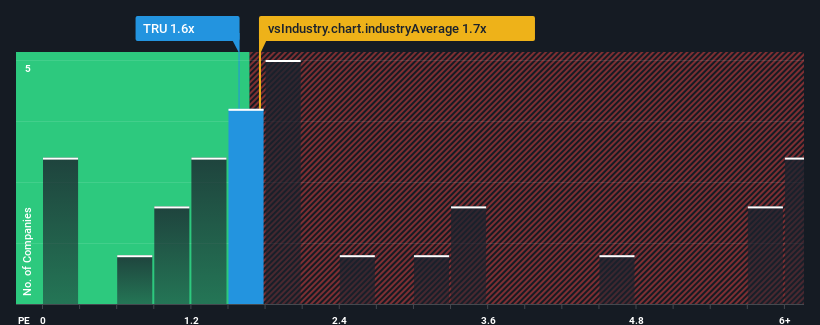

There wouldn't be many who think TruFin plc's (LON:TRU) price-to-sales (or "P/S") ratio of 1.6x is worth a mention when the median P/S for the Diversified Financial industry in the United Kingdom is similar at about 1.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We check all companies for important risks. See what we found for TruFin in our free report.View our latest analysis for TruFin

What Does TruFin's Recent Performance Look Like?

Recent times have been advantageous for TruFin as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on TruFin will help you uncover what's on the horizon.How Is TruFin's Revenue Growth Trending?

In order to justify its P/S ratio, TruFin would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 203%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 18% as estimated by the one analyst watching the company. With the rest of the industry predicted to shrink by 13%, it's a sub-optimal result.

With this in mind, we find it intriguing that TruFin's P/S is similar to its industry peers. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

What We Can Learn From TruFin's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

TruFin currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. In addition, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. A positive change is needed in order to justify the current price-to-sales ratio.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for TruFin with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of TruFin's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if TruFin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TRU

TruFin

Provides niche lending, early payment services, and video game publishing in the United Kingdom.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives