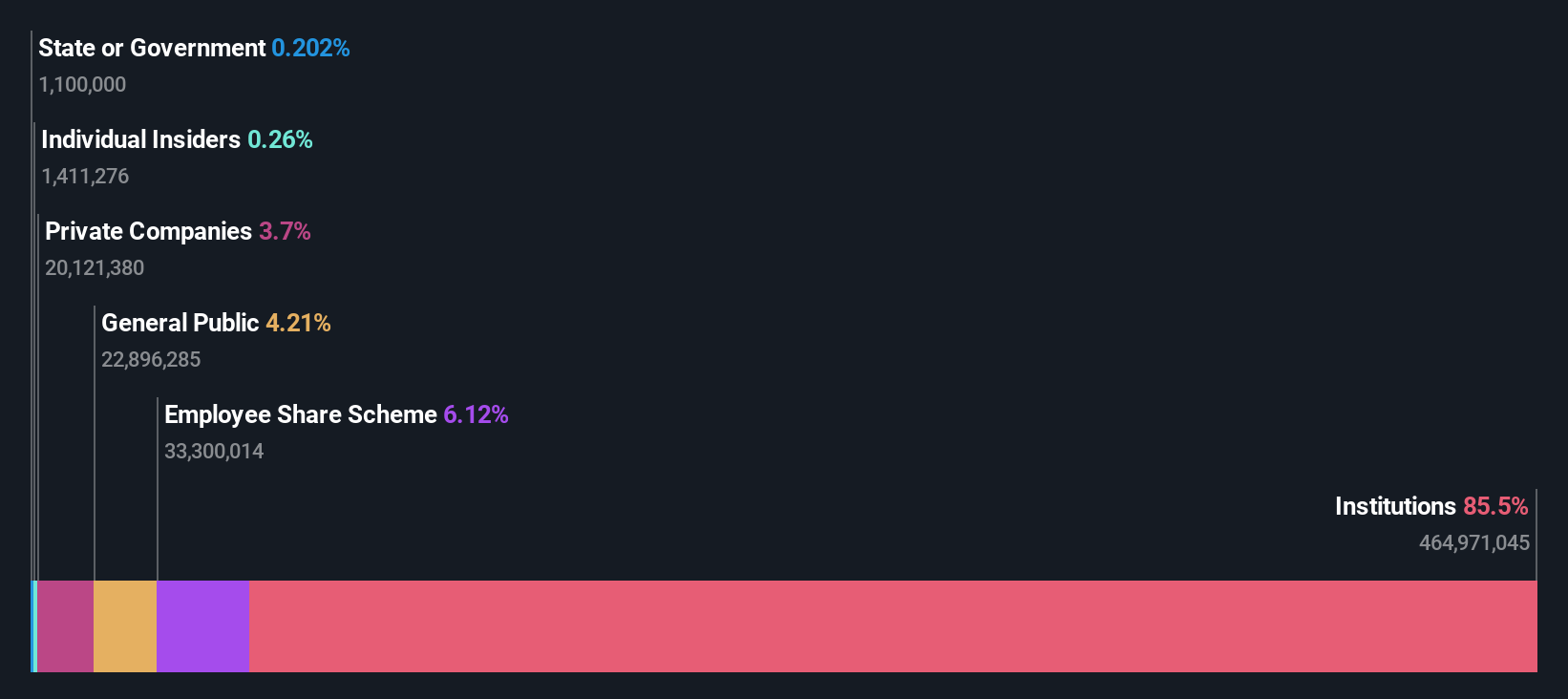

Overview: Hays is a leading global recruitment company specializing in qualified, professional, and skilled recruitment services with a market cap of approximately £1.92 billion.

Operations: The primary revenue stream for the company is from qualified, professional, and skilled recruitment services. Over time, the company's gross profit margin has shown variability, with a recent figure of 4.21%. Operating expenses include significant allocations towards general and administrative costs.

PE: -254.8x

Hays, a UK-based recruitment firm, is currently perceived as undervalued within its sector. The company projects a significant earnings growth rate of 62.68% annually, suggesting strong future potential. Despite relying entirely on external borrowing for funding, which introduces higher risk, insider confidence is evident with recent share purchases by executives in the last quarter of 2024. Recent board changes include Joe Hurd and Helen Cunningham assuming key roles in ESG leadership following MT Rainey's departure after nine years.

Summing It All Up

- Reveal the 27 hidden gems among our Undervalued UK Small Caps With Insider Buying screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FGP

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives