- United Kingdom

- /

- Capital Markets

- /

- AIM:WHI

WH Ireland Group plc (LON:WHI) Screens Well But There Might Be A Catch

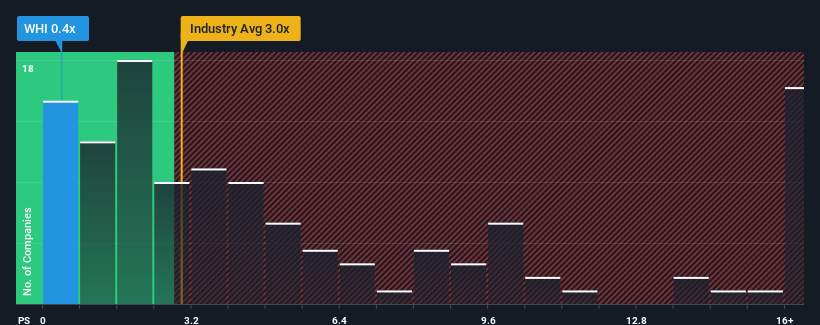

You may think that with a price-to-sales (or "P/S") ratio of 0.4x WH Ireland Group plc (LON:WHI) is definitely a stock worth checking out, seeing as almost half of all the Capital Markets companies in the United Kingdom have P/S ratios greater than 3x and even P/S above 10x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for WH Ireland Group

What Does WH Ireland Group's Recent Performance Look Like?

As an illustration, revenue has deteriorated at WH Ireland Group over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on WH Ireland Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on WH Ireland Group's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, WH Ireland Group would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 24% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to shrink 3.4% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's quite peculiar that WH Ireland Group's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From WH Ireland Group's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at the figures, it's surprising to see WH Ireland Group currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for WH Ireland Group you should be aware of, and 2 of them make us uncomfortable.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if WH Ireland Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:WHI

WH Ireland Group

Provides wealth management services primarily in the United Kingdom.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives